TIMELINE: Obamacare stabilizes just in time for TrumpCare/GOP to destroy the market.

(this is mostly a repost from last week, but there've been some additional developments since then):

Politically, the big unknown is whether or not Paul Ryan and Mitch McConnell will get away with trying to pin the blame for this on the Democrats/the law itself. That's why they've been pushing the "Obamacare is already in a death spiral!" claim hard for the past few weeks, even though it quite simply isn't.

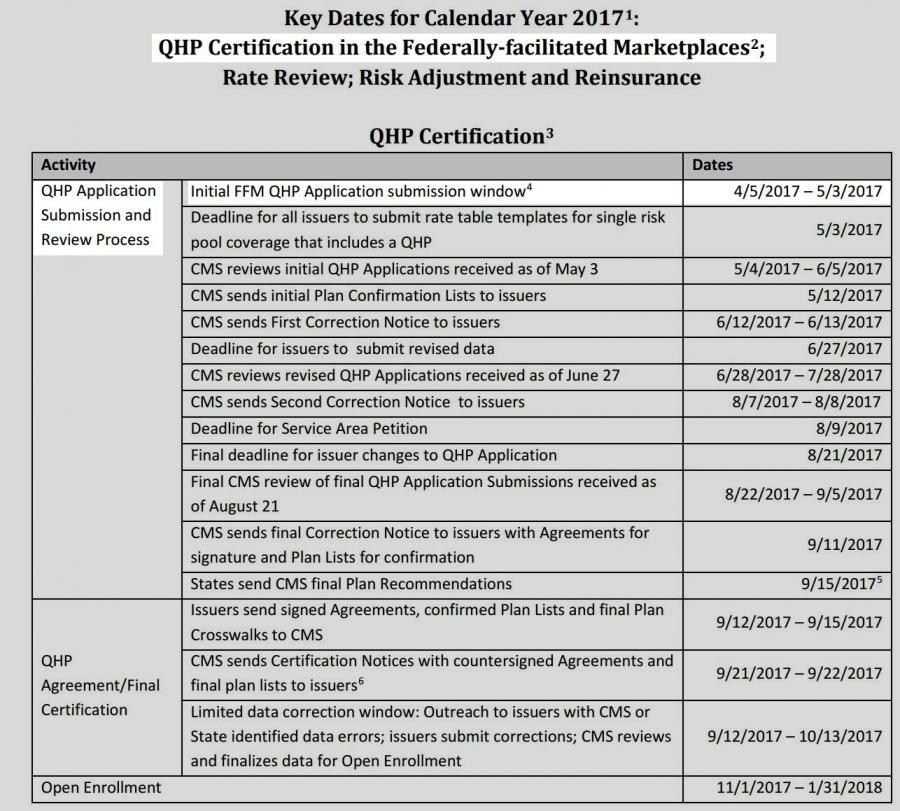

...So, if this does end up in a worst-case scenario, Trump's "stop enforcing the mandate altogether!" order here could end up causing that death spiral even if the GOP doesn't technically end up repealing anything legislatively. The carriers would start announcing that they're bailing next year as soon as this spring (remember, the first paperwork for 2018 exchange participation has to be filed in April or May), and McConnell/Ryan would simply say, "See?? We told you it was collapsing all by itself! We didn't touch nuthin'!!"

The agencies also estimate net federal subsidies for coverage obtained through the marketplaces to be $49 billion, or 0.3 percent of GDP, in fiscal year 2017. Those subsidy amounts are projected to rise at an average annual rate of about 9 percent, reaching $110 billion (or 0.4 percent of GDP) in 2027. For the 2018– 2027 period, the net subsidy is projected to total $919 billion under current law.

...Finally, the CBO is now stating, flat out, that prior to Trump taking office, the GOP starting the ACA repeal process, Trump's "sabotage" executive order and so forth, they were projecting average subsidies for ACA exchange enrollees to increase at a rate of roughly 9% per year for the next decade.

...Again, this is all speculative, but the bottom line is that the CBO is stating pretty clearly that with the ACA, while they don't see the individual market being in the greatest shape, neither do they see a death spiral under the current law.

October 6, 2016, via Anna Wilde Mathews:

Molina Outperforms Rivals in ACA Marketplaces

...Molina’s approach—rigorous cost control, limited networks of doctors and hospitals and close management of patients’ health—signals what can work in the health-coverage marketplaces created by the Affordable Care Act. Long Beach, Calif.-based Molina has done relatively well in the exchanges, where larger rivals have faltered. While UnitedHealth Group Inc., Aetna Inc. and Humana Inc., have lost millions on ACA plans and are pulling back from the marketplaces, Molina is profitable, though the margins are slim. The company projects that its margins on the exchange business this year will be within its targeted range, between 1.5% and 2%.

...Analysts worry that Molina, which has around 600,000 marketplace enrollees across nine states, next year may pick up high-cost enrollees formerly covered by insurers that withdrew from exchanges. Molina “is really going to be tested as the bigger players leave the market and the risk moves to them,” said James Sung, an associate director with S&P Global Ratings.

Ms. Rubino said company officials “anticipate another solid year” for the exchange business in 2017, and that Molina adjusted prices to account for the impact of others’ exits.

So, that was how Molina, one of the largest ACA exchange participants (around 7% of all exchange enrollees) felt about the future of the ACA just a month before the election.

And now?

Tuesday, January 24th, via Bob Herman of Axios:

In an interview, Molina said the executive order is "symbolic" and doesn't change the plans for his company, an insurer that mostly covers Medicaid members but also has more than a half million Obamacare customers. Yet when asked if Molina Healthcare would keep offering Obamacare plans in 2018, he said: "There are just too many unknowns at this point to give a definitive answer."

