After 7 years of constipation, Paul Ryan & House GOP finally crap out their replacement bill.

So, it's finally here. After seven years and over 100 entries, Huffington Post healthcare reporter Jeffrey Young can finally shut down (or at least archive) his famous "JUST IN TIME!" Storify collection, which has been chronicling the endless empty promises of the Republican Party insisting that their "replacement plan" for the Patient Protection and Affordable Care Act was going to be revealed at any moment.

Yes, after seven years, it's finally here (Part 1) and here (Part 2). It has a catchier title than the ACA ("The American Health Care Act"), which is typical of Republican bills. Remember George W. Bush's "Healthy Forests Initiative", which actually opened previously protected forest areas to logging, often unnecessarily or under false pretense? See, it has the word "American" right there in the title, so it must be good, right? I'll be abbreviating tthis as "AHCA", although they're already annoying me by spelling "healthcare" as two words (I strongly believe it should be one).

Here's the stuff which supposedly can't be changed via the reconciliation process, and is therefore might not be touched...yet. That is, these are changes which would suppposedly either require 60 votes in the Senate or would require the GOP to kill the filibuster entirely to push through:

- Guaranteed issue (no pre-existing condition denials)

- Community rating (can't charge different people more for the same policy outside of a tight set of parameters)

- The ACA's preventative benefits (I'm not sure if this list changes, but I'd imagine not)

- No lifetime or annual limits on coverage (a few people have stated otherwise, but this seems to be the consensus)

- Required essential benefits for every plan on the private market (ie, group or individual)

- Limits on out-of-pocket costs for enrollees

- Young adults 19-25 being allowed to stay on their parents' plan (I've noted before that I always suspected this would survive any repeal effort)

- "Removing the lines" to allow carriers to "sell insurance across state lines" (at least not any more so than the ACA already allows them to)

- The "Grassley Amendment": Congressional staffers will still have to enroll via the DC exchange in order to receive tax credits.

- The 80/20 Medical Loss Ratio (requires insurance carriers to refund the difference to enrollees if they spend more than 20% of premium costs on anything other than actual, legitimate medical care)

All of the above sounds great at first glance...but again, keep in mind that for the most part this is only because they can't touch them without 8 Democratic Senators agreeing to do so...or killing the filibuster, which they could still do. That's a hell of a Sword of Damocles to be hanging over everyone's head.

OK, so what would change via the AHCA, assuming they manage to pass it with simple majorities in the House and Senate, and Trump signs it (which I'm certain he would)?

In no particular order...

- It prevents lottery winners from enrolling in Medicaid. Seriously, that's a Really Big Deal in this bill; it spends seven friggin' pages (out of 66 total) yammering on about which lottery winners can and cannot enroll in Medicaid under this bill. I mean, don't get me wrong, I agree that if you hit the PowerBall you probably should be kicked off of Medicaid, which is primarily intended for low-income folks...but seven pages? Really?

- It apparently wipes out SHOP (the ACA's Small Business exchange/tax credit) program. This is a shame, but honestly, I'm pretty sure it never enrolled more than perhaps 200,000 people nationally anyway; SHOP seems to have been a solution to a problem which might not really have existed, although it's more a matter of it just not being quite generous enough for most small businesses to bite. Just to give you an idea about how forgotten SHOP is, there's been exactly one official enrollment number released by the HHS Dept. in the 3 1/2 years since the exchanges launched, and even that was sort of buried in the news and wasn't even broken out by state.

- IT DEFUNDS PLANNED PARENTHOOD. This'll go over really well with the 5 million women, men and children who use Planned Parenthood's services every year. That was sarcasm.

- IT DEFUNDS MEDICAID EXPANSION. Yep, nearly fifteen million people kicked to the curb. They'd be given a few bucks to buy a private policy instead (see below). Of course, the average Medicaid enrollee costs anywhere from $2,500 - $18,000/year to treat, so most of them aren't gonna make out too well. I should note that this doesn't happen immediately; current enrollees could stick around for a couple of years. After that, they cut off new enrollment, thus winding it down via attrition. The problem is that Medicaid has a huge churn rate, with people jumping into and out of the program every few months in come cases, so I wouldn't be surprised to see that number run down to zilch within a year or so after that.

