2017 Rate Request Early Look: North Carolina

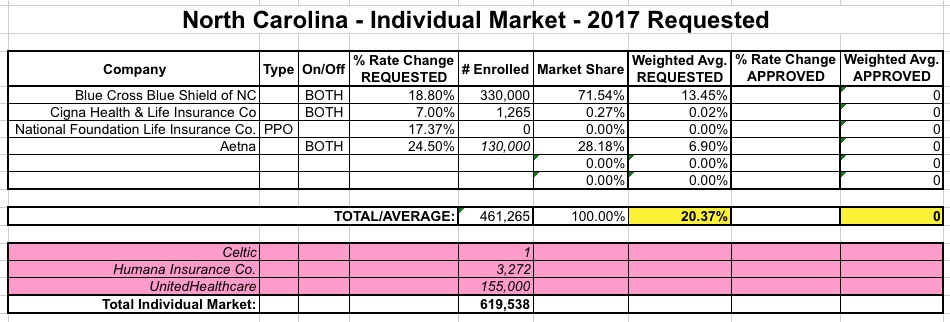

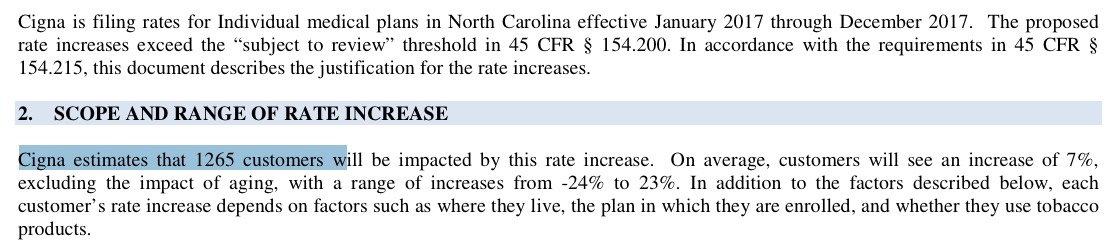

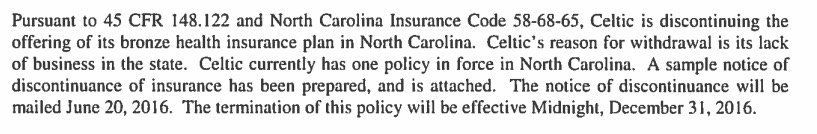

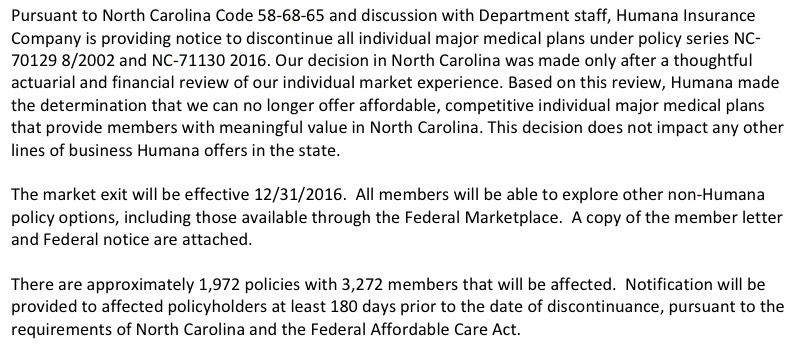

North Carolina's individual market, which only had 5 carriers participating to begin with this year, suffered a double blow recently when both UnitedHealthcare (155,000 enrollees) and Humana (3,272 enrollees) announced that they were dropping out of the market entirely next year (Celtic is also leaving the state, but they have literally just 1 person enrolled state-wide anyway). Fortunately, nature abhors a vacuum, so Cigna Health & Life Insurance decided to join the exchange for 2017. Cigna is already selling off-exchange individual policies, but only has fewer than 1,300 people enrolled in them at the moment. There's also a carrier called "National Foundation Life Insurance" which is raising rates 17.4%...but doesn't have a single person enrolled at the moment anyway, so I'm not sure what to make of that.

