5 other major insurers tell Wall Street to chill out over ACA exchanges

After UnitedHealthcare freaked everyone in the health insurance investor community out (along with enrollees, politicians, healthcare reporters/pundits, etc.) with their Thursday morning announcement that they might drop off the ACA exchanges in 2017, just 2 years after entering the exchanges and just 1 month after painting a rosy picture of the situation, several other major players in the individual market decided to calm everyone the hell down:

U.S. health insurers Aetna Inc and Anthem Inc on Friday sought to reassure investors that their Obamacare businesses had not worsened after UnitedHealth Group Inc warned of mounting losses in that sector.

Aetna and Anthem said their individual insurance businesses, which include the plans created by President Barack Obama's national healthcare reform law, had performed in line with projections through October. Both backed their earnings forecasts for 2015.

The announcements came the day after UnitedHealth cut its earnings forecast and said it might exit the Obamacare exchanges in 2017. It said it was losing money on that business because of low enrollment and high costs.

Anthem remains committed to the exchanges and to "continuing our dialogue with policymakers and regulators regarding how we can improve the stability of the individual market," Chief Executive Officer Joseph Swedish said in a statement.

...Aetna said it still expected 2015 operating earnings of $7.45 to $7.55 per share, and Anthem reiterated its outlook of $9.53 to $9.63 per share.

...The earnings affirmations echo that of Centene Corp and Molina Healthcare Inc. The small health insurers, which focus on Medicaid, also said its exchange business was performing in line with its expectations.

Molina CEO J. Mario Molina said that Molina was targeting low-income people, similar to its Medicaid patients, and that it was not having the same problems as UnitedHealth.

Kaiser Permanente, a hospital and insurer system, also said that it was "strongly committed" to the exchanges.

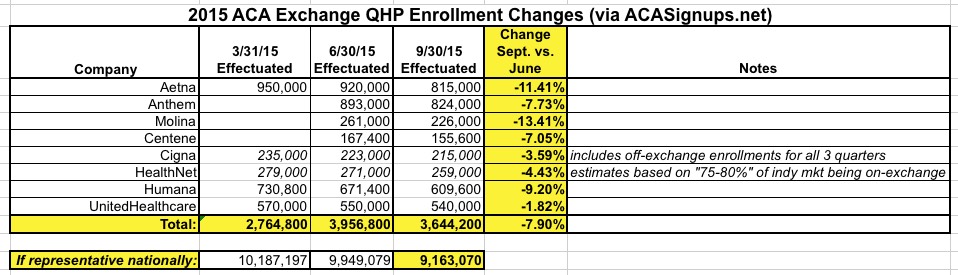

As a reminder, here's where the currently-effectuated exchange enrollment numbers stood as of 9/30/15 for 8 major insurers...including 5 of the 6 companies listed above:

OK, so that's one company with 540,000 enrollees pulling the panic button (UnitedHealthcare) vs. 5 companies with a minimum of 2.25 million exchange enrollees reassuring people (I don't know what Kaiser Permanente's enrollment numbers are this year, but a year ago they had 240,000 effectuated enrollees in California alone; I presume that this is higher for 2015).

By my count, that's about a 4.2 to 1 advantage for the "Keep Calm and Stick With the Exchanges" crowd, at least for now.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.