UPDATE: HC.gov Week Eight Snapshot Report: BOOM: 275K weekly, 8.54M cumulative.

As I noted last Tuesday, the Week Seven HC.gov Snapshot Report threw a bit of a curveball; while they did add most of the bulk auto-renewals to the total, they also stated that some unknown number had yet to be added. As far as I can tell, that number could be as low as 1...or (theoretically) as high as 680,000. My best spitball take is that it was somewhere around 150,000, which presumably have all been added to this week's report.

As for new enrollments, with Week Eight taking place a) entirely after even the extended deadline for January coverage and b) the same week as Christmas Eve and Day, I'm not expecting many to be added; perhaps 100,000 or so, for a grand total of roughly 250,000 for the week, which in turn would bring the cumulative total (for the federal exchange only) up to right around 8.50 million even.

I also noted that nationally there have been 6.48 million renewals confirmed to date, of which 5.86 million were via HC.gov. Assuming I was correct about the additional 150K HC.gov renewals, that would bring the Week Eight total up to 6.01 million renewals.

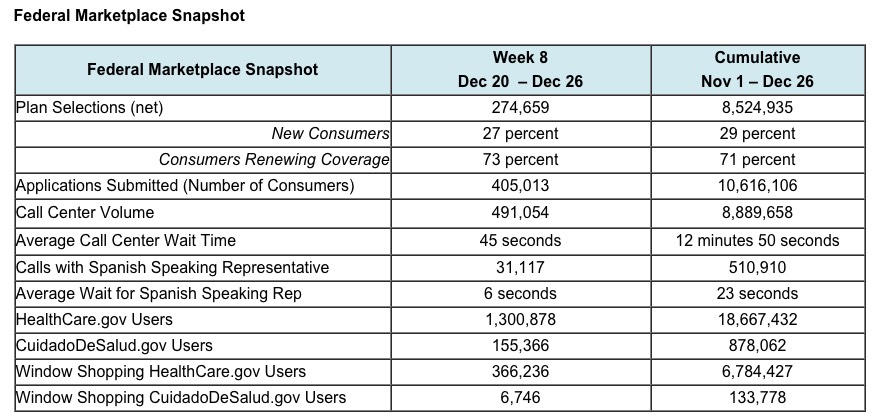

Moments ago, CMS did indeed release the Week Eight HC.gov Snapshot Report:

Health Insurance Marketplace Open Enrollment Snapshot - Week 8 December 20 – December 26, 2015

Since Open Enrollment began on November 1, more than 8.5 million consumers signed-up for health coverage through the HealthCare.gov platform or had their coverage automatically renewed. Of the about 6 million Marketplace consumers whose coverage was renewed, about 3.6 million actively renewed and 2.4 million consumers were automatically renewed.

“As 2015 comes to an end, I am encouraged to see Marketplace consumers showing how engaged they are with their health coverage,” said Department of Health and Human Services Secretary Sylvia Burwell. "Millions of consumers that had 2015 coverage – an impressive 60 percent -- came back to HealthCare.gov to update their information, explore the options available for 2016 and select the plan that best fits their needs. As we kick off the New Year and begin counting down to the final enrollment deadline on January 31, we will continue working to help more families learn about their options and sign up for coverage."

OK, so I actually undershot a bit this week (250K vs. 275K), but that's fine. The bigger question is the breakout between renewals and new additions: 73% renewals = around 200.5K, which is about 50K higher than I spitballed, yay!

In terms of how close/far off I was:

- I figured 250K...actual was 275K (9.8% higher)

- I figured 6.01 million total renewals...actual was around 6.05 million (0.7% higher)

- I figured 8.50 million total HC.gov QHP selections...acutal is 8,524,935 (0.3% higher)

HOWEVER, this also means, by definition, that the remaining 27% = around 74,000 people...which is not only lower than my 100K estimate, it's actually lower than last year's post-Christmas weekly total of 96,000 new additions...which may be significant...or may mean nothing whatsoever.

