Sen. Shaheen reintroduces ACA 2.0 bill & lets me revisit one of the ACA's wildest rollercoasters

This actually happened way back in January, but I didn't stumble upon the press release until now:

Shaheen Reintroduces Legislation to Lower Health Care Costs & Expand Access to Insurance for Millions More Americans

- Provisions of the Improving Health Insurance Affordability Act were signed into law through the Inflation Reduction Act & the American Rescue Plan Act

- Estimates suggest 8.9 million Americans have lower premiums thanks to enhanced tax credits

- **Shaheen’s efforts mark the most significant update to Affordable Care Act in a decade

(Washington, DC) – U.S. Senator Jeanne Shaheen (D-NH) today reintroduced her legislation, the Improving Health Insurance Affordability Act. The bill would make permanent enhanced tax credits that led to record Marketplace enrollment, while reducing health care costs for millions of additional Americans.

OK, before I get into it, let's be clear: There is no way in hell this bill is gonna go anywhere before January 2025 at the very earliest (and even then it's an extreme long shot). It's still worth digging into, however.

The first part of this bill would, as described, simply make the upgraded Advance Premium Tax Credits (APTC) of the American Rescue Plan (later extended by another 3 years as part of the Inflation Reduction Act) permanent. I strongly support doing so, of course.

It's the rest of the bill which is more noteworthy, however...not just what it would do, but how it would do it and how it would impact and interact with some other elements of the Affordable Care Act:

...The bill would also make the second-lowest-cost Gold plan the benchmark plan upon which premium tax credits are based, which would substantially reduce deductible and out-of-pocket costs for families of all incomes. Finally, the bill would also increase the value of cost-sharing reduction (CSR) assistance for people with income between 100 and 250 percent of FPL (who are already eligible), while also expanding eligibility for CSR assistance to people with income up to 400 percent of FPL.

The bill had 13 co-sponsors in the Senate upon introduction (all Democrats of course). Nevada Senator Jacky Rosen signed on as the 14th co-sponsor back in June, which I find mildly interesting given that she's up for what's expected to be a tough reelection campaign next year.

I originally wrote about the Improving Health Insurance Affordability Act when it was first introduced back in early 2021:

This bill alone would permanently Kill the Cliff & Up the Subs. It would upgrade the benchmark ACA plan from Silver to Gold and expand/beef up the CSR subsidy formulas so that instead of being weak over 200% FPL and gone over 250%, it would be strong all the way up to 400% FPL.

This basically means that every exchange enrollee earning up to 300% FPL could afford to enroll in what's effectively a Platinum plan, while those earning 300 - 400% FPL could afford a Strong Gold (or weak Platinum?) plan. These are healthcare plans which rival all but high-end employer-sponsored coverage.

Meanwhile, those earning more than 400% FPL would still receive subsidies limiting their premiums to no more than 8.5% of their income while providing Gold level coverage instead of the current Silver.

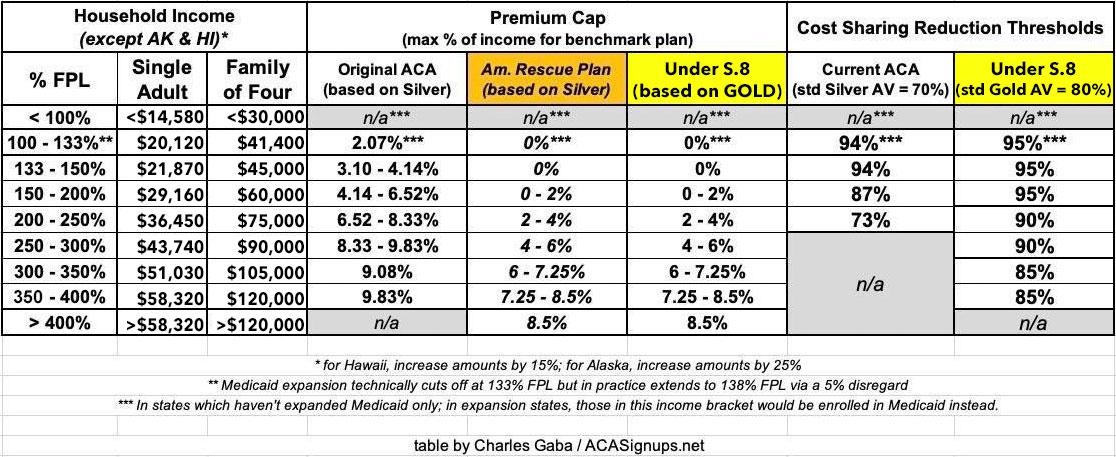

Here's what all of this would look like as compared to the original ACA formula and the current temporary ARP/IRA subsidy formula:

So far, so good. Shaheen's bill includes one more important provision at the very end, however, which opens up a whole lot of ACA history in a mere 53 words:

(b) FUNDING.—Section 1402 of the Patient Protection and Affordable Care Act (42 U.S.C. 18071) is amended by adding at the end the following new subsection:

‘(g) FUNDING.—Out of any funds in the Treasury not otherwise appropriated, there are appropriated to the Secretary such sums as may be necessary for payments under this section.’’.

Boom.

OK, what's that all about?

Well, for that we have to all the way back to 2014, when U.S. House Republicans, under the leadership of then-Speaker of the House John Boehner (remember him?), filed a lawsuit against the Obama Administration over a provision of the Patient Protection & Affordable Care Act (or, more specifically, over the lack of a provision in the law). The case was legally filed as United States House of Representatives v. Burwell, et al. (since Sylvia Burwell was the HHS Secretary at the time), although it was later changed to House v. Price when Tom Price became HHS Secretary under Donald Trump, and eventually House v. Azar when Price resigned after being caught in a taxpayer-funded chartered flight scandal and was replaced by Alex Azar as Trump's second HHS Secretary.