- In addition to wiping out Medicaid expansion, it twists the knife further by switching traditional Medicaid from its current funding arrangement into...wait for it...block grants with a set per-enrollee dollar amount. The net effect of this will be to slash Medicaid funding dramatically over the next few years, kicking millions more off their coverage.

- It would restore Medicaid DSH cuts. I didn't know what the hell this meant until I read up on it; as far as I can tell, it looks like this is a form of reimbursing hospitals for unpaid bills from uninsured patients. When the ACA was passed, it was assumed that every state would expand Medicaid anyway, so the DSH payments were cut...but 19 states didn't do so, and since the GOP law would kick 15 million Medicaid enrollees off their coverage, the payments would be restored, which of course begs the question of what the point is of kicking them off in the first place is. It would also pony up some additional money to cover the uncompensated expenses hospitals in non-expansions states have racked up. Again, if it's just gonna cover the same costs anyway, what the hell is the point of reshuffling the deck here?

- It would provide $100 billion, over a 9-year period, to the states to go towards High Risk Pools and other "risk pool management" programs (state-based reinsurance programs and the like, I'd imagine...probably similar to what Alaska and Minnesota have done recently). That sounds like a lot of money, but again, it's spread out over nine years and goes to cover all 50 states. That's an average of $11 billion per year. Remember, estimates of how much HRPs would cost to properly fund per year are somewhere in the $25 - $50 billion range, so this is still an insult...and again, that assumes that all $100 billion is used for HRPs exclusively. If some of it is used for other programs, that leaves the HRPs even more severely underfunded.

- KISS COST SHARING REDUCTIONS GOODBYE starting in 2020. Yup, that's 6-7 million people between 100-250% of the Federal Poverty Line who can expect to see their deductibles skyrocket. Of course, that assumes that Trump even bothers making good on the CSR reimbursements legally owed to the carriers between now and then.

- The AHCA would allow carriers to start charging older enrollees five times as much as younger enrollees, vs. the current 3:1 limit. This is supposed to help lower premiums for younger people (thus drawing more of them in), but it could also just as easily mean up to a 66% premium hike for 64-year olds over current rates.

