Arkansas: *Approved* 2016 rates: 4-5% on weighted average

Yes, I'm back. From what I can tell, the major Obamacare/health insurance-related stories while I was out were a) Scott Walker/Marco Rubio finally releasing their proposed "replacement plans" (such as they are) for the ACA, and b) the approved 2016 rate changes for ACA-compliant individual/small group policies across a whole mess of states (technically all 50 states +DC had to be finalized as of 2 days ago, but it'll still take awhile to dig up all of them, since many news stories & reports may leave out off-exchange plans, increases of less than 10% and/or actual market share for weighting purposes).

I'm ignoring the Walker/Rubio story for the moment, mainly because they're both complete jokes, but will write up something about that later. For now, let's dive into the approved 2016 rate change story, starting with Arkansas.

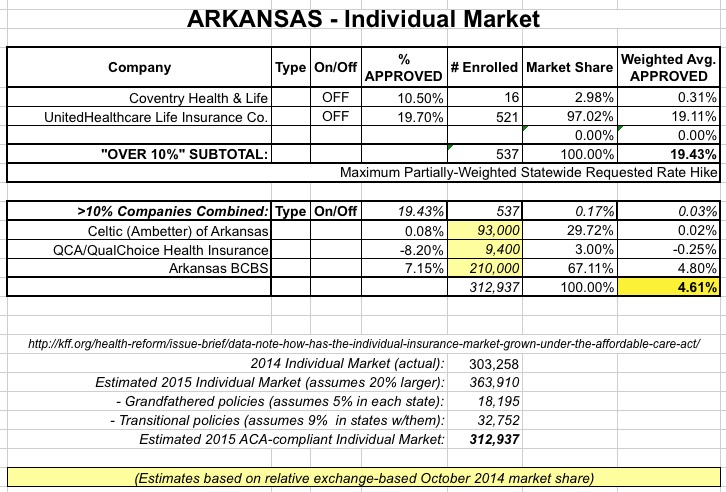

A couple of weeks ago I noted that only 2 AR companies even requested hikes of more than 10%, and only a few hundred people are currently enrolled in those policies anyway. Based on this, plus the informed opinion of local reporter David Ramsey (an expert on all things ACA-related in Arkansas), I projected a weighted average rate increase request of perhaps 4% overall.

Today it looks like the approved average should be pretty close to that:

LITTLE ROCK, Ark. (AP) - Arkansas' insurance commissioner says health insurance rates on the state's marketplace will increase by no more than 7.15 percent next year.

The Arkansas Insurance Department approved the 2016 rates for companies participating in Arkansas' health insurance marketplace, which was established under the federal health care overhaul. More than 57,000 Arkansans receive tax credits to purchase insurance through the exchange.

Insurance Commissioner Allen Kerr says he's pleased there are no double-digit rate increases next year. Arkansas Blue Cross and Blue Shield's individual plans will go up by 7.15 percent, while group plans will increase by about 3 percent. Celtic Insurance Company's individual plan will increase by 0.08 percent, while QualChoice Life and Health Insurance Company's individual plan will decrease by 8.2 percent.

The 2 off-exchange companies I mentioned also had slight modifications to what I listed last week, although the changes and numbers are so tiny as to be inconsequential.

Unfortunately, I don't know what the actual current individual market share is for each company in Arkansas. The only thing I have to base my estimate on is the exchange-based market share as of a year ago. At the time, Blue Cross Blue Shield of Arkansas held the lion's share of the market, with around 68%, with Celtic/Ambetter making up around 30%. The remaining 2% was primarily QCA/QualChoice.

Assuming these ratios are around the same today, here's how it looks on the spreadsheet:

Again, there's still some big caveats here. It's possible that the total market size is larger or smaller, although I'm pretty confident that it's in the 310K range. The larger unknown is the relative market share size; for all I know, BCBSAR has increased their share, which would raise the overall weighted average closer to the 7% mark. On the other hand, it might have shrunk, which would make the overall average lower than the 4.6% shown. I'll update this entry as appropriate if I receive more accurate data, but for the moment, 4-5% seems to be about where Arkansas is coming in.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.