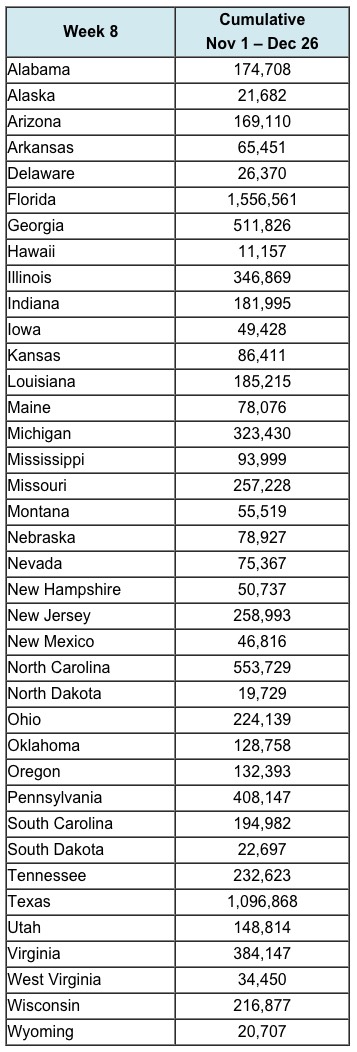

I'll be writing more about what this all means later, but for the moment, here are the cumulative state-level numbers for the federal exchange:

UPDATE: HOLD THE PHONE, FOLKS: There's a very important caveat at the bottom; check out the glossary definition of "Plan Selecion":

Plan Selections: The weekly and cumulative metrics provide a preliminary total of those who have submitted an application and selected a plan. Each week’s plan selections reflect the total number of plan selections for the week and cumulatively from the beginning of Open Enrollment to the end of the reporting period, net of any cancellations from a consumer or cancellations from an insurer during that time.

Because of further automation in communication with issuers, the number of net plan selections reported this year account for issuer-initiated plan cancellations that occur before the end of Open Enrollment for reasons such as non-payment of premiums. This change will result in a larger number of cancellations being accounted for during Open Enrollment than last year. Last year, these cancellations were reflected only in reports on effectuated enrollment after the end of Open Enrollment. As a result, there may also be a smaller difference this year between plan selections at the end of Open Enrollment and subsequent effectuated enrollment, although some difference will remain because plan cancellations related to non-payment of premium will frequently occur after the end of Open Enrollment.

Here's what this means.

LAST YEAR, the official number of QHP Selections reported through the end of Open Enrollment (2/22/15) was 11,688,074...while the official number of effectuated enrollees as of 3/31/15 (just 37 days later) was only 10,187,197.

That's a "drop" of a whopping 1.5 million people, or 12.8%.

Now, the vast majority of these were people who didn't pay their first premium or who were kicked off their policies due to legal residency verification issues, etc etc...but last year, these reductions weren't subtracted from the official numbers until after Open Enrollment ended. In other words, the 11.7M figure for OE2 didn't subtract the "cruft"; it took another 5 weeks for them to be yanked from the official record.

THIS year, it appears that CMS is subtracting many of these cancellations on the fly (although there will no doubt still be some additional reduction before the Q1 2016 report is compiled).

This means two things:

- The Bad News: The official OE3 "QHPs Selected" number will end up being slightly lower (perhaps 5% or so?) than it otherwise would have been without this improvement in the record-keeping system. Let's say it ends up being 14.0 million instead of the 14.7 million I've projected; it sounds like up to 700K additional people may have been "purged" from the official record during open enrollment instead of over a month later (which would ironically mean that I'd still end up being dead on target after all in that scenario!)

- The GOOD News: This should mean that the attrition rate (ie, the gap between the official OE3 total and the Q1 effectuation report) should be much smaller. Instead of a 13% "drop", it should only be perhaps 3% or something along those lines.

Put another way: If this system had been in place last year, instead of 11.7 million, the official OE2 number might have only been, say, 10.5 million...but the Q1 number would still have been 10.2 million (around 3% net attrition instead of 13%).

More on this to come...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.