Here's what we kind of, sort of know about the Senate Trumpcare bill

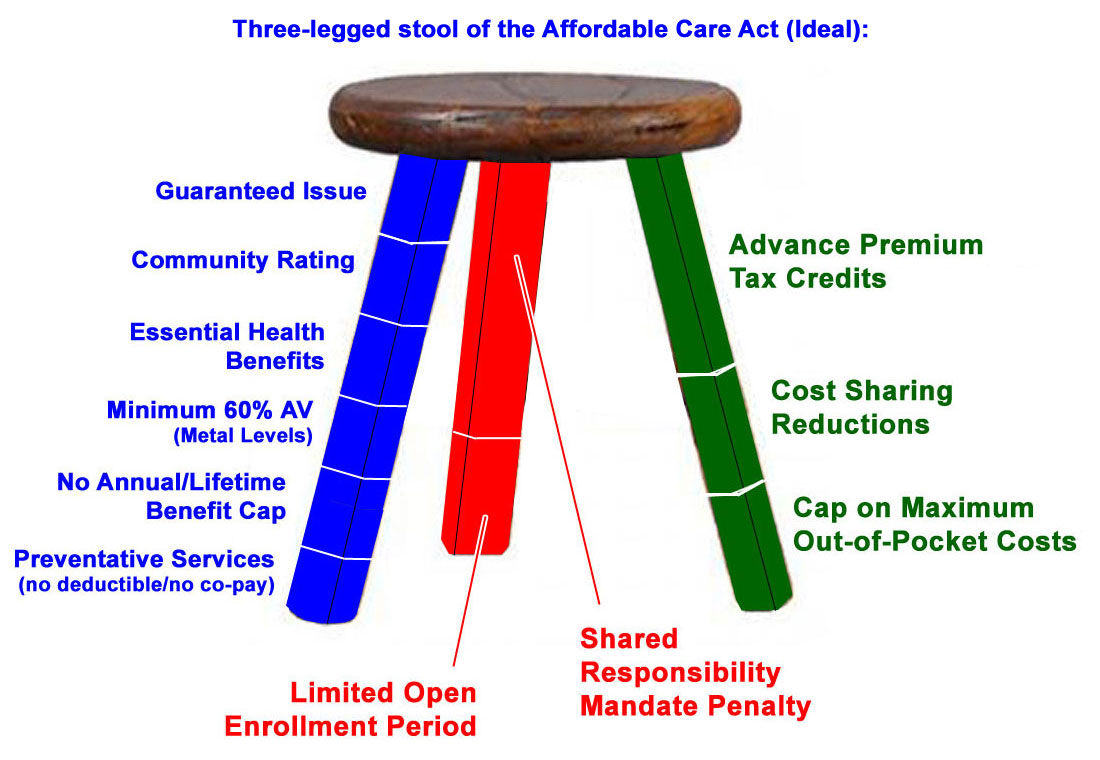

OK, so this is what the "Three-Legged Stool" of the ACA is supposed to look like for the individual market:

Of course, I say "supposed to" because two of the three legs are simply too short, causing it to lean over somewhat.

The tax credits need to be beefed up and made available to those over the 400% FPL income threshold, and the individual mandate penalty should really be increased.

In a sane world, that's exactly what Congress would do: Raise the cap for the tax credits, beef 'em up below that, and also bump up the mandate penalty. This wouldn't resolve all of the ACA's issues, but it'd take care of the most obvious/glaring ones.

Instead, here...to the best of my reckoning...is what the House GOP's AHCA bill would do to the "3-legged stool" metaphor if implemented: Instead of lengthening the tax credits and penalty so that they balance out the carrier coverage regulations...the AHCA would:

- Blue Leg: It would allow individual states to completely remove 2-3 sections partly or entirely.

- Green Leg: It would wipe out the CSR sections entirely, while converting APTC assistance into a far stingier, age-only based structure which would be far worse for older/lower-income people (while also adding some credits for higher-income people from 400% FPL to around 950% FPL)

- Red Leg: It would remove the Individual Mandate entirely...but would replace it with their own weird, even-less-effective "30% surcharge" penalty for those who let their coverage lapse.

Needless to say, this would cause the stool to either lean even more dangerously to the side or completely topple over.

OK, so what about the SENATE version which has been kept under wraps by Mitch McConnell?