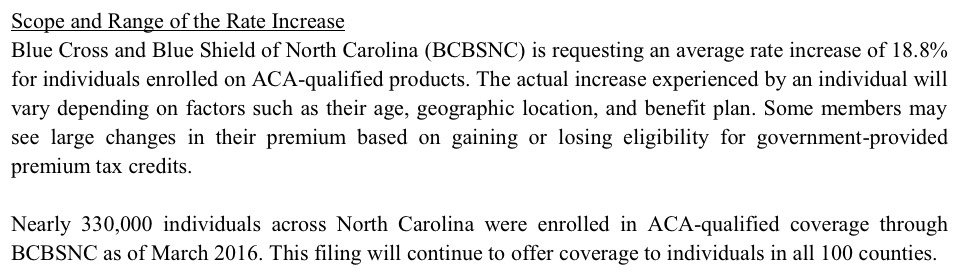

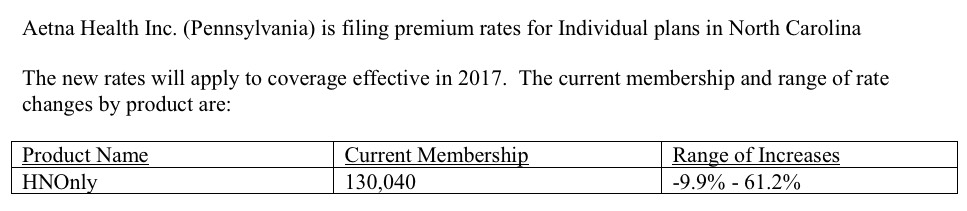

That leaves Blue Cross Blue Shield of NC and Aetna. BCBS's filing is pretty straightforward: 330K enrollees, 18.8% hike requested. Unfortunately, I can't seem to find Aetna's rate filing at all...but according to two separate news articles, they're requesting a 24.5% rate hike, and one of the articles lists their enrollment number as 130,000 people.

The only problem with this is that I'm pretty sure that 130K figure doesn't include off-exchange enrollees. In 2014, NC's total individual market was around 633K people, and it's likely increased by around 25% since then (assuming parity with the national increase). All told, NC's indy market should be roughly 790K people. Assuming around 10% of those are enrolled in grandfathered/transitional plans and that leaves around 711K.

The thing is, when you add up all of the above carriers including those who'll have to shop around via United & Humana, it only comes to around 620K. My guess is that Aetna actually has another 80K or so people enrolled in ACA-compliant policies off-exchange.

Without those extra 80K, North Carolina's overall indy rate increase requests come in at 20.4%. If you tack another 80K onto Aetna's number, this increases slightly more to right around 21% even.

UPDATE: OK, thanks to commenter InTheKnow for digging up the link to an alternate SERFF database for North Carolina; as a result I was able to find the actual Aetna filing, and sure enough it lists current enrollment as 130,040 (see below). Therefore, 20.4% it is.

I should also note that according to the News Observer article...

Blue Cross also wants to be compensated for having to beef up its customer service operations in response to a flood of customer pleas for help in the past five months. Most of those pleas came after a Blue Cross technology system malfunctioned, leaving thousands of ACA customers double-billed, enrolled in the wrong health plans or unable to confirm that they have insurance.

The Blue Cross enrollment fiasco prompted the N.C. Department of Insurance to launch an investigation this year; the department submitted the results to Blue Cross on Tuesday. The insurer now has 30 days to respond before the agency announces fines. State Insurance Commissioner Wayne Goodwin recently said he expects to fine Blue Cross in the millions of dollars for its misdeeds.

Nonetheless, in its rate filing, Blue Cross said it wants customers to pay the costs of dealing with the technology crash: “BCBSNC will increase resources to better address call volume and demand in response to our higher-than-anticipated call volumes in 2016. This important investment is needed to provide the quality customer service experience our customers expect.”

That stand may not placate angry customers.

“I can’t believe the arrogance of this company,” said Karen Carlton. “They wouldn’t have had the call volume they had if they hadn’t messed everything up.”

Carlton, an administrative coordinator at a private family foundation, said it took more than 20 hours over four months to get her Durham address correct on her insurance records.

Ah, there's the old "private corporations are more efficient than government services" truism in action.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.