And here...we...go: Say hello to the GOP Senate's pile of BCRAP! (PART 1)

Yes, that's right: The official name of the Senate GOP's Trumpcare Plan is "The Better Care Reconciliation Act" Plan...otherwise known as "BCRAP".

There's a lot to absorb here, but this is the bottom line:

- MEDICAID: It's MORE draconian and cruel to Medicaid enrollees than the House version...but delays the worst of it by a few more years.

Seriously, that's it in a nutshell. It phases out the ACA's Medicaid expansion more gradually...but as the years pass, would eventually squeeze even more people off their coverage...mainly via non-ACA Medicaid, which means that this bill really has little to do with "repealing Obamacare" and is mainly about giving massive tax cuts to the ultra-rich at the expense of the poor and low-income workers.

- INDIVIDUAL MARKET:

- It keeps the ACA's basic tax credit structure in place...but makes it even LESS generous and cuts off at an even LOWER income threshold.

- It does fund the critical CSR reimbursements to insurance carriers for 2018 and 2019...but then eliminates them entirely.

- It kills off the individual mandate penalty altogether...and unlike the House version, doesn't even replace it with a dumber, less-effective version.

- It technically keeps Guaranteed Issue and Community Rating provisions...but allows states to opt out of covering Essential Health Benefits and Minimum AV Ratings, and as I understand it, would also result in Annual/Lifetime Limits coming back while the Maximum Out of Pocket expense cap would effectively be eliminated.

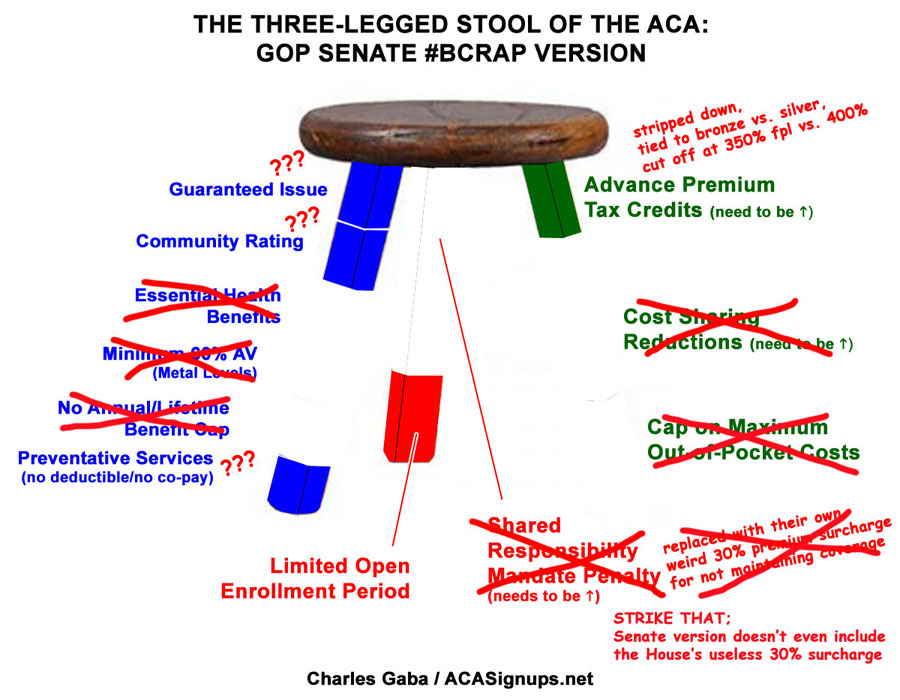

In short, instead of filling in the gaps of the "3-Legged Stool" concept as illustrated below (i.e., beefing up the tax credits and mandate penalty, which are two of the biggest issues with the ACA as it stands)...

...the Senate BCRAP bill rips away huge chunks of all three legs...

...which would result in the ACA's "Bar Stool" effectively being turned into a rickety Step Stool.

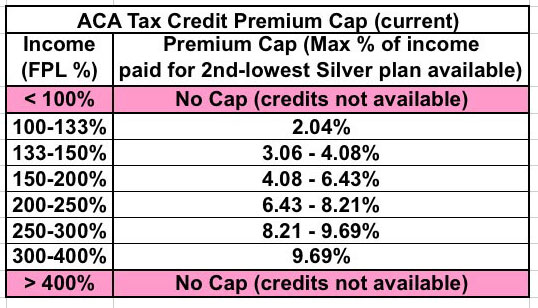

Regarding the tax credit structure: Here's the current structure for the ACA's Advance Premium Tax Credits. People below 138% FPL (roughly $17,000) are supposed to be enrolled in Medicaid, which is why it doesn't provide tax credits to anyone below 100% FPL. Of course, 19 GOP states have refused to expand Medicaid under the ACA, leaving around 2.6 million people below 100% FPL (around $12,000) caught in the "Medicaid Gap". Those over 400% FPL (around $48,000 for a single adult/no kids) have to pay full price, which is of course one of the major problems in the ACA today. Everyone in between 100-400% FPL receives tax credits on a sliding scale depending on their income and a few other factors, primarily the "benchmark premium" in their area. The benchmark premium is based on the 2nd-lowest price Silver plan available on the exchange in their area. However much more the benchmark plan costs than the percent below is the amount of the tax credit for that enrollee.