Well, according to articles by Caitlin Owens of Axios and Paige Winfield Cunningham of the Washington Post, here's what we know:

- What would be waivable:

- Essential health benefits

- Actuarial value, or the requirement that plans cover a certain percentage of an enrollee's health care costs

- The definition of a quality health plan

- Tax Credits

- The backup plan is to leave the current ACA premium subsidy structure in place, but to scale it back.

- However, the bill will also include an insurer stabilization fund, like the House bill. This probably will be funneled through the Children's Health Insurance Program, which does contain the Hyde amendment. Thus the stabilization fund can't be used to cover abortions.

- Since most plans will use the stabilization fund, they won't be allowed to cover abortions — a roundabout way of including pro-life protections.

- Medicaid

- We haven't heard anything new here today. Still a lower growth rate than the House beginning in 2025 and a three-year glide path for phasing out Medicaid expansion.

- It will also let states choose the base amount for their per capita caps based on eight consecutive quarters.

Senate leaders on Wednesday were putting the final touches on legislation that would reshape a big piece of the U.S. health-care system by dramatically rolling back Medicaid while easing the impact on Americans who stand to lose coverage under a new bill.

A discussion draft circulating Wednesday afternoon among aides and lobbyists would roll back the ACA’s taxes, phase down its Medicaid expansion, rejigger its subsidies, give states wider latitude in opting out of its regulations and eliminate federal funding for Planned Parenthood.

The bill largely mirrors the House measure that narrowly passed last month but with some significant changes. While the House legislation pegged federal insurance subsidies to age, the Senate bill would link them to income as the ACA does. The Senate proposal cuts off Medicaid expansion more gradually than the House bill, but would enact deeper long-term cuts to the health-care program for low-income Americans. It also removes language restricting federally-subsidized health plans from covering abortions, which may have run afoul of complex budget rules.

...Subsidies are currently available to Americans earning up to 400 percent of the federal poverty level. Starting in 2020, that threshold would be lowered to 350 percent under the Senate bill -- but anyone below that line could get the subsidies if they’re not eligible for Medicaid.

Yes, that's right: They want to lower the tax credit ceiling...the exact opposite of what needs to happen. And they'll screw even more Medicaid enrollees than the House version would...they'll just do it more slowly. Lovely.

OK, here's how I think the Senate version would look...very similar to the House version, including a similar income-based tax credit system...except much skimpier: Instead of cutting people off at 400% FPL, it would cut them off at 350% (which would mean roughly 400,000 of the enrollees on exchange policies as of today would lose their tax credits), and supposedly the benchmark plan would be tied to bronze plans instead of silver (which means far less assistance):

The GOP Senate version of Trumpcare attempts to balance the three-legged stool. The problem is that it tries to do this by shortening all three legs instead of lengthening the two which are too short. It basically tries to "solve" the problem by turning the Bar Stool into a Step Stool.

In addition, assuming it keeps the GOP House version's weird "30% surcharge penalty for not maintaining continuous coverage", I'm not even sure that it shortens the red leg at all...the metaphor gets a little strained on that one, because it's both more draconian AND less effective than the current "$695/year for not having coverage" penalty is.

Why? Because under the 30% Surcharge scheme, a Young Invincible (you know, the very type of people who aren't signing up for coverage in enough numbers as it is) could go a solid decade without getting covered, then go ahead and sign up 10 years later. Sure, they'd have to pay that 30% surcharge when they do so...but they'd have saved 10 years worth of premiums in the meantime, and if they are diagnosed with an expensive ailment, it'd still be a bargain for them.

Of course, none of this even touches on the real atrocity of the GOP Senate version: It would kick even more people off of Medicaid in the long run...and pushes the worst of it out until well after the next couple of elections, thus making it Someone Else's Problem®.

UPDATE: OK, the draft text of the Senate version is out, and it's literally BCRAP. No, seriously: The name of it is the "Better Care Reconciliation Act" Plan...or BCRAP for short.

I'll be posting a full write-up on it soon, but in the meantime, it turns out my modified 3-legged stool graphic above was mostly correct, but it's even worse than that:

Yes, that's right...it turns out that the Senate version eliminates the individual mandate entirely. Anyone who remembers what happened in New York when they added a Guaranteed Issue provision but didn't tie it to a mandate penalty should shudder at the prospects.

Also, the open-season waiver options (even worse than the House version in many ways) means that annual/lifetime limits are likely back...while the cap on maximum out of pocket costs are likely gone in many states as well.

More to come in a new post soon...