New York: NY SoH sending out erroneous letters re. Essential Plan eligibility

I'm a bit late following up on this, but since New York State of Health isn't launching their 2024 ACA Open Enrollment Period until tomorrow anyway (Nov. 16th...every other state already started theirs on Nov. 1st or earlier), it's still timely.

Two weeks ago a Twitter follower of mine gave me a heads up:

The letter I received had the Essential Plan at 250%. My Navigator told me it was a mistake and pending approval? DM me for specifics

This is definitely cause for concern, since New York's Essential Plan is only available to NY residents who earn between 138 - 200% of the Federal Poverty Level ($29,160/yr for a single adult, $60,000/yr for a family of four).

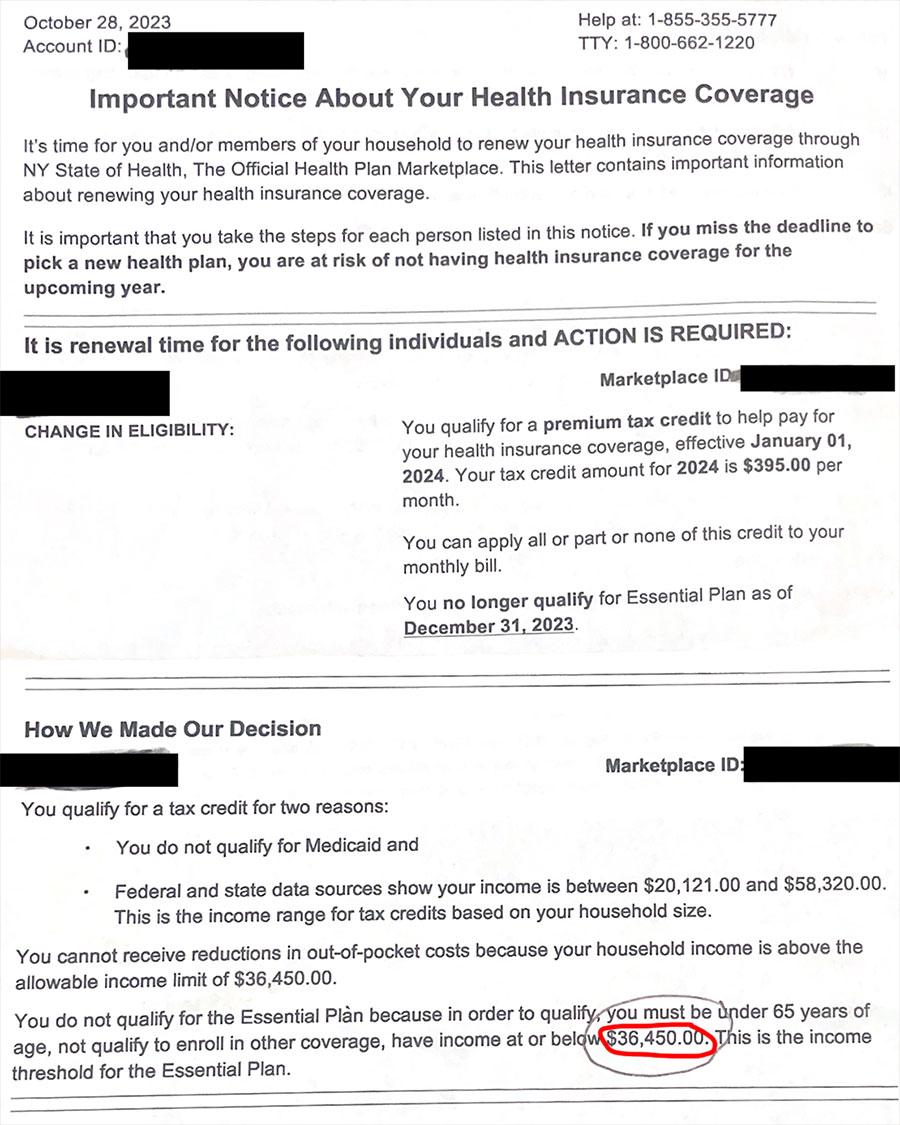

Sure enough, they sent me the full letter they received from New York State of Health (personal info redacted, of course):

The error is shown at the very bottom--it's claiming that the income threshold for a single adult is $36,450/year...which is indeed 250% of the Federal Poverty Level, not 200%.

As this person noted:

I’m part of the great Resignation. I retired early. Used a qualified plan the first year. Since I used non retirement funds to live on so I qualified for the Essential Plan. They then renewed it for 2 years automatically because of the Pandemic. I can probably qualify based on Next Years income and will use my Navigator if it’s 36K.

Unfortunately, to the best of my knowledge, the $36,450 income threshold is indeed a mistake on NY DOH's part. New York has been planning on expanding their Essential Plan program to people who earn up to 250% FPL...but the last I heard, that was on hold:

Dear Secretary Yellen and Secretary Becerra,

The State of New York is writing to formally request that the U.S. Department of Treasury and U.S. Department of Health and Human Services pause its consideration of our pending 1332 State Innovation Waiver application.

Given the uncertainty surrounding the timing to release final regulations related to the current Basic Health Program (proposed in 88 FR 52262, 52542 (Aug. 8, 2023), we request that consideration of our application resume once the relevant regulations have been finalized. I understand that we must resubmit certain components of our application with a new effective date.

Our team looks forward to continuing our work on this important project once the uncertainty has been resolved. Thank you for your consideration in this matter.

To the best of my knowledge, this hasn't changed as of today. The Centers for Medicare & Medicaid Services (CMS) section on NY's Innovation Waiver to expand the program still lists the letter above (from Sept. 29th) as the most recent update:

New York

On May 12, 2023, New York submitted a State Innovation Waiver application. On June 6, 2023, the Departments deemed New York's waiver application complete. Federal public comments on New York's waiver application were accepted from June 6, 2023 through July 5, 2023. To view public comments received, please see below under the 'Application' section.

In response to public comments received, New York submitted an addendum to its waiver application on August 23, 2023. To promote transparency the Departments have posted this addendum and are accepting comments from August 23, 2023 through August 30, 2023. On September 29, 2023 New York requested that the U.S. Department of Treasury and U.S. Department of Health and Human Services pause its consideration of their pending 1332 State Innovation Waiver application.

Application:

- New York Section 1332 State Innovation Waiver

- Addendum to Waiver Application (8/23/23) (PDF)

- Public Comments on Waiver Application during Federal Comment Period (PDF)

Correspondence:

- Notice of Preliminary Determination of Completeness (PDF)

- Letter from NY Department of Health Pausing Review of Waiver (PDF)

Other Correspondence:

- New York 1332 and BHP Request and Response Letter (7/14/23) (PDF)

The silver lining (pun intended) is that if this person's income really does come in at $36,000 in 2024, they'd qualify for $659/month in Advance Premium Tax Credit (APTC) savings in Nassau County, which would qualify them for a $0-premium bronze plan (albeit with a $4,600 deductible), a $116/month Silver plan with a $2,100 deductible, or a $277 Gold plan with just a $600 deductible. None of these would be nearly as good as the Essential Plan, of course, but they wouldn't be too bad.