Minnesota decides to rain on the California/Maine parade

(sigh) Just 2 days ago there was excellent news on the 2016 rate increase front from the largest state (California, 4% weighted average) and one of the smaller ones (Maine, just 0.7%). Today brings the other side of the coin: Assuming the requested rate hikes are approved, Minnesota is looking at some pretty unpleasant increases next year:

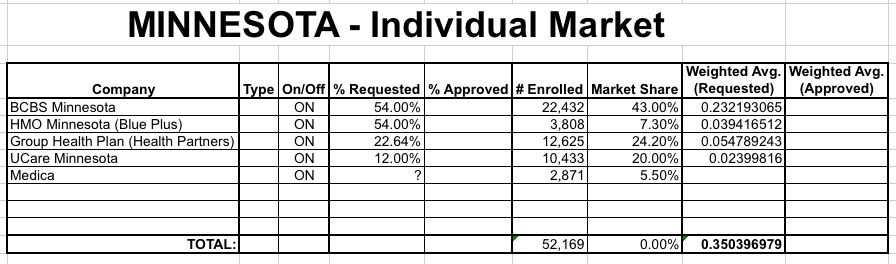

A team of actuaries at the Minnesota Department of Commerce are currently scrutinizing the proposed rates that have been filed for 2016, and final rates will be announced on October 1. But for now, four MNsure’s individual market carriers have proposed the following rate changes for coverage effective January 1, 2016 (market share is as of the end of the 2015 open enrollment period):

- UCare Minnesota = 12 percent weighted average increase (20 percent of MNsure’s market share)

- HMO Minnesota (Blue Plus) = 54 percent increase (7.3 percent of MNsure’s market share)

- Group Health Plan (Health Partners) = 22.64 percent increase (24.2 percent of MNsure’s market share)

- Blue Cross Blue Shield of Minnesota = 54 percent increase (43 percent of MNsure’s market share)

Only health plans that have proposed rate increases of ten percent or more are listed on the rate review tool, and one MNsure carrier – Medica – does not show up on the list. Based on the market share numbers above, presumably Medica has the other six percent of MNsure’s individual market share, as those five carriers were the only ones offering coverage through the exchange in 2015.

As Louise Norris notes, if the above numbers were the entire picture, MN would be looking at a weighted average of somewhere around 37% (the 5th carrier, Medica, could theoretically nudge the overall weighted average down to 35.6% with a 9.9% increase request, 35.0% if they don't change their rates at all, or 34.5% if they lower their rates by 9.9%):

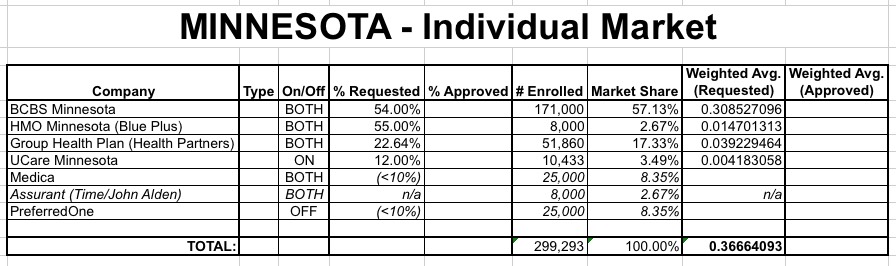

However, it's important to note that these enrollment numbers are only for exchange-based enrollees...people who signed up via MNsure. They don't include the off-exchange enrollees in the state:

Even so, the filings touched off a political skirmish, in part because they apply to the portion of the market that includes the state’s MNsure health exchange. Plus, the proposals suggest premium hikes could be on the horizon for more than 225,000 Minnesotans.

Proposed premium increases

The federal government released data Wednesday on proposed premium increases from health insurers in Minnesota. The numbers represent average premium increases for subscribers who purchase certain non-group policies from the health plans. Premiums will be reviewed by regulators before being publicly released Oct. 1.

- Blue Cross Blue Shield of Minn. +54 % 171,000 people

- Blue Plus (a Blue Cross co.) +55% 8,000 people

- HealthPartners +23% 51,860 people

- UCare +12% 10,000 people

...Summary information on the federal website didn’t say how many subscribers would be affected by proposed increases in Minnesota from PreferredOne, John Alden Life Insurance Company and Time Insurance Company.

Across all companies doing business in Minnesota, proposed increases range from 10.82 percent to 74.13 percent.

At least one firm that’s had a presence in the state’s individual market, Minnetonka-based Medica, did not have any plans listed on the federal website as seeking a premium increase of 10 percent or more.

Hmmm...if I add up the 4 numbers above, they total 240,860; not sure why it says ">225K" but whatever. And the lack of data for the other companies leaves some pieces of the Minnesota puzzle missing:

You can scratch both "Time Insurance Company" and "John Alden" off the list, as the parent company for both (Assurant) has gone out of business (in large part because it turns out they were screwing over their enrollees with discriminatory pricing prior to the ACA):

Assurant Health’s accusation that the Affordable Care Act (ACA) killed its earnings turns out to be true. Assurant’s decline illustrates the law’s effectiveness as a tool for preventing discriminatory practices in health coverage. Assurant Health, which once provided more than 1 million Americans with health insurance, generated $1.9 billion in revenue in 2014 but posted a loss of $64 million. In the first quarter of 2015 alone, it lost $84 million. The company’s profits sank at least in part because it could no longer engage in what federal and state regulators say were unethical practices to rid its rolls of the sickest patients. The ACA made many such practices illegal.

It looks like Time and John Alden combined only account for about 8,000 people total.

As for PreferredOne, they had a massive market share in 2014 (about 60% of the 55K who enrolled via MNsure last year), but they screwed up by massively underpricing that year (which is, of course, how they gained the market share in the first place) and pulled out completely. They still sell off-exchange individual policies, but historically only had around 2.8% of the individual market (roughly 7,000 people out of 248K in 2013) prior to the exchanges launching, and jacked their prices up 63% this year. 60% of 55,000 is around 33,000 people, but with that large of a rate hike presumably most of those 33K moved to a competitor. In short, it's safe to assume that PreferredOne has fewer than 20,000 enrollees on off-exchange individual policies at the moment.

Minnesota's total individual market in 2014 was roughly 293,000 people, and is presumably a bit larger this year; I'd estimate around 330K or so, of which perhaps 30K are likely still enrolled in Grandfathered policies (Minnesota didn't allow Transitional). Out of the 300K remaining, I've accounted for about 249K. The other 51K should be split between PreferredOne (somewhere between 7K - 33K) and Medica (somewhere between 2,900 - 44K).

With those unknowns recognized, here's what it looks like state-wide:

Again, without knowing either the enrollment/market share or requested changes for either Medica or PreferredOne, it's impossible to get a precise weighted average, but the other 4 carriers combined make up a good 80% of the total individual market, so it's safe to assume that the missing figures aren't likely to move the needle very much one way or the other. We do know that neither one is over 10%, for whatever that's worth, so the worst-case scenario (if they're both 9.9% hikes) would be 38.3% total; the best-case scenario (if both reduced rates by 9.9%) would be 35% even.

So, there you have it: No matter how you slice it, it looks like individual market insurance carriers in Minnesota are seeking anywhere between a 35-38% weighted average rate hike. Now we'll just have to see whether the regulators lop those numbers down at all before October 10th.