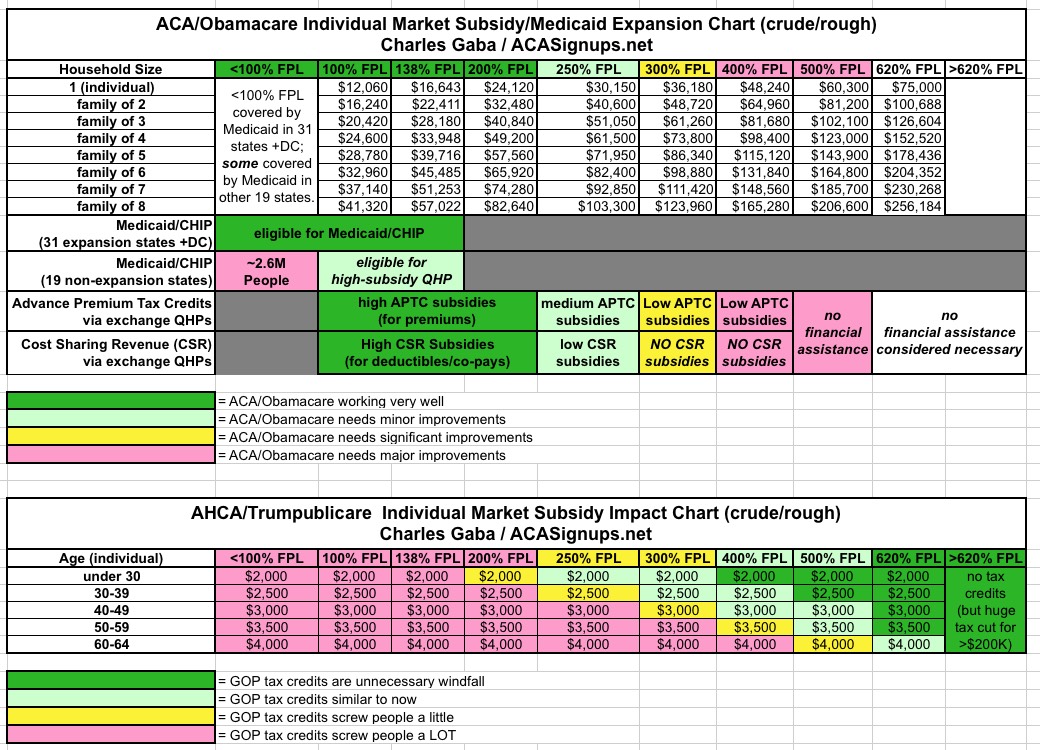

- Right now, tax credits are based on your income and a somewhat confusing formula based on the "benchmark plan" in your rating area and a couple of other factors. If your income is between 100-400% of the FPL ($12K - $48K for an individual, $24K - $98K for a family of 4), you generally qualify for tax credits which bring the premium down to between 2 - 9.7% of your income, on a sliding scale. Under the GOP plan, this would all be scrapped in favor of a much simpler age-based tax credit system: $2,000/person for those under 30 years old, increasing to $4,000 for those up to 64 years old, regardless of income...but tapering off for those starting at $75,000 down to nothing at $115,000.

As I noted the other day, between the income-based-to-age-based tax credit change and Medicaid expansion being cut off to nearly 15 million people, this completely reverses the categories of people who are helped by or hurt by the healthcare law (see charts below). Under the ACA, people under around 250% FPL are helped a lot, those from around 250% - 350% are helped a little, and those over 400% aren't helped at all (and for several million people in that range, yes, they're having to deal with real problems paying their premiums and deductibles). The obvious solution to this would be to beef up the income-based credits by raising the cut-off threshold to, say, 500 or 600% FPL and increasing the credits and CSR reimbursements below that threshold.

Well, the GOP plan does raise the cut-off line even further, to around 620% FPL ($75,000)...except that the dollar amount is locked in by age, regardless of your income within that range. A 25-year old earning just $20,000/year gets a $2,000 credit...but so does a 25-year old earning $75,000. Meanwhile, a 64-year old earning $20,000 only gets twice as high a credit ($4,000) even though he can be charged up to five times the premium, which doesn't make a damned lick of sense.

I've modified both of the "who's helped/hurt" charts a bit to give a closer apples-to-apples comparison. As you can see, the ACA primarily helps those in the lowest income brackets while not helping those at the upper end at all...while the GOP bill is the exact opposite.

As an aside: There is exactly one good reason to use age-based credits instead of income-based: Administration and verification. Basing them purely on age, at the very least, would mean enrollees wouldn't have to provide all sorts of documentation of their income from year to year. However, by reducing credits starting at $75K and up, the AHCA would still require proof/verification of income just as the ACA currently does...which means eliminating even that already weak upside.

Oh, yeah, and speaking of the overhauled tax credits...

- They can't be used for policies which cover abortion (other than rape/incest/save life of the mother)...which effectively means that barely any such policies will even be offered, forcing women to either try to buy an "abortion rider", which is incredibly degrading or pay full price for abortion themselves (which itself is, of course, the whole point of such a policy in the first place).

- The EMPLOYER MANDATE would be wiped out. To be perfectly honest, aside from losing it as a funding mechanism (via the penalty fees for noncompliance) I'm not necessarily opposed to this, if only because I'm strongly opposed to "Job Lock" anyway (ie, people being "tied" to their jobs purely to hold onto their health insurance). And it does sound like the paperwork to keep track of employees is kind of a pain in the ass. If the rest of the bill wasn't so awful and they actually had another means of replacing the lost revenue, I'd probably be OK with this...but it is awful and (I'll come back to this later) they don't, so there you go.

- Next we come to the infamous INDIVIDUAL MANDATE. As you may recall, under the ACA, if you aren't covered by a qualifying healthcare policy (and don't qualify for a hardship exemption), you have to pay a "shared responsibility penalty" tax of either $695 per person ($347.50 for children) or 2.5% of your household income, whichever is larger (but with a maximum penalty of $2,085). Under the AHCA, the individual mandate is wiped out...except it's replaced with a 30% premium surcharge for people who don't maintain continuous coverage for more than 2 months.

