California: Holy Smokes! CA's total number may not impress, but have they managed a 95% payment rate this year??

This board meeting report from Covered California actually includes a few pleasant surprises! when added to the existing data:

- The official exchange QHP selection tally in CA as of February 22, 2015 was 1,412,200

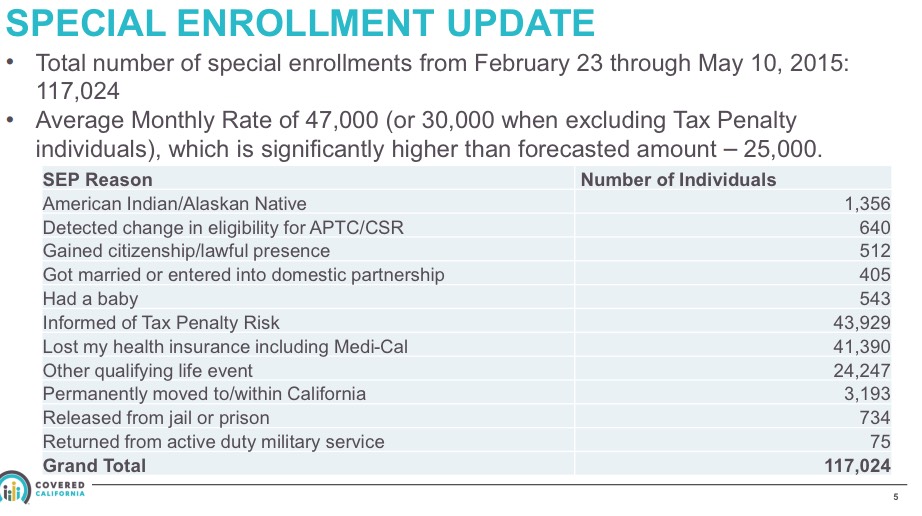

- According to the new report, they've had a total of 117,024 QHP selections since then (through May 10th), including #ACATaxTime enrollments:

- Add them together and you get 1,529,224 total QHP selections to date (well, as of 5/10, anyway).

- One interesting side note: CA's final #ACATaxTime tally turned out to be nearly 10,000 higher than expected (they previously reported around 33K with just a couple of days to go in the special enrollment period; apparently a lot of people jumped in at the last second after all)

On the surface, aside from the extra 10K for #ACATaxTime, that doesn't sound too interesting...I already had CA down with 1,503,200 QHPs, so this is just 26,024 higher. Big deal, right?

Except for one thing: I've confirmed that the number below represents actual paid, effectuated enrollments as of March 2015:

What does that mean? Well, remember, that was as of March, which means that it doesn't include the extra 117K who signed up since February 22nd.

That means that 1,342,956 out of 1,412,200 people paid their premiums in time for March 1st coverage...or 95.1%!

Now, it's possible that I'm misreading this, and that I need to divide by the larger, more recent number (1,529,224). If so, that would make the payment rate "only" 87.8%...which is exactly what I've been using as a rule of thumb for nearly a year now. However, even if that's the case, that would still be a substantial improvement for California specifically, which only hit a disappointing 81.7% last year.

IF, however, California has indeed managed to hit a 95% payment/effectuation rate, then that has huge implications for the rest of the numbers that I've been estimating...and due to CA's sheer size, it would have an impact whether it's representative of other states or not.

Here's what I mean by this:

- Let's suppose that the national payment rate turns out to be closer to 95% than 88%

(which I wrote about as a possibility last November) - In that scenario, instead of 10.9 million paid enrollments to date out of 12.4 million total, we'd be looking at 11.8 million (900K higher)

- In that scenario, intead of effectuated enrollments peaking at 10.1 million throughout most of the summer/fall, it would be more like 10.8 million (700K higher)

- In that scenario, instead of a monthly average of around 9.7 million, it would be more like 10.4 million per month (700K higher)

- Finally, on a less positive note, instead of 6.2 million people having their federal tax credits at risk of being cut off from the King v. Burwell decision, it would be more like 6.7 million (500K higher)

I'm waiting to receive clarification about which denominator I need to divide the 1.343 million number into.

In the meantime, at the very least, this brings the grand totals up to:

- California total QHP selections: 1,529,224

- National #ACATaxTime QHP selections: 206,896, plus whatever New York's number is (likely around 6-8,000)

- National total QHP selections: 12,024,658

THERE!! We're officially over the 12 million mark, for real now (whew)!!

As for off-season QHPs, not including the #ACATaxTime numbers, that's 73,095 from 2/23 - 5/10, or 949 per day.

California made up around 12% of total exchange enrollments this year. Assuming that percentage is representative during the off-season, that should mean roughly 7,900 people per day enrolling nationally during the off-season, not counting the tax filing SEP.

This is very close to the 7,000 - 7,500/day estimate that I've been using for off-season Graph projections for some time now.

Update: As an aside, the report also note that SHOP (small business) enrollment is at 16,855 "members", which is pretty much the same as it was in early March. However, at the time, that 16K figure referred specifically to employees, which means it didn't include their dependents (family). Assuming around 2.5 people per household, that's around 42,000 covered lives.

Update x2: Drat. I just received clarification...no, 16,855 "members" includes dependents as well. Gah.