2017 Rate Request Early Look: Texas

Hoo, boy. Here comes the pain.

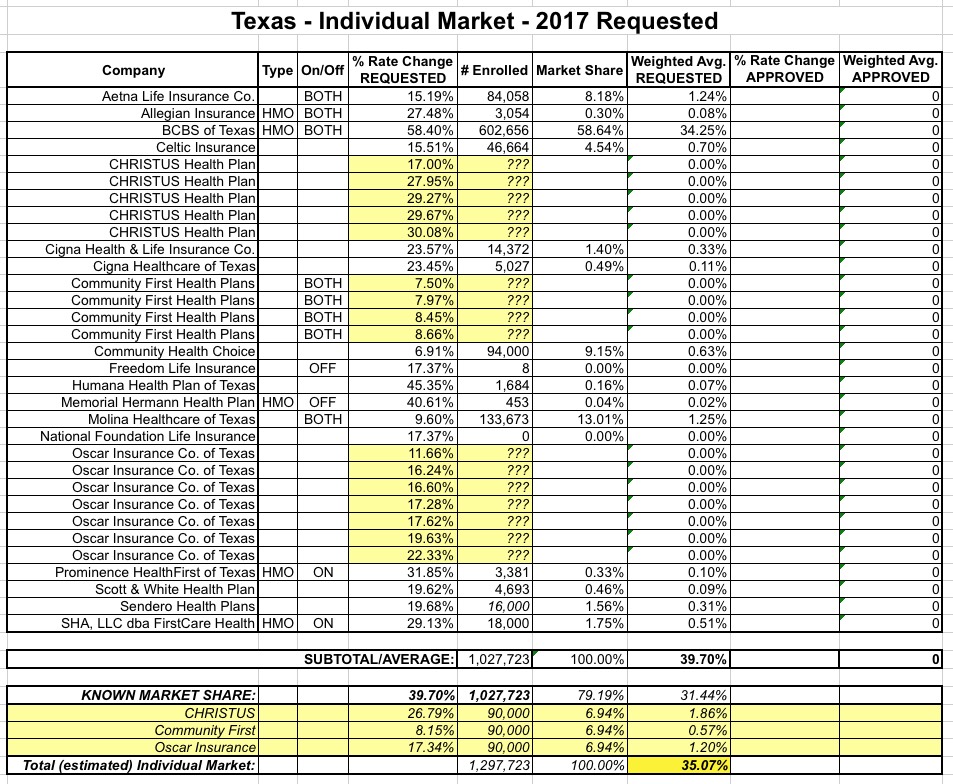

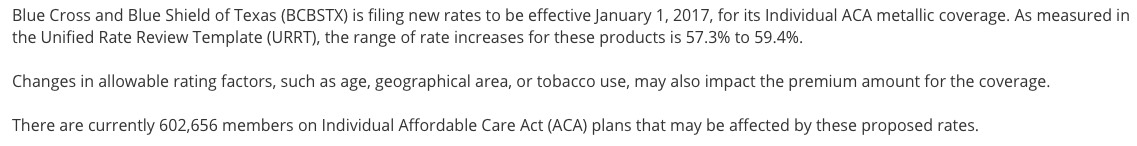

Last year, the Texas ACA-compliant individual market carriers requested an average rate hike of around 16%, although it was a pretty fuzzy guesstimate since I couldn't track down the average rate hikes for about 25% of the market other than knowing that whatever it was, it was under 10%.