Anyway...

The House v. Burwell case centered around the ACA's Cost Sharing Reduction (CSR) reimbursement payments. Under the ACA, CSR subsidies were designed to be handled differently than the advance premium tax credit (APTC) subsidies. With APTC, everyone knows exactly how much the premiums are going to be before the policy becomes effectuated, so it's a fairly simple matter for the federal government to pay its share of the cost.

CSR is different, because those subsidies go to cover a portion of the enrollees deductibles, co-pays & coinsurance without knowing how much it's going to be ahead of time. Therefore, CSR subsidies were set up so that the insurance carriers agreed to cover a portion of whatever out of pocket expenses came up every month, and then they'd submit those costs to the federal government, which in turn would send them reimbursement payments.

It was clunky, but that's how it worked from 2014 through most of 2017.

Unfortunately, there was a problem with the final version of the ACA's legislative text: Somehow, in Section 1402 (the portion dealing with CSR reimbursement payments), Congressional legislators forgot to include a line which specifically gave permission for the Treasury Department to actually make those reimbursement payments.

House Republicans discovered this omission and pounced, filing a lawsuit claiming that CSR reimbursement payments were unconstitutional since they'd never been specifically appropriated.

The lawsuit moved its way through the federal court system for a year and a half, but eventually Judge Rosemary Collyer ruled in favor of the House on the merits...but also said that Congress had authorized the program itself, which seems a bit contradictory. In any event, she enjoined (stopped) erimbursement payments pending legislation adding official appropriation of them...but also put a stay on her own injunction pending appeal by the Obama Administration.

That's where things stood for another year or so...at which point it was no longer the Obama Administration but the Trump Administration (thus the name change to House v. Price).

As an aside, Tom Price had been a Republican member of the House of Representatives since 2005 before resigning in order to be appointed Trump's first HHS Secretary. This means that he was in the unique position of having his legal status change from being a Plaintiff to a named Defendent in the same lawsuit.

Trump spent most of 2017 (the year of the infamous "Repeal/Replace" Debacle) constantly and publicly threatening to cut off CSR payments, which he thought would "blow up" the ACA exchanges. What he was actually threatening to do was to drop the appeal of the case, which in turn would trigger Judge Collyer's injunction to go through, which in turn would mean the Treasury Dept. would no longer be allowed to reimburse ACA insurance carriers.

Trump eventually followed through with his threat in October 2017, cutting off CSR reimbursement payments for the last 3 months of the year as well as for all of 2018 and beyond.

However, instead of "blowing up" the exchanges, something else happened. Most of the insurance carriers found a different way of getting the money owed them instead: They estimated roughly how much they expected to rack up in CSR expenses for the upcoming year, then divided that amount across their enrollees, and raised premium rates to cover that amount.

This led to a stunning ~30% average premium increase for ACA exchange plans in 2018...nearly half of which (around 14 points) was due specifically to covering the expected CSR costs.

With CSR reimbursement payments having become a moot point since they were no longer being paid anyway, a few months later a settlement was reached which formally dropped the appeal and dismissed the injunction...but which made it clear that reimbursement payments still couldn't start up again unless & until a formal appropriation was added to the ACA via legislation.

And that's where things have stood ever since late 2017: Every year since then, carriers have had to bake that extra expected CSR cost into their annual premiums, meaning that the unsubsidized, full price premiums for ACA plans have been billions of dollars higher than they would otherwise have been.

In fact, many carriers took it one step further: Since only people enrolled in Silver ACA plans were receiving CSR assistance in the first place, many of them "loaded" 100% of the CSR losses onto the Silver plans only (instead of spreading them out evenly across Bronze, Silver, Gold and Platinum plans). This meant that Silver plan premiums would spike dramatically...while Bronze, Gold and Platinum plans would only go up by the "normal" amount (to cover medical trend and other typical increased costs). The colloquial term for this rate pricing strategy is called Silver Loading, and it in turn has another vitally important consequence:

APTC subsidies are based on how much the benchmark Silver plan costs, so if the benchmark plan increases significantly, so do the APTC subsidies enrollees are entitled to. But since those subsidies can be used to enroll in Bronze, Gold or Platinum plans instead, this means that ACA enrollees who choose those metal levels can get them for far lower net premiums...in many cases paying less than they would for a Silver plan with higher cost sharing!

So what does any of this have to do with Sen. Shaheen's bill?

Well, that last little snippet of her bill would finally, a decade later, add the critical Simon Says authorizing the Treasury Dept. to reinstate CSR reimbursement payments. And that, in turn, would mean that the insurance carriers would no longer be able to tack on extra premiums to cover their CSR losses (since there would no longer be any losses). It would also end the practice of Silver Loading.

This, in turn, would reverse the situation--the amount of federal APTC subsidies would in turn drop off substantially, saving the federal government billions of dollars...which savings Sen. Shaheen is in turn proposing to use to help pay for the cost of upgrading Silver to Gold and enhancing the CSR program itself.

To a certain extent doing all of this would end up accomplishing the same outcome: Higher APTC subsidies and less expensive Gold plans. But it would benefit far more people while being easier for enrollees to understand (basically, every ACA enrollee would be guaranteed either an 80%, 85%, 90% or 95% Actuarial Value plan no matter what).

As I said above, it has no chance of passing in the current political environment...but it makes for a heck of a convoluted story!