Why this matters: Insurance companies need to submit their 2018 Obamacare plans and rates in the next few months. Molina is a significant and profitable player in the marketplaces, and its hesitancy indicates insurers will wait as long as they can before they decide to stay in or leave. That's not exactly a recipe for a stable market.

On Obamacare: Trump cannot unilaterally eliminate Obamacare's insurance mandate and coverage penalties. They are embedded within the law and require an act of Congress. Instead, Molina is more concerned what Congress will offer up as a full-scale replacement.

Wednesday, January 25th, via Paul Demko of Politico:

The Trump administration has pulled the plug on all Obamacare outreach and advertising in the crucial final days of the 2017 enrollment season, according to sources at Health and Human Services and on Capitol Hill.

Even ads that had already been placed and paid for have been pulled, the sources told POLITICO.

...The last five days of the open enrollment season are seen as critical because many individuals procrastinate and then join a last-minute sign-up surge. That’s particularly true for younger and healthier customers who are crucial to making insurance markets work.

...The decision to scrap Obamacare outreach and advertising came directly from the White House, according to sources.

Now, they did backtrack somewhat on this the following day, either due to the massive backlash, sheer inability to pull the ads that late or a combination of both, but they still killed off a substantial amount of last-minute advertising:

Spending on television spots by HealthCare.gov plummeted in the final days of open enrollment, according to data from iSpot.tv, an ad tracking firm. Advertising peaked at roughly $1 million per day from Jan. 24 to 26. Then, it fell roughly 80 percent — to less than $250,000 per day — over the next four days, according to the most recent data.

“That basically tells me that the strategy or the plan to eliminate as much advertising as possible was executed,” said Kevin Counihan, the CEO of HealthCare.gov in the Obama administration. “The is the second most active period of time to enroll, and a disproportionate share of younger people come in at this time.”

Friday, January 29th, via Tami Luhby of CNN Money:

Insurers warn: We're outta here with no Obamacare replacement

Health insurers want to see how Congress intends to replace Obamacare before they commit to offering policies for 2018, a new survey has found.

One of the biggest issues is the individual mandate, which requires nearly all Americans to buy insurance or pay a penalty. If Republican lawmakers repeal the mandate without a replacement plan, insurers said they'd "seriously consider" withdrawing from the market next year, the Urban Institute report said. They see "significant" risks in remaining while the details of a replacement bill are in doubt.

...Surveys show that as many as 40% of enrollees say they wouldn't have signed up without the mandate, the Urban report found.

"Pulling one leg out of the stool, we crash to the ground," said one respondent.

Wednesday, February 1st, via Zachery Tracer of Bloomberg News:

Obamacare’s Slow and Painful Death Puts Health Insurers in Limbo

Obamacare looks like it’s going away. Until that happens, big health insurers aren’t sure what to do with it.

Republicans and President Donald Trump haven’t given details on how they’ll repeal and replace the Affordable Care Act. Uncertainty about the law, which covers millions of Americans, has left companies trying to figure out if they’re better off stuck in limbo or just quitting entirely.

Aetna Inc. Chief Executive Officer Mark Bertolini warned Tuesday that the company won’t sell Obamacare plans again in states where it has pulled out, and may continue shrinking its participation, “given the unclear nature of where regulation’s headed.” On Wednesday, Anthem Inc. said its ACA business is stabilizing, but it’s carefully watching Washington while developing 2018 plans.

“We will make the right decisions to protect the business,” CEO Joseph Swedish told Wall Street analysts in a conference call. “If we can’t see stability going into 2018, with respect to either pricing, product, or the overall rules of engagement, then we will begin making some very conscious decisions with respect to extracting ourselves.”

Congressional Republicans face a dilemma, too. They want to paint Obamacare as collapsing to help justify its repeal. Yet they need to keep its markets humming this year, and probably into 2018, or take the blame for millions of people who might lose coverage. That will be the topic of hearings Wednesday in the Senate and Thursday in the House.

“Markets need clarity,” Tennessee’s insurance regulator, Julie Mix McPeak, will tell the Senate’s health committee, according to prepared remarks provided before the hearing. If insurers don’t get answers, some will quit the market, and Tennesseans could be left with nowhere to buy coverage, she says in her remarks.

...“They create a lack of confidence and then they point and say, ‘See, the ACA is failing,’” Hoyer said. “The chaos and uncertainty that this administration has created over the last 10 days has led to the very thing that they say is the problem.”

Gee, that sounds familiar.

Or, to put it even more succinctly, here's Anthem CEO Joseph Swedish regarding the 2017 Open Enrollment Period:

$ANTM CEO Swedish: encouraged by early #Obamacare open enrollment numbers; no outlook on make-up of risk pool; expect to break even on plans

— Bertha Coombs (@berthacoombs) February 1, 2017

...and here he is regarding the 2018 Open Enrollment Period (assuming there is one at all):

So, $AET says April 1 key date for #repealobamacare #repealanddelay rules; $ANTM says will decide on pulling the plug on 2018 at end of Q2

— Bertha Coombs (@berthacoombs) February 1, 2017

Yup. It's true that some carriers might have been considering dropping out of the exchanges in 2018 regardless...but between Trump winning, the GOP going full-speed ahead with repeal plans, Trump's executive order, the GOP not having the slightest clue what, if anything, they would replace the ACA with (or when that might take place), and the initial filing deadlines bearing down on the carriers like a freight train, some of the major players are already seriously talking about bailing BECAUSE OF THE TRUMP/GOP-INDUCED UNCERTAINTY.

I cannot stress this enough: IF the individual market collapses next year, it will be primarily due specifically to deliberate sabotage and uncertainty created by the GOP.

And for the record, here's the official timeline for carrier participation on the federal exchange (I presume the dates are a bit different for the various state-based exchanges, but we're still talking about just a few months here):

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.