For instance: Let's suppose you're a 40-year old single adult, no kids, earning $24,000/year (200% FPL). Let's suppose the benchmark plan (2nd lowest Silver plan) costs $250/month (w/a $5,000 deductible). That's $3,000/year, or 12.5% of your income.

Under the ACA, you would receive a tax credit of around $121/month, or $1,457/year (i.e., the difference between 6.43% of your income ($1,543) and the $3,000 cost of the benchmark plan).

You don't have to buy the benchmark plan, mind you...you can apply that $1,457 towards a Gold, Platinum or Bronze plan instead if you wish (though if you get a Bronze plan and the full-price premium is less than $121/month, you don't get money back).

At 200% FPL, you also would qualify for CSR assistance to cut down on your deductible and co-pay amount. I'm not actually sure what the formula is for CSRs, but for many people it can lop them down from, say, $5,000 to only $500 or so.

Under the House version of the bill (AHCA), of course, it simplifies this to the level of absurdity: Everyone gets anywhere from $2,000 - $4,000 per year (depending on your age) to go towards a healthcare policy. It doesn't matter how much or little the policy costs; you get a flat $2K - $4K, period. This means a healthy 21-year old living in, say, Massachusetts makes out like a bandit, but a sickly 60-year old living in Alaska is royally screwed.

So, what about the Senate's BCRAP version?

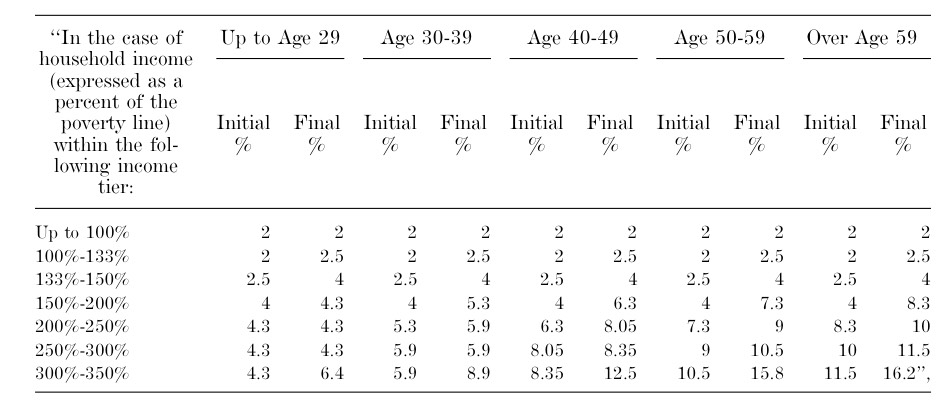

Well, the good news is that it goes back to an income/benchmark plan-based tax credit structure, similar to the ACA. The bad news is that it's far, far less generous in both the cut-off point as well as the amount of assistance provided. Here's the table:

The most obvious difference is that unlike the ACA's formula which is based purely on income/affordability, the Senate version is also still partly based on age as well for anyone earning more than 150% FPL (roughly $18K/year). A 21-year old earning 300-350% FPL is limited to 4.3 - 6.4% of their income for a policy ($1,550 - $2,700/yr), while a 60 year old has to pay 11.5 - 16.2% of theirs ($4,140 - $6,800/year).

The second major difference is that the tax credits are cut off at an even lower income threshold: 350% instead of 400%. This is going completely the wrong direction. The ACA's biggest problem right now is that those on the individual market earning over 400% FPL (roughly 6-7 million people at the moment) have to pay full price because they don't qualify for any tax credits whatsoever. This change would mean that those earning 350 - 400% FPL would be added to the "full price" population.

According to the 2017 Open Enrollment Report from CMS, roughly 9.1% of current exchange enrollees earn between 300-400% FPL. I'm not sure what the breakout is at 350%, but my guess is that roughly 4% are in the upper half of that range. That translates to perhaps 420,000 people currently on ACA exchange policies having their tax credits yanked away entirely.

The third major difference is that unlike the ACA, which bases tax credits on the 2nd lowest-priced Silver plan available in the area, the BCRAP bill changes this to the median-priced Bronze plan. Changing from "2nd lowest priced" to "median-priced" seems to actually be a good thing according to David Anderson (he has a big problem with "Silver plan spamming" under the current structure), but switching the benchmark from Silver (70% Actuarial Value) to Bronze (58% AV...not even 60% anymore) is a huge step in the wrong direction.

To use my single 40-year old / $24,000/year example above:

Under the ACA, you'd receive around $1,457/year in assistance, plus some amount of CSR to cut down that $5,000 Silver deductible.

Under the BCRAP, let's say that the benchmark Bronze plan is $150/month (w/a $12,000/year deductible). That's $1,800/year, or 7.5% of your income. Under BCRAP, you're limited to 6.3% of your income, or $1,512 for a Bronze plan, so you'd receive $24/month or $288/year regardless of which plan you enroll in. There's no CSR, so you pay the full deductible whether you get the Bronze or Silver.

Let's say you go with the Silver plan in both cases (assuming, of course, that they're both equivalent plans otherwise):

- ACA: You'd pay a total of $1,543/year, plus somewhat less than the $5,000 deductible. Assuming you max out the deductible, that’s $6,043 total.

- BCRAP: You'd pay a total of $2,712/year, plus the full $5,000 deductible. If you max out the deductible, that’s $7,712 total.

I'll have a lot more to say but will leave it at this for now.