Virginia: Ah, crud: Bare County problem may be back as Optima drops out of a bunch of them

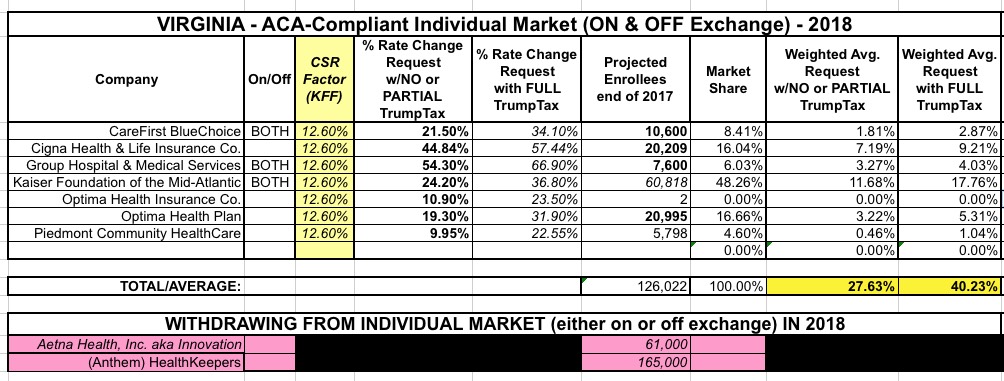

Virginia was the very first state whose 2018 rate filings I analyzed, way back in early May. At the time, the initial filings amounted to 9 carriers on the individual market with an average rate increase request of around 30%. At the time I hadn't started distinguishing between "with CSR payments" or "without CSR payments", so I don't really know which scenario that 30% reflected; it was probably a mix of both depending on the carrier. 61,000 Aetna enrollees would have to shop around for a new carrier since they had previously announced they were pulling out of the individual market.

Last month I revised my analysis to include two big changes: I broke out the CSR/no CSR factor...and removed Anthem, which dropped out of the VA indy market entirely, citing the CSR reimbursement issue as a major factor in their decision. The new requested rate hike averages now stood at 27.6% or 40.2% depending on whether CSRs are funded or not, while another 165,000 Virginians would now have to shop around. In addition, Golden Rule Insurance, which appeared to have around 5,400 enrollees when I previously checked, had disappeared somewhere along the way; I'm not sure if their earlier filing was there in error, or only applied to Grandfathered/Transitional polices or what, but they were no longer listed in this official July 18 form on the VA DOI website.

Unfortunately, yesterday Optima Health announced that while they will be offering policies both on & off the ACA exchange next year, they're pulling out of a whole bunch of counties:

OPTIMA HEALTH REMAINS IN 2018 AFFORDABLE CARE ACT EXCHANGE

Optima will continue to offer Individual plans on and off the ExchangeNORFOLK, Va.—Optima Health announced today it will continue to participate in the Individual market, offering plans both on and off the Affordable Care Act (ACA) Exchange, in Virginia in 2018.

“From day one, our desire has been to find a way to stay in the ACA Exchange,” said Michael M. Dudley, President and CEO, Optima Health.

With three national insurers—Anthem, Aetna and UnitedHealthcare—leaving the market, over 350,000 Virginians will be losing their healthcare coverage on January 1, 2018. The exiting of carriers along with the uncertainty in Washington, presented unprecedented circumstances.

“The decisions we made were challenging ones given the recent changes and ambiguities in the marketplace,” said Dudley. “Our most recent filing with the state reflects these dynamic changes, as would be expected in these circumstances.”

Optima Health is limiting its Individual plans offered on and off the 2018 ACA Exchange to locations where there are Sentara Healthcare hospitals and physicians. This will allow Optima Health to better manage chronic conditions to keep members healthy.

This move apparently means that the "bare county" problem--which was recently thought to be resolved with companies like Centene moving in to cover the last counties without any carriers participating--is back again: 63 of Virginia's 133 counties (technically 95 plus 38 "independent cities") are now facing no exchange carriers whatsoever. This will apparently leave around 70,000 current exchange enrollees without any carriers to switch to unless another carrier jumps in at the last minute.