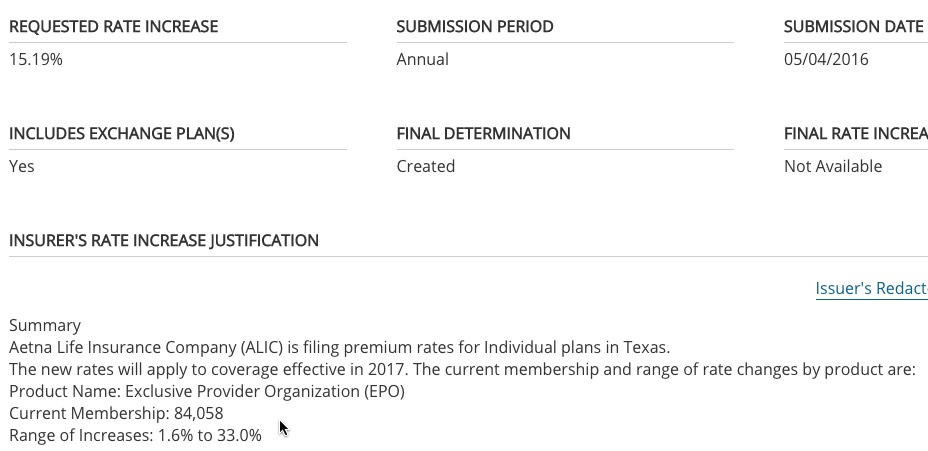

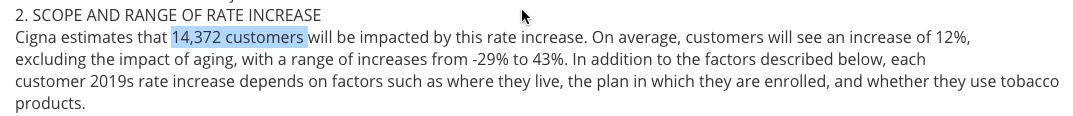

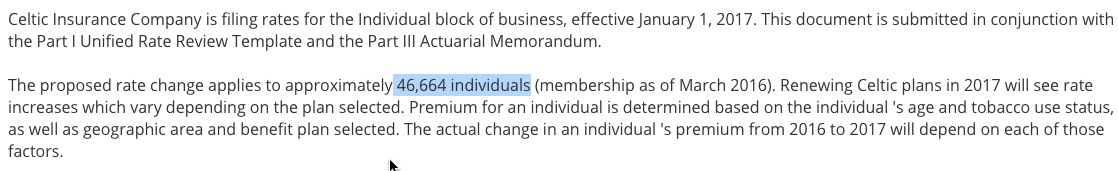

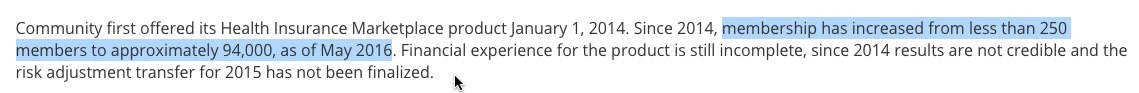

This year, the good news is that CMS has started posting all rate change requests whether over or under 10%, making it easier to fill in some of the data. The bad news is that 3 of the 19 carriers offering individual policies next year redacted any data giving a clue as to what their current enrollment numbers are: CHRISTUS, Community First and Oscar Insurance.

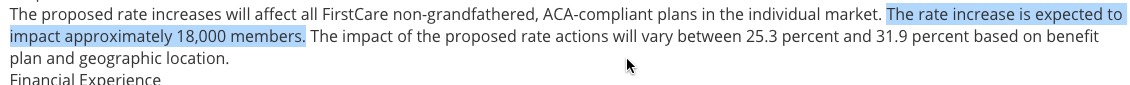

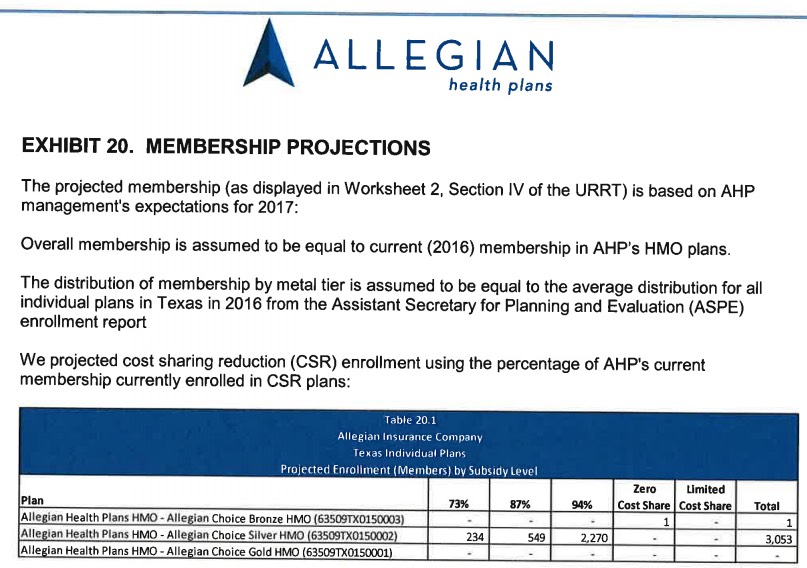

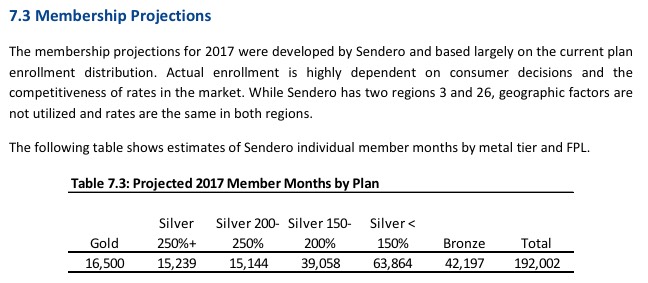

The other 16 carriers did provide those numbers pretty clearly (except for Sendero, which only gave a projection of "member months" which I had to divide by 12 to get a rough enrollment estimate).

In order to get a rough estimate of the remaining three carriers, I had to make several assumptions. I realize there's some leaps of faith involved here, but it's the best I can do for the moment:

- First, Texas's total individual market in 2014 was appx. 1.25 million people, according to Mark Farrah & Associats via the Kaiser Family Foundation. Note that this included grandfathered/transitional policies.

- The total individual market nationally is around 19.5 million today, or roughly 25% larger than the 15.6 million in 2014 estimated by Mark Farrah/KFF.

- Assuming this is proportional by state, that means Texas's total indy market should be roughly 1.56 million people today.

- Subtracting around 10% of this for grandfathered/transitional policies leaves roughly 1.40 million ACA-compliant enrollees state-wide.

- I've already accounted for 1.03 million of these via the other 16 carriers, leaving around 375,000 estimated "unknown" individual enrollees.

- Finally, UnitedHealthcare is dropping out of Texas next year. How many individual enrollees do they have? Beats me, but I'll assume it's at least as many as any of the other 3 "mystery" carriers. Let's say around 100,000, leaving 270K to split evenly (?) among those three, or around 90,000 per carrier.

- Finally, there's the matter of each of these carriers having multiple rate filings for different types of plans. Again, I don't know how many people are enrolled in CHRISTUS's "17% hike" filing vs. their "27.95%" filing; in the absence of any more data, I'll have to just run a simple average for each, giving 26.8%, 8.2% and 17.3% respectively.

Add all of the above up and you get something resembling the following (with the 3 mystery carriers listed at the bottom):

Ouch. 35% if all of my assumptions above are close to accurate; nearly 40% if you ignore those three and just look at the 16 known carriers.

ONCE AGAIN, this does not necessarily mean that these rate increases will be approved by Texas regulators, but it's certainly a forboding image.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.