Idaho: Approved 2016 rates range from 8% decrease to 26% increase (20% avg?)

This article from the Idaho Statesman provides the final approved rate changes for 2016 in Idaho, which were mostly left intact:

Blue Cross of Idaho’s rates for individuals buying their own plans will go up an average of 23 percent. Company officials say the increase is needed after Blue Cross lost millions of dollars because current customer premiums are not keeping up with claims paid.

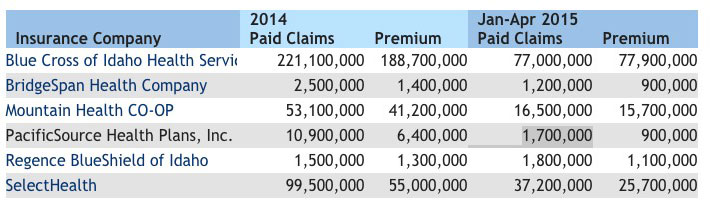

Last year, the company’s average rate increase for individual policies was about 15 percent. That year, the company paid nearly $221.1 million in claims while receiving $188.7 in premiums.

Other average rate changes for 2016, including for plans sold off the Idaho health insurance exchange:

- Mountain Health COOP: 26 percent

- SelectHealth: 15 percent

- Regence BlueShield of Idaho: 10 percent

- BridgeSpan Health, a sister company of Regence: 7 percent

- PacificSource Health Plans: -8 percent

State Insurance Director Dean Cameron said he did not find any proposed rate changes to be unreasonable.

The actual Idaho Insurance Dept. website lists slightly different approved numbers; SelectHealth requested a 15% hike but was knocked down to 14%. Notably, Mountain Health COOP was actually raised more than they had requested (26% vs. 25%), which has also been seen for some insurers in Oregon and Florida so far.

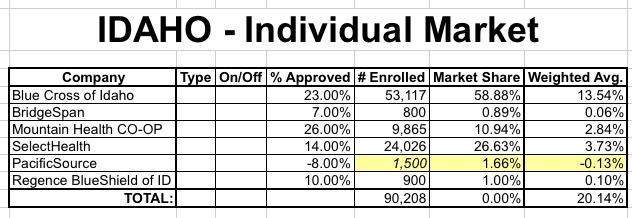

In terms of the weighted average, however, it gets a bit trickier. I'm able to track down the actual number of affected lives for 5 of the 6 companies...but PacificSource is eluding me so far. This is doubly frustrating because PacificSource is the only one which requested a rate decrease for next year; if their market share is significant, it could reduce the weighted average significantly.

The good news is that while the enrollment figure for PacificSource isn't listed, the ID Insurance website does list the paid claims and premiums for all 6 companies for both 2014 and the first half of 2015.

Based on this, it looks like PacificSource should have roughly the same number of enrollees as BridgeSpan, or perhaps slightly higher based on the payouts so far this year; I'll call it 1,500 or so:

If this is accurate, Idaho is looking at roughly a 20% weighted average rate hike.

The only problem with this is that this only brings the total ACA-compliant individual market size up to around 90,000 people...when the entire individual market (including non-ACA compliant policies) was around 150,000 in 2014, and is likely larger this year.

Of course, some of that 150K is made of non-ACA compliant policies (grandfathered/transitional), but I find it hard to believe that these make up 40% of the total; in most other states these are down to around 14% combined, and if the total market has grown that might even cancel those out.

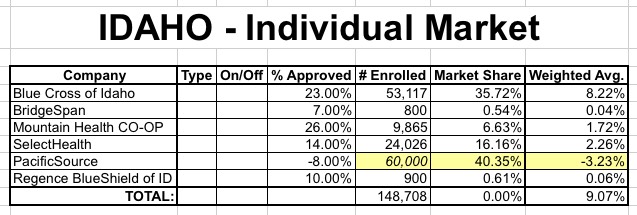

The best-case scenario here would be if PacificSource has managed to massively ramp up their enrollment numbers to 60,000 people. If so, that would slash the total weighted average down to just 9.1%, which isn't bad at all...

However, this is also extremely unlikely...because, again, look at those premium numbers above. PacificSource had $900K in premium revenue in the first 3 months of this year. That's just $300K per month. If that's split up among 60K enrollees, that'd be just $5 per person per month, which obviously isn't what happened (bear in mind that this is the full price of the premiums, regardless of any federal tax credits).

At 1,500 enrollees, this would be $200 per person per month...which is far more likely (still a bit low, in fact, but what the heck).

So, where are the "missing" 60,000 people? Again, around 21K of them are probably grandfathered/transitional. As for the other 40K or so, I have no idea.

In any event, it looks like Idaho is probably facing roughly a 20% individual market rate hike on weighted average.