Happy Birthday #ACA! (Part 7: Household Income)

Part 1 | Part 2 | Part 3 | Part 4 | Part 5 | Part 6 | Part 7

Finally, we come to HOUSEHOLD INCOME BRACKETS.

This is, of course, extremely important since household income is one of the most critical factors in calculating how much financial assistance enrollees receive (or if they're eligible for Advance Premium Tax Credits (ATPC) at all).

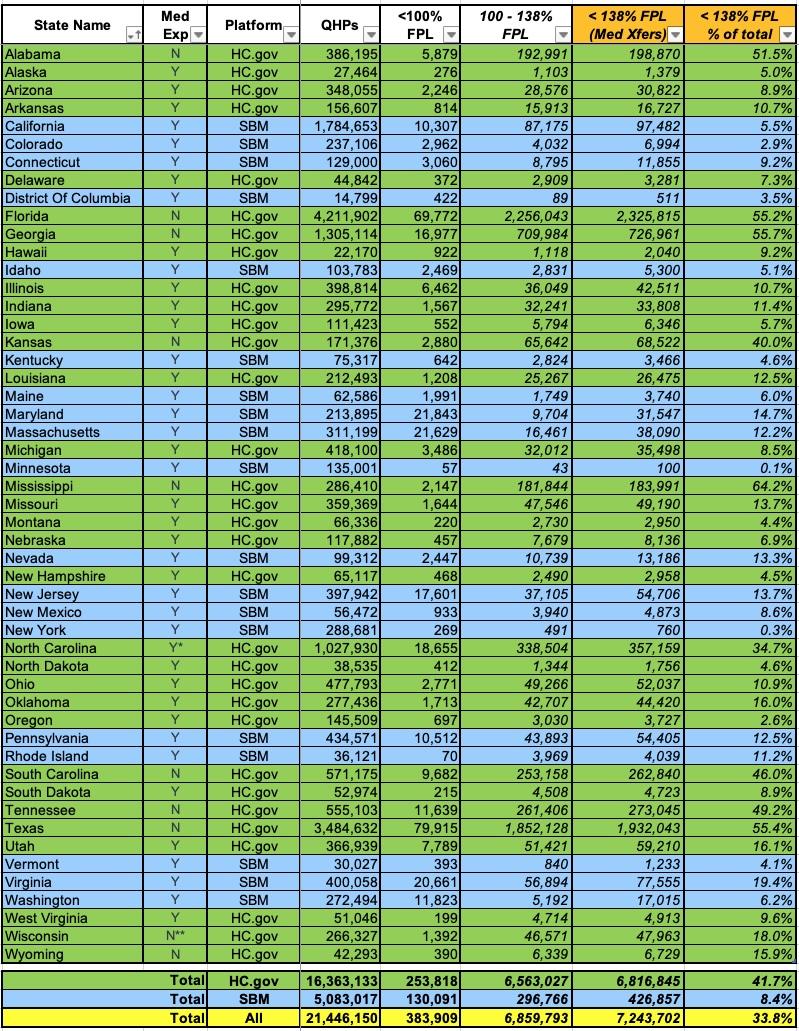

Since there's so many income bracket columns and there's a lot to delve into for many of them, I've broken the full spreadsheet out into several sections. The first focuses on exchange enrollees who earn less than 138% of the Federal Poverty Level (FPL). This is a critical threshold because it's the cut-off point for ACA Medicaid expansion enrollment in the 40 states (+DC) which have expanded it.

Nationally over 1/3 of all exchange enrollees earn less than 138% FPL, which may sound stunning given that 40 states have expanded Medicaid until you realize which states haven't done so yet: Over 4.25 MILLION enrollees in Florida and Texas alone earn less than 138% FPL (2.3 million & 1.9 million respectively).

Across all ten holdout states (AL, FL, GA, KS, MS, SC, TN, TX, WI & WY), over 6 million ACA enrollees are below the cut-off point; the vast majority of them would be shifted over to Medicaid instead if their states expanded the program.

Note that I said "the vast majority..." not all of them. As you can see, even in the expansion states there's still over 1.2 million enrollees who you'd normally expect to be enrolled in Medicaid instead but aren't. The main reason for this (as Louise Norris reminded me again) is that documented immigrants who haven't lived in the United States for at least five years aren't eligible for Medicaid but are eligible for ACA subsidies. In fact, this category of new residents are eligible for subsidies even if they earn less than 100% FPL, which is a bit odd since U.S. citizens aren't...as evidenced by the Medicaid Gap.

Speaking of exchange enrollees under 100% FPL, there's In fact, 183,000 of them in expansion states, plus another 200,000 in non-expansion states (383,909 nationally). Besides documented immigrants who aren't eligible for Medicaid, there are other exceptions to this:

Estimated household income at least 100% of the federal poverty line. You may qualify for the PTC if your household income is less than 100% of the federal poverty line and you meet all of the following requirements:

- No one can claim you as a dependent for the year.

