UPDATE: "Skinny Repeal" could make the individual market even skinnier than the CBO projected.

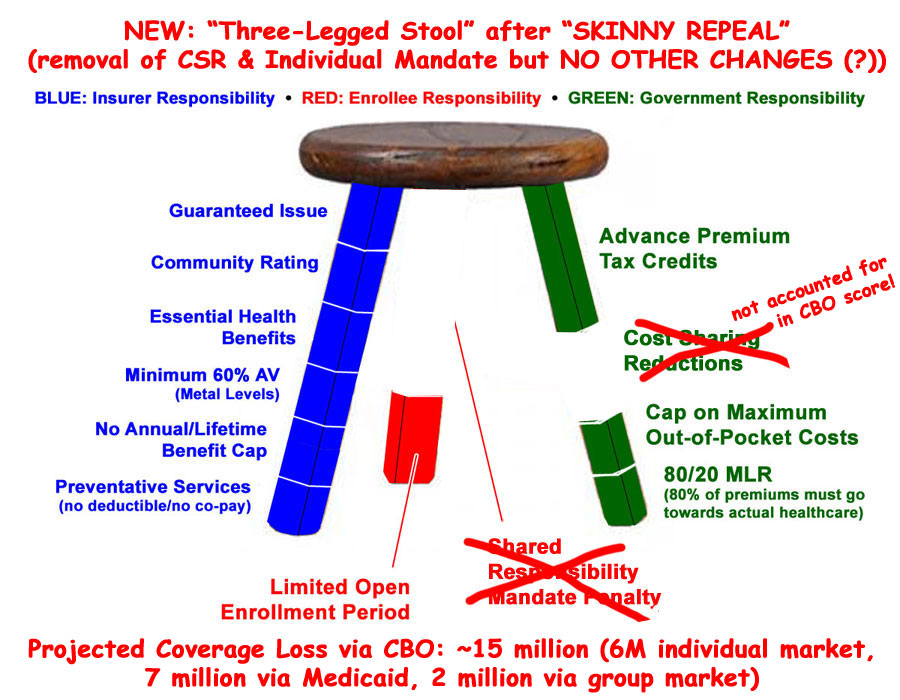

UPDATE: Hey, who's that up there? Why it's the guy who Republicans wanted to become President just 5 years ago, explaining why, if you're going to guarantee solid health insurance policies to everyone regardless of their medical history and without discriminating on price, you have to include some sort of incentive for them to do so: A carrot and a stick. The tax credits and out of pocket maximums are the carrot. The individual mandate and open enrollment period are the stick.

(sigh) I debated whether to even write a post about the last-minute "Skinny Repeal" plan slapped together by Mitch McConnell yesterday morning for a couple of reasons: First, because even if it passes, the sole purpose of "Skinny Repeal" is to get past the 50-vote Senate threshold...at which point it would be scrapped and replaced with whatever Godawful pile of garbage McConnell comes up with via reconciliation afterwards anyway.

Second, and more to the point, they're supposed to be voting on "Skinny Repeal" within the next few hours, so it's possible that it could be a moot point before anyone even reads this.

However, seeing how I went throught the trouble of whipping up a "Skinny Plan" graphic and everything, I might as well get some use out of it.

According to Timothy Jost of Health Affairs:

There is talk of the Senate ending up with a skinny bill that would simply repeal the individual and employer mandates and the medical device tax. The CBO has already scored pieces of this and it is possible that it would score such legislation as meeting mandatory deficit reduction goals. The bill would then go to conference with the House in secret and be brought back to the Senate floor for a final vote. Who knows what the final bill would do.

