Serendipity: RWJF releases report showing huge *savings* from ACA Medicaid expansion!

A few days ago, I wrote about a Hot Air/Forbes piece attempting to tear down Ohio Governor John Kasich because he didn't read the GOP's memo about not expanding Medicaid under the ACA.

Now, I'm no fan of Gov. Kasich, but credit where due: Like my own otherwise-destructive governor here in Michigan, Rick Snyder, Gov. Kasich knew a good deal when he saw it and pushed through the ACA's Medicaid expansion program in the Buckeye State, resulting in somewhere between 590,000 - 650,000 additional low-income Ohioans receiving heatlhcare coverage, many for the first time.

The gist of the Hot Air/Forbes piece was the claim that not expanding Medicaid actually would have saved Ohio residents millions of tax dollars. I pointed out that the same expansion tax revenue is still collected regardless of whether a given state expands the program or not, so they might as well take advantage of it by getting their money back. In response, several conservative writers (including the author of the original Hot Air piece) took me to task by countering that taxpayers do save money by not expanding Medicaid...because those funds are instead used to pay down the federal deficit.

To me, this is a semantic distinction. After all, the higher-income state resident who has to pay the 3.8% investment surcharge mandated by the ACA still has to pay it regardless of whether that money is used to cover Medicaid expansion for their fellow residents or if it goes to reduce the deficit. It makes no difference in the dollar amount coming out of their wallet.

Anyway, we jabbed back and forth about the issue, not really settling much...which is why a brand-new report issued by the Robert Wood Johnson Foundation is fortuitously timed. As Bruce Japsen writes over at (yes) Forbes:

States that expanded Medicaid under the Affordable Care Act saw more job growth, lower health inflation and spent less on social and health services unneeded once more residents had medical coverage, a new analysis shows.

A new report issued by the Robert Wood Johnson Foundation said states that opted to expand Medicaid coverage for poor Americans are saving “in many cases, tens of millions of dollars.” Researchers examined savings and increased revenue for 12 states that expanded Medicaid in an update of a report first issued last year.

The report comes six years after President Obama signed into law the Affordable Care Act on March 23, 2010. States that agreed to expand Medicaid began doing so in 2014 and began to see less need for mental and health social programs. They also saw a boost to their economies once federal dollars began to flow from use of healthcare services.

“Evidence from states that have expanded Medicaid consistently shows that expansion generates savings and revenue which can be used to finance other state spending priorities or offset much, if not all, of the state costs of expansion,” says the report, issued by researchers at the consulting firm Manatt Health with funding from the Robert Wood Johnson Foundation. “Medicaid expansion is also bringing hundreds of millions of federal dollars annually to states, which ripples through state economies, creates jobs, and strengthens struggling and rural hospitals.”

In states that expanded, Medicaid spending grew by just 3.4% between 2014 and 2015 while those that did not expand saw spending rise by more than double the rate at 6.9%, researchers said. Expansion states have also seen jobs grow at a higher rate, uncompensated care expenses fall at health facilities and not as many rural hospitals at risk for closure.

In other words, no one part of the economy exists in a vacuum. Spending $X million on expanding Medicaid in a given state doesn't mean you can simply tack $X million onto the budget and call it a day; doing so impacts, either directly or indirectly, other parts of the economy.

Frankly, I'm not sure why this is such a foreign concept to Republicans. They're the ones, after all, who have been calling for the CBO to use "dynamic scoring" of budget projections:

Dynamic scoring predicts the impact of fiscal policy changes by forecasting the effects of economic agents' reactions to incentives created by policy. It is an adaptation of static scoring, the traditional method for analyzing policy changes.

Hell, for that matter, isn't this the whole idea behind "trickle down economics" that the GOP has been in love with for decades? The idea there is that if you cut taxes for the rich, tax revenue will actually stay the same (or even increase) because the rich will take those savings, invest them in new businesses/hiring/etc, thus growing the economy and generating even more tax revenue from the population as a whole.

Of course, decades of evidence have proven that tax cuts for the wealthy don't result in anything of the sort...but that's the argument that conservatives have been using for a long time, so you'd think they would be happy to see that the general philosophy is correct...but only when you reverse the process: Increasing taxes on the wealthy, and then using that additional revenue to fund a financial stimulus for those with low incomes (in the form of Medicaid expansion, in this case), does have a positive ripple effect across the rest of the ecomomy. Imagine that!

Unfortunately, Ohio wasn't among the 11 states (+DC) which the RWJF used for their study (disclosure: The RWJF has a long-standing banner ad agreement with ACASignups.net), but my own state of Michigan is...and seeing how MI and OH have similar economies, demographics, populations (9.9 million vs. 11.6 million), almost identical Medicaid expansion enrollment (620K vs. 650K) similar "extremely right-wing except when it comes to Medicaid" Governors and happen to be right next to each other geographically, Michigan seems like a pretty good stand-in for Ohio. According to the report itself:

- Michigan projected savings of $190 million in SFY 2015 by transitioning enrollees in a state-funded program that provided targeted services for the seriously mentally ill into the new adult group.

- Michigan projected a reduction in state correctional spending of $19 million in SFY 2015, as the federal government picks up the hospital inpatient costs for incarcerated individuals who are Medicaid-eligible through the new adult group.

