UPDATE x3: 2017 Rate Request Early Look: Virginia

In light of today's confirmation that the average 2016 premium rate increase ended up only being appx. 8% nationally on the individual market (as opposed to the headlines screaming about 40%, 50%, 60%+ rate hikes being "typical"), I've decided to get a jump on the 2017 rate changes. Someone gave me a heads up that Virginia appears to be first out of the gate this year, with requested 2017 rate filings having already been submitted by at least 8 carriers.

Now, for 2016 there are actually 13 carriers offering individual policies in Virginia (although some of these are available off-exchange only). I'm don't know if the 5 missing carriers have decided to drop out of the VA market or if they simply haven't submitted their 2017 filings yet (it looks like in Virginia the carriers technically have until July 15th to get their requests to the HHS Dept. in states which have their own rate review process, but the state itself presumably has an earlier deadline). It's also possible that some additional carriers might join the exchange and/or start offering policies in the state which don't this year.

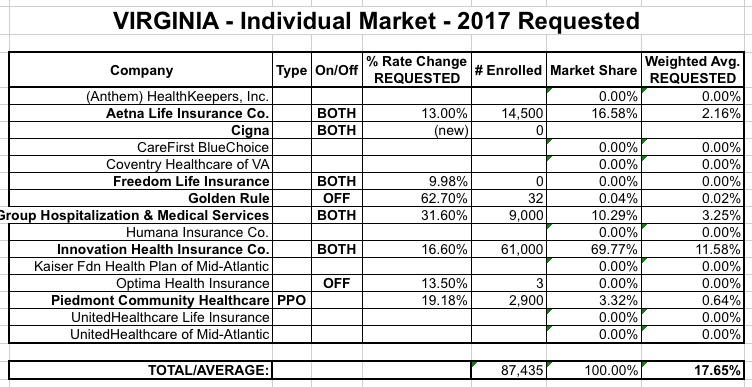

In any event, here's what I've found so far for Virginia:

- Aetna requested a 13.68% average rate hike for 2016, but was only approved for 10.25% increase on average, which impacted around 14,500 people state-wide (remember, this includes both on and off-exchange individual plan enrollees). For 2017, Aetna has requested a 13.0% average rate hike which, interestingly, is also expected to apply to...14,500 people state-wide.

- Cigna is entering the Virginia individual market for the first time in 2017, and therefore has no current rates (either on or off-exchange) to compare against. They will, however, be offering their policies both on and off the federal exchange.

- Freedom Life is requesting an average rate hike of 9.98% for 2017. While they did offer policies for 2016 as well, they don't appear to have any current enrollees who would be impacted by these rate changes, which means either they failed to enroll a single person or they've scrapped their old plans and replaced them with entirely different ones for next year.

- Golden Rule: At first glance, Golden Rule's jaw-dropping 62.7% average rate hike request may raise some eyebrows...except for one thing: It looks like they only had 49 people enrolled state-wide last year...and if I'm reading Section 21 (Membership Projections) correctly, they're only expecting an average of...32 people this year (388 total projected member months). That's right: Not 32,000. Not 3,200...32. People. Enrolled. In the entire state of Virginia. They even state that "These plans will not be actively marketed, though they will be available for anyone who requests to purchase them." These policies will only be available OFF-exchange anyway.

UPDATE: OK, it looks like the actual number of policyholders impacted is even smaller: 27 people.

- Group Hospital & Medical Services (CareFirst): It looks like "GHMS" is actually the same as "CareFirst BCBS". For 2017, they're requesting an average rate increase of 31.6% for their Silver and Gold plans. A major part of the reason for this is that they're discontinuing Bronze plans in 2017, and appear to be planning on "uniformly modifying" current Bronze enrollees over to the Silver equivalent unless they actively switch policies during open enrollment. GHMS says that around 9,000 currently-enrolled members will be impacted. They'll be selling both on & off exchange.

- Innovation Health: Innovation Health currently has around 61,000 enrollees. Last year they were among the few carriers to lower their rates on average; for 2017, however, they're requesting a weighted average rate hike of 16.6%, whle also adding 2 new silver plans. One other interesting tidbit is this bit on Page 6 of the cover letter, where they state that they expect 90% of their 2017 enrollments to be on-exchange with only 10% off-exchange.

- Optima Health Insurance had over 3,900 individual market enrollees off-exchange last year. However, for 2017 they appear to be anticipating just...3 people?? Anyway, they're asking for a 13.5% hike for...again...3 people. Not sure what to make of that.