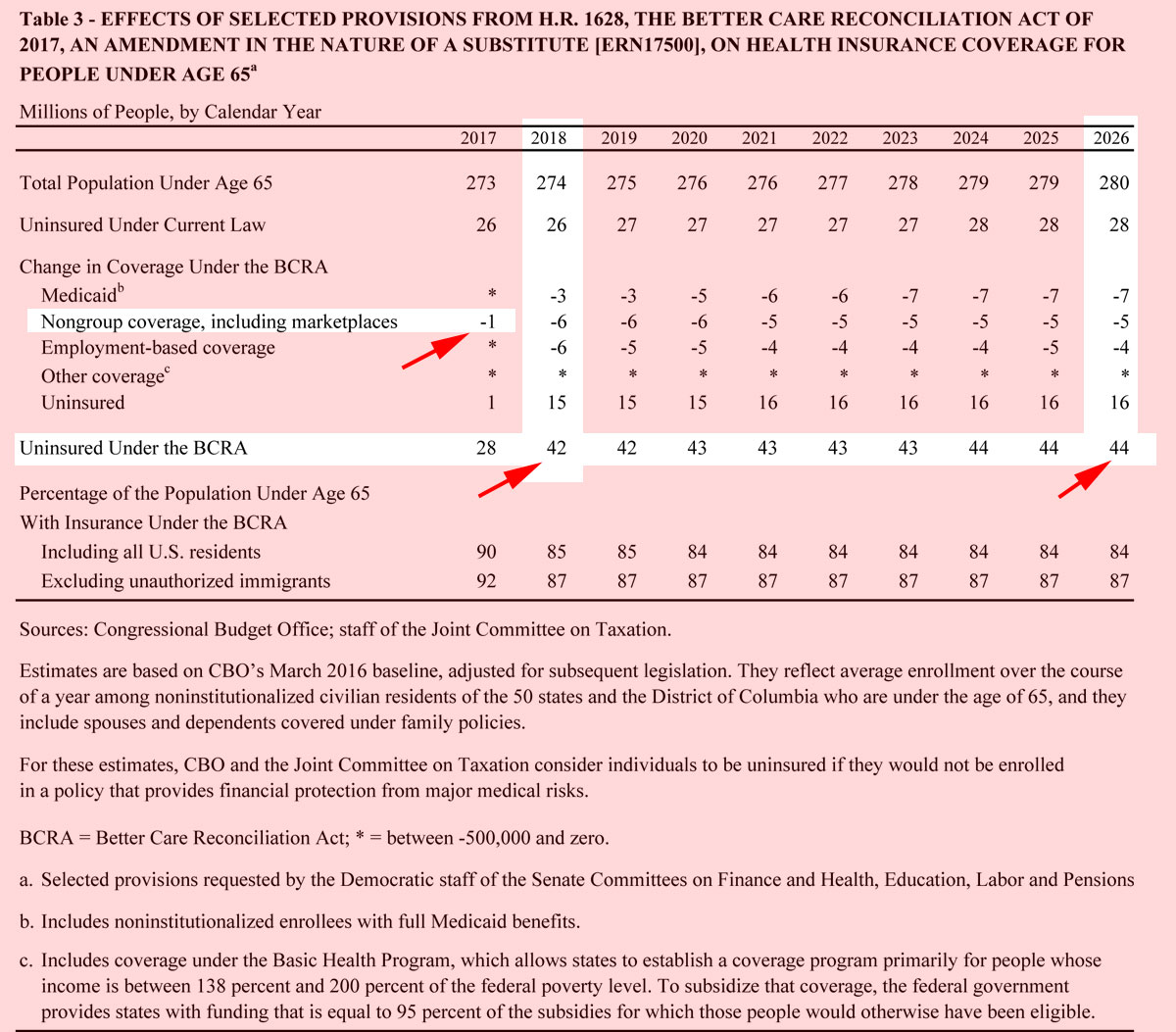

The CBO scored "mandate repeal only" twice. Their more recent score, from last December, concluded that around 15 million people would lose coverage by 2026:

A repeal of the individual mandate would cause a substantial reduction in the number of people with health insurance, CBO and JCT estimate. Under current law, about 28 million people under age 65 in the United States would be uninsured in 2026. This option would change that number as follows: About 2 million fewer people would have employment-based coverage, about 6 million fewer people would obtain nongroup policies (insurance people can purchase directly either in the marketplaces or from insurers outside the marketplaces), and about 7 million fewer people would have coverage under Medicaid. All together, the agencies estimate, 43 million people would be uninsured in 2026.

As I just wrote about the other day, scenarios similar to this have already played out in New York and Washington State, and the results weren't pretty:

CBO and JCT estimate that a repeal of the individual mandate also would result in higher premiums for coverage purchased through the nongroup market. Health plans in the nongroup market would still be required to conform to the ACA’s rules for that coverage. Insurers could not deny coverage or vary premiums because of an enrollee’s health status nor limit coverage because of preexisting medical conditions. They would be permitted to make only limited adjustments to premiums because of age, tobacco use, and geographic location. Those features are most attractive to applicants who expect to have relatively high costs for health care, and CBO and JCT anticipate that repealing the individual mandate would tend to cause smaller reductions in coverage among older and less healthy people and larger reductions among younger and healthier people, thus increasing premiums in the nongroup market.

There's a difference here, however: New York and Washington State only included one leg of the 3-legged stool, whereas the "Skinny Repeal" scenario would include two legs...sort of:

The effects of such adverse selection, however, would be mitigated somewhat by other factors—including the marketplace subsidies (which make health insurance less costly and more attractive to younger and healthier enrollees who are eligible for those subsidies) and the annual open-enrollment periods in the nongroup market (which reduce the incentive for people to wait until they become ill to obtain coverage). Moreover, the available subsidies would greatly reduce the effect of premium increases on coverage among subsidized enrollees. CBO and JCT estimate that adverse selection would increase premiums for policies in the nongroup market, whether purchased through the marketplaces or not, by roughly 20 percent relative to premiums under current law. That change, in turn, would increase federal per capita costs for people receiving subsidies through the marketplaces.

