UPDATED: Washington: Weighted 2016 *requested* rate increases: Just 5.4% (or 6.1%)

Thanks to Rebecca Stob for the heads up.

On the one hand, Washington State, like Oregon, has a nifty, easy-to-use web-based searchable database for their 2016 rate request filings, yay!

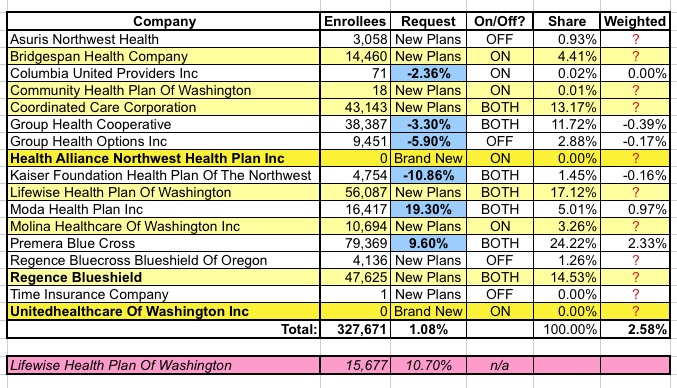

On the other hand, when you get into the details, some of it can be pretty confusing stuff. In 2014, there were 8 companies approved for the WA exchange. For 2015, there were 10 companies, plus 2 more which didn't make the cut. For 2016, a total of 17 companies/subsidiaries have requested approval to sell on the individual market. There's no guarantee that all 17 will be approved to sell in the state, but I'm assuming they all will be for the time being.

There's actually 18 listings, however, because Lifewise split their policies into two entries...one of which is "grandfathered" policies only, and is therefore not relevant for the table below...although this does answer the question "how many people are sill enrolled in Grandfathered policies in Washington State?" The answer appears to be just 15,677 people...out of 343,348 total in the individual market, or only 4.5% of the total.

Since WA didn't allow "transitional" policies at all, that means that the remaining 327,671 people enrolled on the individual market are "clean" (ie, fully ACA compliant, whether on or off the Exchange itself).

However, things get a bit more complicated for several reasons.

First, only 13 of the 17 companies appear to be asking to sell on the exchange (or both on and off); the other 4 are selling off-exchange only.

Secondly, of the 17 total ACA-pool listings (and 13 looking to sell via the exchange itself), only 6 of them (making up a combined 45.3% of the total market share) have actually requested changes to existing policy premium rates. The other 11 companies have apparently scrapped their old offerings and replaced them with brand-new plans...which means that there's no easy way to do an apples-to-apples comparison of the old plans vs. the new ones.

Add all of this up and here's what it looks like:

As you can see, the unweighted partial average increase is only 1.08%, while the weighted partial average increase is just 2.58% (I've listed the "Grandfathered" plans from Lifewise underneath just for completeness' sake).

Again, though, without knowing how all of those "New Plans" compare with whatever types of policies they replaced, there's no way to give an accurate assessment of their impact on the state-wide average.

For instance, look at Lifewise Health Plan. They're on the exchange this year, and have over 56,000 ACA-compliant enrollees total. That's over 17% of the total market, so any significant rate increase (or decrease) from Lifewise would move the state-wide needle significantly.

However, according to their initial filing request, they're basically scrapping their current plans (which are compliant with the ACA already, mind you) and replacing them with all-new plans...which means that even if the premiums stay exactly the same (0% change), what you're getting for that price will likely be very different next year.

To be frank, that seems awfully strange to me. For all the fuss and bother about some states allowing extensions of "transitional" policies to avoid "losing the plan you like", Washington State was one of those which didn't allow extensions...which means that every one of those policies should already be fully ACA-compliant.

It seems strange to me that over half of the companies in WA would wipe out their old plans & replace them with new ones, especially when not a single one did so in Oregon (which is allowing transitional plans). Both Rebecca and myself agree that what's probably going on here is that Oregon likely requires companies to "map" the new policy rates to whatever the closest old policy rate was...while WA requires them to officially list it as a "new" policy.

I can see the merit in both policies...but Washington's certainly makes things more difficult for me here...

In any event, with the long list of disclaimers/caveats/etc. above, the table you see is the closest I can come to estimating the (semi)-weighted rate increase requests for Washington State: Around 2.6% based on 45% of the total.

If the plans offered by the other 11 companies composing the other 55% of the market don't end up moving things up or down significantly, that's fantastic.

Finally, remember that these are just the requested rates, not the approved ones, with 1 exception: According to the WA insurance commissioner database, "Group Health Options" (with 9,451 enrollees off of the exchange) has already had their 5.9% reduction in rates approved.

UPDATE 5/11/15: Hmmmm...ok, the WA Insurance Commissioner's office just issued the official press release, which confirms much of the above but also claims the overall average requested rate increase is 5.4% instead of 2.6%.

On the one hand, the PR confirms that this includes both on- and off-exchange policies, and that 11 of the 17 companies have filed "all new plans".

While I can't accurately compare the new plans vs. the old ones for those 11 companies (which hold 55% of the market), apparently the WA insurance division can, and is stating that when you include those in the mix, the overall rate increase request is 5.4%, vs. the 2.6% covered by the other 6 companies.

Unfortunately, they don't say whether this is a weighted or unweighted average. Since the 6 companies I do know of make up 45% of the market, here's how it would have to play out:

- IF 5.4% = UNWEIGHTED:

- 45% x 1.08% = 0.486%

- 55% x 8.93% = 4.912%

- Total = 5.4%

- IF 5.4% = WEIGHTED:

- 45% x 2.58% = 1.161%

- 55% x 7.71% = 4.239%

- Total = 5.4%

In other words, if the 5.4% average is not weighted, then the weighted average would be around 6.1%:

- 45% x 2.58% = 1.161%

- 55% x 8.93% = 4.912%

- Total = 6.07%