- Piedmont Community HealthCare: OK, I'm a little confused by this one. On the one hand, this summary statement says that they only have about 2,900 members, and are requesting an average rate hike of 19.18%. However, the detailed filing report lists the average request as 24.9%. Not sure which of these is accurate, but either way that's pretty steep.

Add all of these up, and here's what a partial, very early portion of the Virginia individual market looks like. I can't stress enough that this is very incomplete and that any or all of these numbers are subject to change (possibly more than once) between now and November 1st:

Just to give you an idea of how incomplete this table is right now, note that all 8 carriers combined only add up to around 87,000 people. By comparison, Virginia enrolled over 420,000 people on ACA exchange policies alone this year, and when you add their OFF-exchange individual enrollment the total is likely 600,000 or more.

That means that the table above likely only represents around 15 - 20% of Virginia's total individual market.

How much of a difference can this make? Well, let's suppose that this is 20% of the total, and the other 80% averages a 10% increase. That would make the overall weighted average hike around 11.5%. If the remaining 4/5ths average a 20% hike, the state-wide weighted average would be roughly 19.5%.

My point here is that NO, people should not start reposting the table above claiming that it automatically means Virginia residents are looking at 17.6% rate hikes. Just like early election results can change dramatically as more data comes in, the weighted average listed above will likely jump around a lot as the remaining carriers chime in...and then again when the approved rates are released.

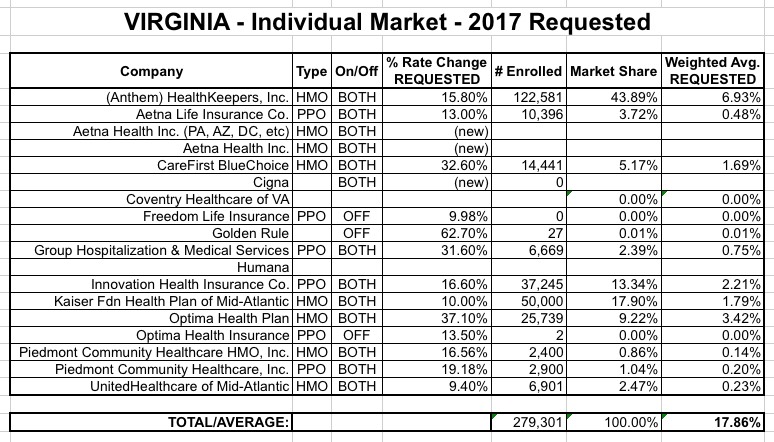

UPDATE: Thanks to Zachery Tracer for pointing out that I was missing some of the filings; it turns out that 13 companies have submitted filings after all!

Some of the numbers above have been altered thanks to the corrected filings; I'll go through and update them as necessary, but in the meantime, here's the fuller picture:

As you can see, even with the additional filings plugged in, this is still a very incomplete picture. It's up to 279,000 currently covered lives, which should only represent about 46% of the total individual market in Virginia.

So, where are the other 300,000 or so people? Well, some might be enrolled in companies such as Coventry and Humana, which may be dropping out of the Virginia individual market entirely...or might just not have submitted their filings yet?