- Michigan expected revenue gains of $26 million in SFY 2015 from the state’s Health Insurance Claims Assessment.

Add those up and that's $235 million in hard dollars either saved or earned in Michigan. MI spends around $3,100 per adult on "traditional" Medicaid; while this might vary for expansion enrollees, it seems like a good base. 100% of this is covered by federal taxes through the end of this year, meaning that by the time Michigan has to start chipping in our 5-10% of the total, we'll likely have racked up perhaps $600 million in savings/extra revenue for the first three years...and remember, those savings/revenue will continue to some degree even after the state has to start ponying up.

Assuming a similar $3,100/year per expansion enrollee, that's a maximum of $310 per person per year that the state will have to contribute...or around $190 million per year.

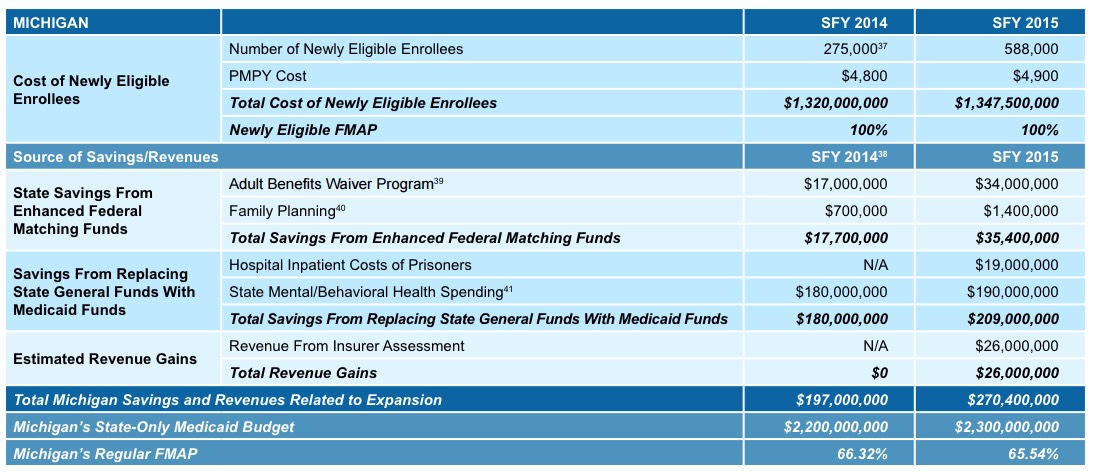

UPDATE: Strike that! It turns out that further on in the report, RWJF actually posts a full breakdown of all 12 states, including both 2014 and 2015 with the actual dollar and enrollment figures involved:

The enrollment numbers are lower than today's 620,000, of course, because the expansion program didn't start until April 2014 and didn't ramp up fully until 2015. On the other hand, the cost per enrollee is higher than I had estimated above ($4,800 - $4,900 apiece vs. my $3,100 rough estimate).

As you can see, the state of Michigan saved (or earned) $197 million in 2014 and another $270 million last year, or $467 million to date. Assuming 2016 runs about 5% higher (620K = 5.4% more enrollees than 588K), that should be another $284 million, bringing the 3-year savings/revenue total up to $751 million.

Let's assume that starting in 2017, the average cost of a Medicaid expansion enrollee in Michigan increases to, say, $5,200, and that it goes up about $100 per year per enrollee after that. I believe the way the ACA works is that the states start paying 5% in 2017, increasing by 1 percentage point per year until they hit 10%. After that, the federal government continues to pay 90% permanently (assuming, of course, that a future Congress doesn't change the law or repeal it). Let's further assume that enrollment in the program goes up about another 20,000 people per year.

For Michigan, that would mean:

- 2017: $5,200 x 640K x 5% = $166 million cost

- 2018: $5,300 x 660K x 6% = $210 million

- 2019: $5,400 x 680K x 7% = $257 million

- 2020: $5,500 x 700K x 8% = $308 million

- 2021: $5,600 x 720K x 9% = $363 million

- 2022: $5,700 x 740K x 10% = $422 million

If my math is correct, even assuming the state didn't save or earn one additional dime in revenue after 2016, the savings from the first 3 years alone would cover the costs halfway through the year 2020. And, of course, there would be additional revenue/savings coming in for 2017 and beyond anyway. Assuming that the savings/revenue did continue to increase at a 3% rate per year, it would be 2021 before the cost to the state would start to outweigh the direct economic benefit.

As far as I can tell, that means that depending on how the numbers play out, it's conceivable that the Michigan state budget could actually profit from the ACA's Medicaid expansion.

Obviously every state will differ. Some may not have existing programs that the expansion is replacing; others may not have as high a percentage of the population enrolled, and so on. And, going back to my debate with the conservative pundits the other day, obviously the other 90-100% of the program's cost is still being borne by taxpayers at the federal level, so this is really mostly a case of state expenses being shifted to the feds. Regardless, the point is that you can't simply say "it costs this much!" and leave it at that.

As a bonus, not only was this report released immediately after my head-butting session on the subject of Medicaid expansion savings, it also came out on the eve of the 6th Anniversary of the Affordable Care Act being signed into law.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.