- You or an individual in your tax family enrolled in a qualified health plan through a Marketplace.

- The Marketplace estimated at the time of enrollment that your household income would be at least 100% of the federal poverty line for your family size for (the current year).

- APTC was paid for the coverage of one or more months during (the current year).

- You otherwise qualify as an applicable taxpayer (except for the federal poverty line percentage).

Alien lawfully present in the United States. Certain aliens with household income below 100% of the federal poverty line are not eligible for Medicaid because of their immigration status. You may qualify for the PTC if your household income is less than 100% of the federal poverty line if you meet all of the following requirements.

- No one can claim you as a dependent for the year.

- You or an individual in your tax family enrolled in a qualified health plan through a Marketplace.

- The enrolled individual is lawfully present in the United States and is not eligible for Medicaid because of immigration status.

- You otherwise qualify as an applicable taxpayer (except for the federal poverty line percentage).

You'll note that enrollees under 138% FPL only make up 8.4% of the state-based exchange enrollments (since all of these states expanded Medicaid) versus 41.7% in the HC.gov states (again, because 10 of them haven't expanded Medicaid).

In any event, if all ten states were to expand Medicaid at once, ACA exchange enrollment would plummet by perhaps 5 million enrollees or so...nearly 25%.

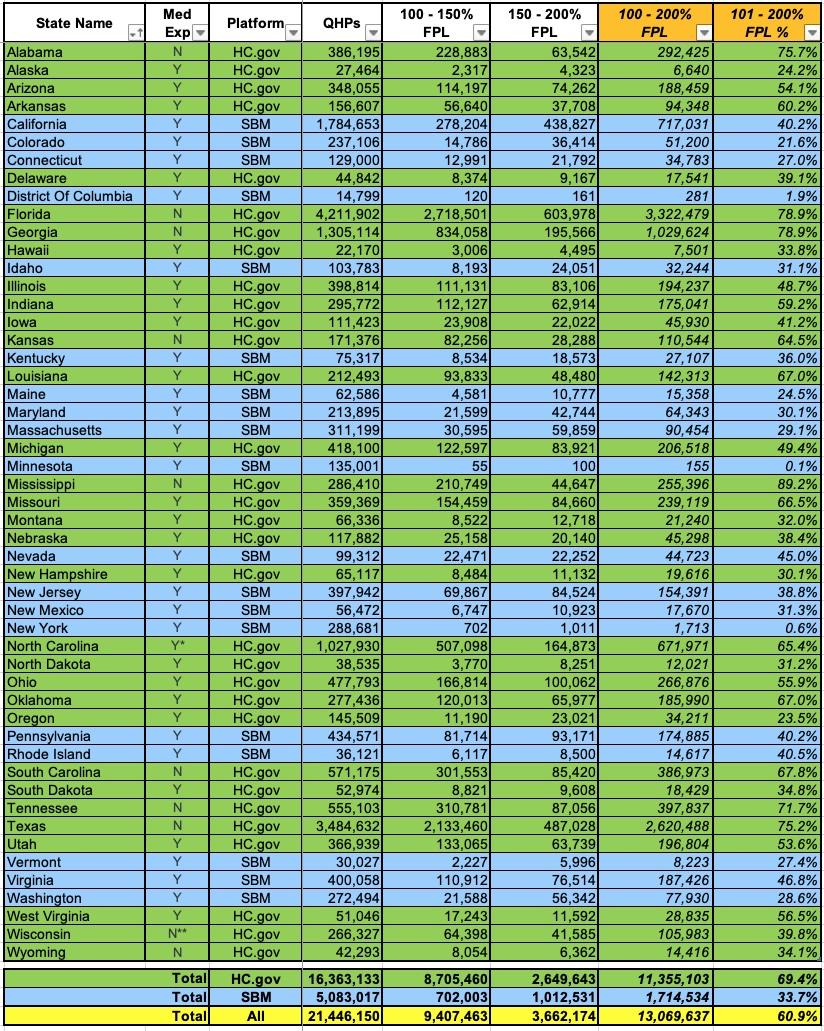

Turning to the 100 - 200% FPL range (and ignoring Medicaid expansion), fully 61% of all exchange enrollees fall into this income range (up from 55% last year).

That's over 13 million people total, and with extremely rare exceptions, just about every one of them should be enrolled in a Silver CSR plan, aka "Secret Platinum", since the extremely generous Cost Sharing Reduction (CSR) assistance in the 100 - 200% FPL range turns Silver plans (which normally have a ~70% Actuarial Value) into either an 87% or 94% AV plan...effectively Platinum (90% AV). In layman's terms, High CSR Silver plans have either free or extremely low premiums along with extremely low deductibles & co-pays.