In other words, as shown below, "Skinny Repeal" would retain all of the blue leg (carrier regulations) along with most of the green leg (financial assistance) and a small section of the red leg (the open enrollment period)...but would wipe out the individual mandate altogether:

There's one other factor to consider here, however: Cost Sharing Reductions.

Again, the most recent CBO score was run back in December 2016, and assumes CSR payments will continue to be made. They kind of have to assume that, since CSR reimbursements are part of the ACA itself...the reason they're at risk is because of a Republican lawsuit claiming they haven't been specifically appropriated. Ironically, both the House and (prior) Senate repeal bills included explicit appropriation of CSR payments...but only for two years, after which they each killed the CSR program entirely.

The "Skinny Repeal" bill doesn't appear to include any CSR appropriation at all...and even if it did, even more ironically, the Senate Parlimentarian ruled that CSR appropriations can't be included in a 50-vote reconciliation bill...because (wait for it)...CSRs are already included in the ACA itself. Read that again.

Anyway, the point is that assuming "Skinny Repeal" were to actually pass and be signed into law as described above and CSR payments weren't made starting in January, the impact on the individual market could be even worse than the CBO projected last December:

However, in addition, silver plans would now cost more than gold plans...which in turn would mean that a bunch of people would upgrade from Silver to Gold, which would mess with the actuarial tables/risk pools something fierce. They figure that around 1 million higher-income exchange enrollees (which is to say, most of that 15%) would drop off the exchanges entirely, which would cause further disruption to the ACA-compliant risk pools, which in turn means more uncertainty, which in turn probably means more insurance carriers saying "to hell with this" and dropping off the exchanges, which in turn leads to more uncertainty and now we're once again into the exact "death spiral" which the GOP has been insisting would be caused by the ACA for years, but which only ever ends up having a real chance of happening due to their insistence on filing these endless lawsuits challenging the law's implementation.

The really bizarre outcome is the last point, though: Ironically, the Urban Institute thinks that one positive outcome of all this is that around 400,000 more low-income people jump on board to take advantage of the "Gold Loophole" as I'm designating it.

In other words, killing CSR payments on top of killing the mandate would mean more people below 400% FPL would sign up...but fewer people above 400% FPL. You'd likely end up with almost 100% of exchange enrollees being heavily (and I do mean heavily) subsidized...but the unsubsidized individual market would be completely wiped out (as opposed to merely mostly wiped out, which is what the CBO is already saying would happen under "mandate repeal" anyway).

The CBO is already saying that the individual market would change from the the current ~10M subsidized/~8M unsubsidized situation to something like ~10M subsidized/~2M unsubsidized. Killing off CSR payments as well would likely wipe out the unsubsidized market entirely...bumping that 15 million total up by another million or so.

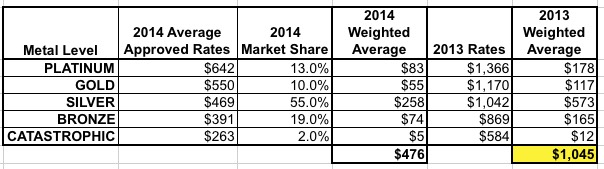

Again, for comparison, here's what happened to New York's individual market when they tried requiring Guaranteed Issue and Community Rating with nothing else (that is, about 2/3 of the blue leg, but none of the other two legs):

State insurance regulators say they have approved rates for 2014 that are at least 50 percent lower on average than those currently available in New York. Beginning in October, individuals in New York City who now pay $1,000 a month or more for coverage will be able to shop for health insurance for as little as $308 monthly. With federal subsidies, the cost will be even lower.

...The new premium rates do not affect a majority of New Yorkers, who receive insurance through their employers, only those who must purchase it on their own. Because the cost of individual coverage has soared, only 17,000 New Yorkers currently buy insurance on their own. About 2.6 million are uninsured in New York State.

This article was from 2013, referring to the reduction in premiums thanks to the ACA. And no, that "$1,000/month" doesn't just refer to New York City; it appears to have been the average state-wide as of 2013...

...which is why the NY indy market had dwindled to just 17,000 people state-wide.

Nationally, keeping the APTC tax credits would keep the subsidized indy market from collapsing (it'd probably stay around the 10 million mark), but for the unsubsidized market, if you extrapolate this out: NY had 19.67 million residents in 2013, so 17,000 = 0.09%. Nationally, that would be around 260,000 people.