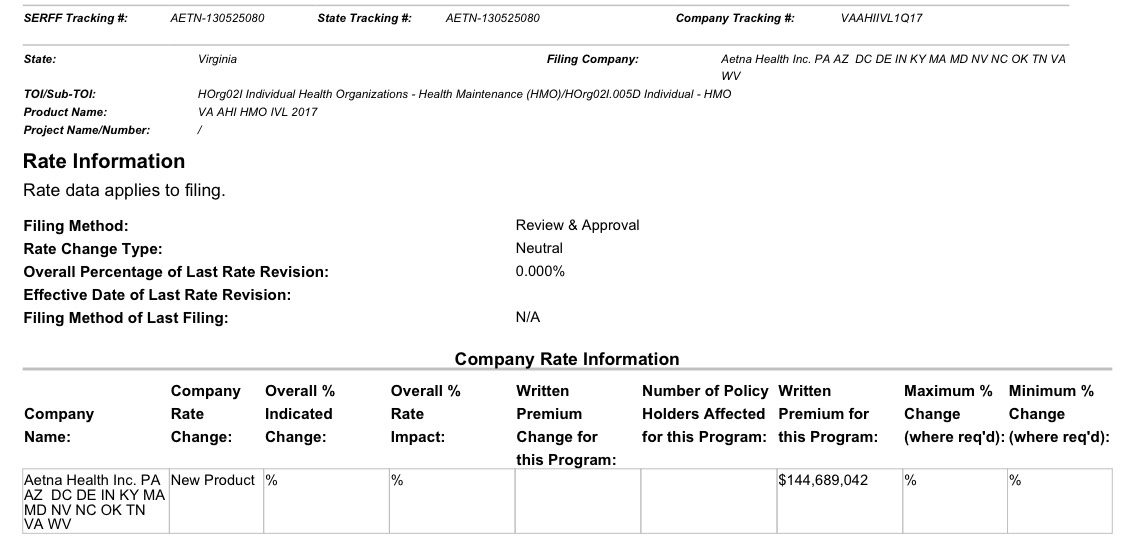

It's more likely, however, that many of them are enrolled in Aetna Health plans. As you can see, Aetna has 10,396 people in PPO plans, but their HMO filings appear to be all brand-new policies:

Unlike Freedom Life, which lists zero people enrolled, Aetna Health's filing is completely blank, so I'm not sure what to make of that. It's certainly possible that Aetna's HMO market share makes up over 50% of the total statewide market, but without that missing info I'm not sure how useful all this work was...

In any event, even with nearly half the picture filled in, it's hard to know what to make of this. On the surface it looks like roughly a 17.8% average hike request, but with over half the data missing it's hard to say:

- If the other 53% averages a 20% hike, that'd be about 19.0% overall

- If the other 53% averages a 10% hike, that'd be about 13.7% overall

- If the other 53% averages an EVEN hike, that'd be about 8.4% overall

For the moment, one important tidbit is that it looks like UnitedHealthcare IS gonna stick with the ACA exchange in at least one state next year.

UPDATE x2: Hmmm...I just got off the phone with the Virginia Dept. of Insurance. According to them, April 11th was the filing deadline for 2017, which means that unless there's some special circumstance which develops, the carriers listed above are it. Assuming I'm understanding correctly (and I might still be missing something here), this means that:

- Cigna is joining the VA indy market in 2017 (both on and off-exchange)

- UnitedHealthcare will still be offering HMOs in Virginia, but is dropping PPOs

- Humana is leaving the VA individual market entirely next year

- Coventry is "leaving" the VA market...but is actually just being "absorbed/rebranded" as Aetna Health Inc. for HMOs.

This would also explain why "Aetna Health Inc." is claiming to only be offering "new" products and therefore has "zero" current HMO enrollees; they do have a bunch of enrollees, but they're technically under the Coventry name, not "Aetna Health".

If anyone can correct/clairify any of this, please let me know, but I think that's everything.

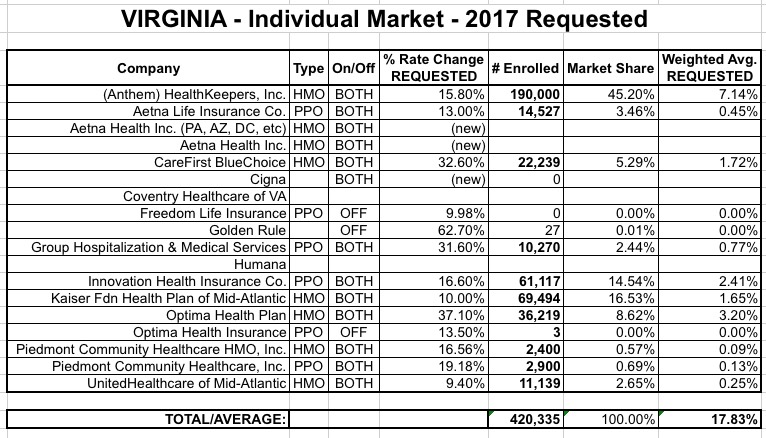

UPDATE x3: OK, sorry about the confusion, but as you can see from the updated version of this entry (thanks to FarmbellPSU for the tip!), I finally have it straightened out:

As you can see, the weighted average request is still around 17.8% even with the corrected enrollment numbers, as the relative market share stayed about the seame.

This does, however, cover a much higher portion of Virginia's total individual market; as far as I can tell, there's perhaps 100K-200K still "missing", most likely to be found in the Humana and/or Coventry fields. Here's how those would play out, assuing 150K:

- If the missing enrollees face a 10% hike, that'd be 0.0236 + 0.131 = 15,5% overall

- If the missing enrollees face a 20% hike, that'd be 0.0526 + 0.131 = 18.4% overall

- If the missing enrollees face a 30% hike, that'd be 0.0789 = 0.131 = 21.0% overall

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.