Unfortunately, as noted in the last post, only 11.7 million enrollees chose Silver this year...and even then, not all of those are in the 100 - 200% FPL range, which means there's quite a few who are in that income range who didn't choose Silver. In most cases these folks are leaving hundreds or thousands of dollars in financial assistance on the table!

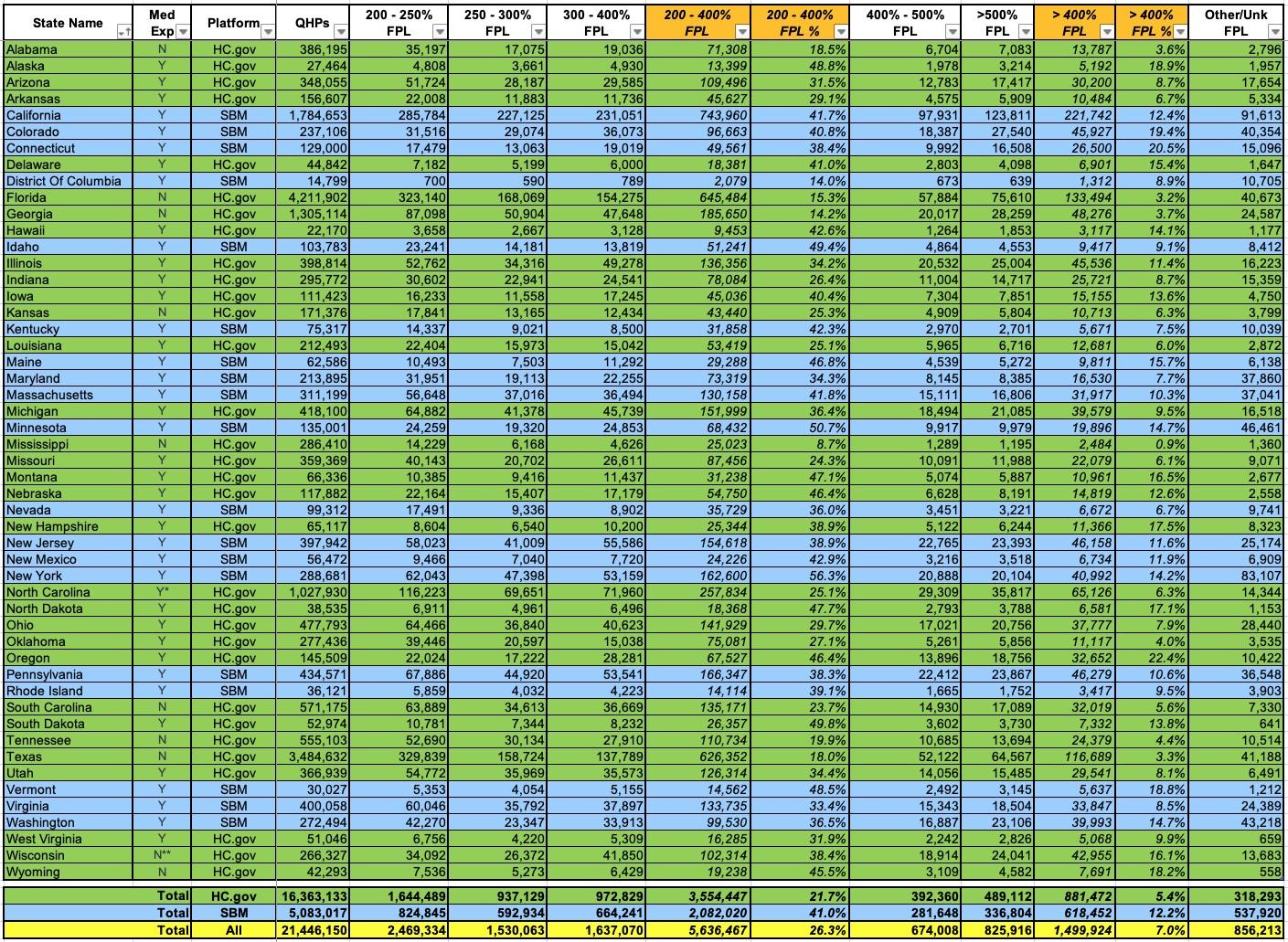

Finally, let's look at the 200 - 400% FPL and 400%+ FPL brackets. These make up 26.3% and 7% of all exchange enrollees respectively (exactly 1/3 of the total combined).

While all 7.1 million of these folks (as well as those who earn less than 200% FPL) will see their insurance premiums jump dramatically if the Inflation Reduction Act's enhanced subsidies are allowed to expire at the end of 2025, it's the latter population (around 1.5 million who earn more than 400% FPL) who will see their premiums skyrocket by the most in hard dollars, since this would mean the return of the infamous Subsidy Cliff. Not only would they lose all financial assistance, they'd also be hit with 6 full years of medical inflation (remember, the ARPA/IRA subsidies will have been in place since 2021).

Finally, there's around 856,000 enrollees whose household income is unknown.