In other words, the GOP's Obamacare replacement bill simply substitutes a different financial penalty for not being insured than the ACA's. If you go uncovered for more than 2 months in a year, you have to pony up an extra 30% on top of whatever the regular premium is for whatever policy you do sign up for...for a solid year. In many (most?) cases, this would likely end up being a higher penalty than the Individual Mandate tax already is! Let's say the policy you're looking at runs $300/month. 30% of that is $90, so you'd have to pay an extra $1,080 for the policy for a year before it drops back to the normal rate. If you have a family plan for, say, $1,000/month and your whole family went without coverage, you'd have to pay an additional $3,600.

Whether you'd end up paying more or less of a penalty depends on the specifics of your situation, of course, but there is no way anyone can argue that this "gets rid of" the mandate. I suspect a lot of Trumpsters are gonna be pretty pissed off when they find out that the "Obamacare Penalty" has simply been replaced with the "Republican Penalty".

"Best" of all? Unlike the ACA, where the mandate penalty is paid to the IRS (that is, to the federal government, so at least it might go towards something useful, like funding the law itself), under the AHCA, you pay the penalty directly to the for-profit, private corporation. I'm honestly not even sure if that's legal--technically what you have here is the federal government legally mandating that private companies charge a specific amount for a service to their customers.

It includes a big tax break for insurance companies that pay their CEOs more than $500,000 per year.

One provision in the House GOP’s proposed Obamacare replacement plan would essentially incentivize major corporations to overpay their top executives — offering a tax break to insurers that pay CEOs more than half a million dollars per year.

Why? Absolutely NO REASON WHATSOEVER other than to be a massive giveaway to fat-cat CEOs. Basically an open bribe to get them to support passage of the bill.

There's some other stuff here as well, but I think that covers most of it. Some of this is changing stuff just to change it. Some of it is "good" in the sense that it's not changing anything at all (at least under reconciliation, that is). However, the single biggest sin here is that it would kick tens of millions of poor and low-income people off of Medicaid...for the sole purpose of allowing a massive tax cut to the ultra-rich.

Which, of course, is the whole point.

Oh, and that reminds me...how, exactly, are they planning on paying for their bill, seeing how it would also wipe out nearly all of the current funding mechanisms (it keeps some around for 1 year, and would actually keep the ACA's "Cadillac tax" on high-end employer plans around...except that wouldn't kick in until 2025, some eight years from now, which might as well be another century in political time)?

The answer is...they don't.

As Matthew Yglesias noted at Vox:

while the GOP plan does reduce outlays on both of those things, it doesn’t eliminate either of them. So that opens up a potentially large fiscal hole. And according to House Republicans’ Frequently Asked Questions page, their plan for what to do about this is, well, they don’t have one:

How are you paying for this plan? How much is it going to cost taxpayers?

We are still discussing details, but we are committed to repealing Obamacare and replacing it with fiscally responsible policies that restore the free market and protect taxpayers.

THEY. WANT. TO. PASS. A. MASSIVE. BILL. AND. TAX. CUT. FOR. THE. WEALTHY. WITHOUT. ANY. IDEA. HOW. TO. PAY. FOR. IT.

When the ACA was passed, it caused some amount of disruption, to be sure, but at least there were positive reasons for doing so.

The AHCA, by contrast, appears to be designed to cause a massive amount of disruption...without fixing any of the legitimate issues the ACA has, while creating a whole lot of new problems, devastating millions of low-income Americans, hurting women, the elderly and children...all for no other reason than giving a huge tax cut to people who have absolutely no need or justification for receiving one. As I noted on Twitter earlier, it's sort of like Windows Vista compared to Windows XP...it's newer, but DOESN'T FIX ANY ISSUES while BREAKING MUCH OF WHAT DOES WORK.

In fact both left-leaning Ezra Klein (of Vox.com) and right-leaning Peter Suderman (of Reason.com) wrote nearly identical thinkpieces this evening:

Actually, I can answer that question: There are two "problems" they're trying to "solve" here:

- 1. They want to give a massive, unnecessary tax cut to the very rich.

- 2. They want to be able to say that they "repealed and replaced Obamacare", even if what they're replacing it with is a shittier, meaner, utterly fiscally irresponsible version of Obamacare.

This bill, if passed, will hurt tens of millions of people for no good reason. It's cruel, fiscally stupid, intellectually stunted and politically nonsensical.

In other words, the perfect bill for the modern Trumpublican Party.