Believe it or not, there's ONE part of the Trumpcare bill which SHOULD be kept.

Yesterday the CBO pretty much torpedoed the Trumpcare bill. Everyone from across the political spectrum now seems to agree that it's a complete disaster, with the exception of Paul Ryan and Tom Price (hell, even an internal Trump White House analysis apparently concluded that even more people would lose coverage than the CBO did...26 million vs. the CBO's 24 million).

However, there's one part of the AHCA which should be kept: The $100 billion that they currently have allocated to throw at the states to stabilize the individual market. As the CBO noted:

Under the legislation, in the agencies’ view, key factors bringing about market stability include subsidies to purchase insurance, which would maintain sufficient demand for insurance by people with low health care expenditures, and grants to states from the Patient and State Stability Fund, which would reduce the costs to insurers of people with high health care expenditures. Even though the new tax credits would be structured differently from the current subsidies and would generally be less generous for those receiving subsidies under current law, the other changes would, in the agencies’ view, lower average premiums enough to attract a sufficient number of relatively healthy people to stabilize the market.

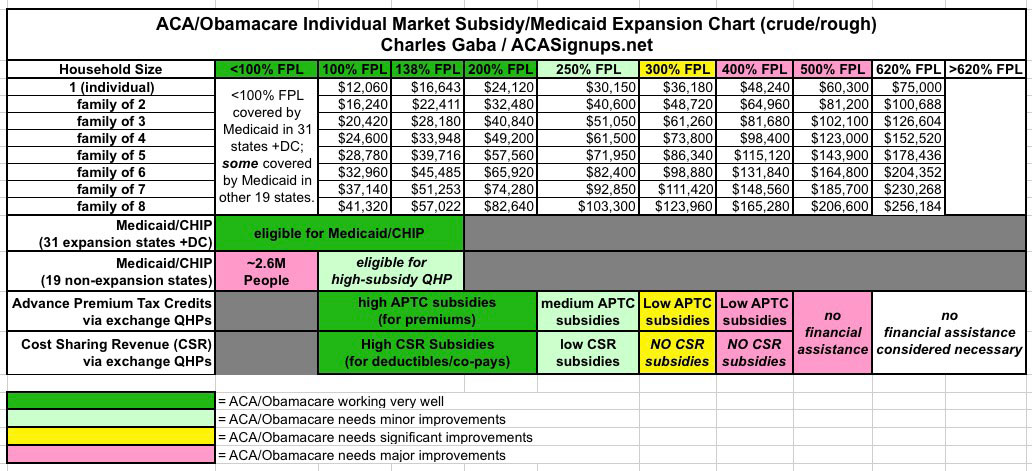

In other words: Under the ACA, there's Medicaid for those below 138% FPL, generous tax credits for those 138-250% FPL (or 100-250% for non-expansion states) and moderate tax credits for those 250-400%.

Under Trumpcare, there are less-generous tax credits spread out across the full 0 - 960% FPL range (the AHCA credits start to drop off at $75K, or 620% FPL, and drop off completely at $115K, or 960% FPL). The gap is supposed to be filled by an additional $100 billion doled out to the states over a 9-year period, which can be used for several different types of market stabilization programs, including High Risk Pools (which I think is a terrible idea) or Reinsurance programs (which I think is a good idea, and which is already being used successfully in Alaska and Minnesota).

As I've pointed out repeatedly, while the ACA has several serious issues which need to be addressed, the single biggest one is that the current 100-400% FPL tax credit structure simply needs to be beefed up. Once again, here's a crude table demonstrating the problem (I'm leaving off the Trumpcare table this time):

The trouble spot is obviously the 300-500% FPL range (500% FPL is roughly $60,000/year for an individual, or $123,000 for a family of 4).

The average APTC amount being received by those who currently qualify (ie, those in the 100-400% FPL range) is around $386/month across the 39 states on the federal exchange.

$100 billion over 9 years is around $11 billion per year. Divide by 12 months and that's around $900 million per month. That would be enough to provide $386/mo in tax credits for 2.3 million additional people. Now, obviously the amount of financial assistance required by those higher up the income scale would be less than $386/mo, but this at least gives a starting point to work with. Instead, I'd use, say, 1/3 of this amount to beef up the APTC amounts in the 250-400% range, another 1/3 to raise the CSR cap from 250% to 500%, and the rest for APTC/CSR for those between 400-500%.

Result? Several million more people would sign up for exchange policies, presumably including plenty of the Young Invincible crowd which is needed to stabilize the risk pool and flatten out premiums...which, in turn, would also reduce the rate of increase needed for the tax credits going forward.

The exact formula and allocation can be played around with, of coruse, but the point is that making this change alone--ie, simply beefing up the ACA tax credits--would go a long way towards resolving the problems facing the individual market...while most of the other parts of the Trumpcare bill would screw things up royally.

Of course, doing what I just suggested would mean rich people don't get a fat, unnecessary tax cut, and we can't have that, of course...