In addition, there will be a premium increase. For any 2017 ACA covered participant qualifying for a subsidy, their 2018 increase will be 1.5% or an average of $4 per month. This means 70% of Optima Health Individual plan members will have their increases mostly absorbed by the government. For the remaining 30% of Optima Health Individual plan members, there will be an average 81.8% increase to premiums. Approximately 20% of this increase is our originally planned rate increase, 23% accounts for the uncertainty of Cost Sharing Reductions (CSRs) not being funded and the remainder is caused by the withdrawal of the national carriers.

The "appx. 20% original" appears to refer to the 19.3% rate hike request noted above, which assumes CSRs will be paid. The Kaiser Family Foundation estimates suggested that replacing CSR funding would "only" add around 12.6 more points to the total, but Optima themselves say that it's actually a whopping 23 points, or 28% of the total increases. That leaves another 39.5% added to cover themselves for an expected flood of high-risk enrollees moving to them from Anthem and Aetna, I presume. Ouch.

This also raises another important point about the Trump/GOP sabotage efforts and how they can build upon themselves in a domino effect: Anthem specifically cited the lack of CSR funding as one of the major reasons why they dropped off the exchange...and because they dropped out (along with Aetna), that's a big part of what led Optima to pull partway out of the state and jack up their rates by a whopping 40 points.

Optima Health will continue to serve the Hampton Roads and Harrisonburg markets and will add the Charlottesville area, Halifax County and Mecklenburg County. Despite having a Sentara hospital and medical facilities in Northern Virginia, Optima Health will not serve that market due to the presence of other carriers covering it.

“Health care is an ever-changing landscape. While this is not the outcome we had hoped, it will allow us to continue to serve 80% of our existing members and provide an option for another 70,000 Virginians who are losing their current insurance plan,” said Dudley. “We believe it is important to continue serving as many people as we can and fulfill our mission to improve health every day. The only other alternative would have been to completely exit the Exchange, and that goes against our mission.”

Members will be notified of their changes in October. In the meantime, they may contact their broker or an Optima Health personal plan advisor to learn more and talk about their options.

Optima Health will continue to serve its existing markets with its employer-based, Medicare and Medicaid plans.

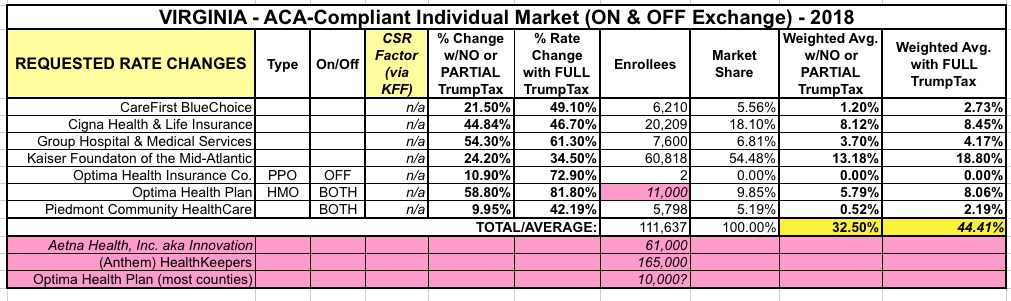

OK, so how does this impact the average rate hike situation? Well, in addition to the Optima problem, the other carriers have all submitted revised filings which assume that CSR reimbursements WON'T be funded. Instead of relying on Kaiser's estimates, I now have hard "Full Sabotage Effect" numbers to work with. Unfortunately, I don't know how many of the 70,000 exchange enrollees referred to above are already Optima enrollees, which means I also don't know how much to reduce their 20,995 figure by, although CareFirst BlueChoice's number has dropped, according to Louise Norris. For the moment I'm going to assume that roughly half of Optima enrollees live in counties where they're pulling out of.

If so, here's my best estimates of the new situation overall:

Aside from the bare county issue, the overall average rate hikes have also increased substantially for both the "partial" and "full" sabotage scenarios: From 27.6% / 40.2% up to 32.5% / 44.4% respectively.

Hopefully some other carrier will jump in at the last minute. Congress formally appropriating CSR funding tor at least the next two years would likely go a long way towards resolving this issue.