Obviously NY has different overall demographics than the nation as a whole, but even if you double that you're still talking about perhaps half a million unsubsidized enrollees nationally.

UPDATE: OK, the CBO has apparently put together a quick "mini-score" for a so-called "Skinny Repeal" option...though not necessarily the option, since as far as I know, there still isn't any actual legislative text just hours before they're supposedly going to have to vote on it.

It's important to note that this CBO score assumes that the bill in question would do the following:

- Repeal the individual mandate

- Repeal the employer mandate

- Repeal medical device tax

- Defund Planned Parenthood

- Repeal Prevention and Public Health Fund

- Repeal Community Health Center Fund

....and nothing else. Of course, the GOP is already protesting that this is pure speculation, but again, of course it is, since they haven't bothered showing their mystery bill to anyone yet.

The numbers are indeed slightly higher as of 2026 than their December projection, atlhough it's my understanding that this still assumes CSR reimbursements would be made (and thus, it'd likely be another million or so higher than that yet). The most interesting parts to mare the 1 million projected to drop coverage this year...presumably people who really hate the mandate and would drop mid-year. Of course, that would wreak havoc with the 2017 risk pool, potentially doing so after 2018 rates have already been locked in by many carriers, meaning the carriers who've been reporting breaking even or making a profit this year would likely kiss that goodbye.

The mix is also different...they're projecting more of a negative impact on employer-based coverage but less on the individual market, and about the same for Medicaid loss.

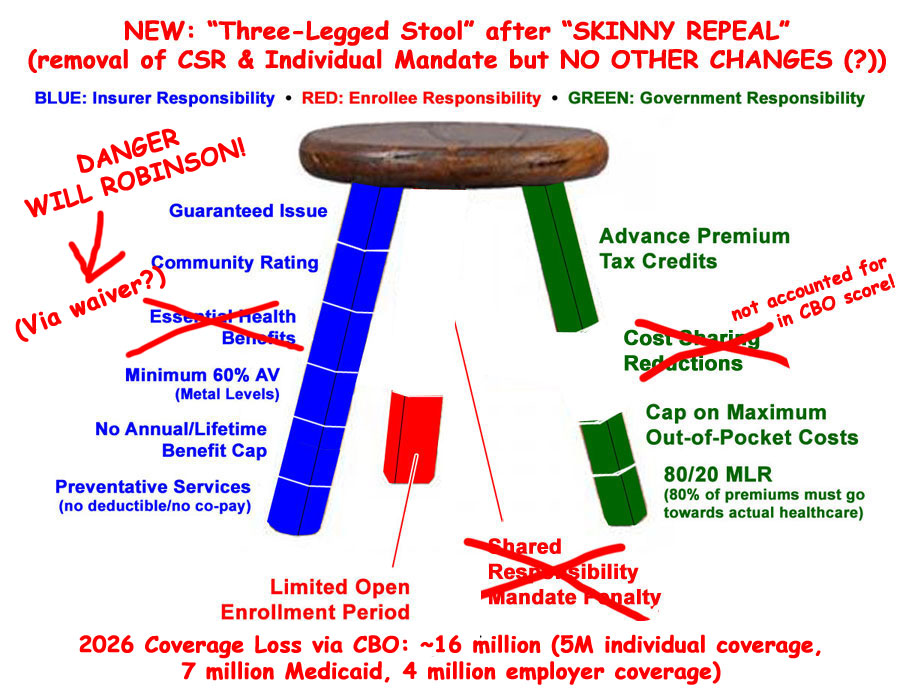

UPDATE 7/27/17: OK, here's the latest (at least, as of around noon, anyway):

Apparently, in order to win over a few more votes and squeeze the bill in under the "budget savings" wire, they're now planning on scrapping repeal of the medical device tax and delaying repeal of the employer mandate (but still repealing it eventually). They're also going to throw in defunding Planned Parenthood even though that was previously scrapped by the Senate parlimentarian.

Finally, they're apparently bringing back the Essential Health Benefit State Waiver provision, which would, once again, blow a massive hole in the "Guaranteed Issue and Community Rating" rules.

At first I assumed keeping the employer mandate would reduce the projected coverage loss by 4 million, but Loren Adler pointed out that a) the mandate would still be scrapped, just not right away (so the 2026 impact wouldn't change), and apparently they only expect about 500K of that 4 million to be due specifically to that--the other 3.5 million would mainly consist of people working for small businesses (companies under 50 employees, which aren't subject to the employer mandate anyway) dropping their employer coverage because of the individual mandate being repealed, some of whom would then shift to individual market coverage instead.

Confusing I agree, but I think this is what it would look like in practice:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.