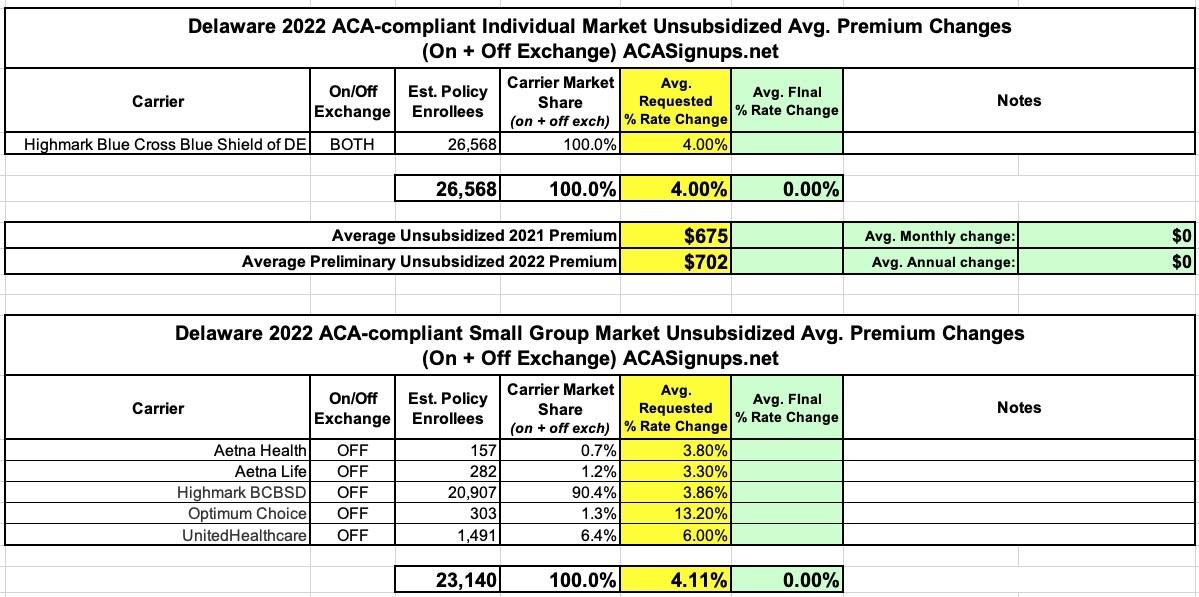

Delaware: Approved avg. 2022 #ACA rate change: +3.0% individual market; +4.1% sm. group market (preliminary) (updated)

via the Delaware Insurance Dept:

Health Insurance rate filings are available for the companies listed below. Additional companies will be listed as their filings are received. Any insurance filings already approved are available to the public through the NAIC’s System for Electronic Rate and Form Filing (SERFF) interface. There is no fee for using SERFF. Rate info can also be accessed at the Rate Review page at Healthcare.gov

Highmark BCBSD Inc: (individual market)

Highmark DE is requesting an average plan level rate increase of 4.0% based on the projected enrollment mix by plan. The plan level rate changes will impact an estimated 26,568 current members. The rate change will vary by product ranging from a minimum of 1.7% to a maximum of 14.7%.

Aetna Health Inc. & Aetna Health Insurance Co. (sm. group market):

Aetna is filing premium rates for Small Group plans in Delaware. The new rates will apply to plan years effective in 2022.

The current membership and range of rate changes by product are:

- Product Name: Aetna Health Maintenance Organization

- # Members as of January 2021: 157

- Range of Increases: 3.8%-3.8%

Aetna Life Insurance Co. (sm. group market):

Aetna is filing premium rates for Small Group plans in Delaware. The new rates will apply to plan years effective in 2022.

The current membership and range of rate changes by product are:

- Product Name: Aetna Preferred Provider Organization

- # Members as of January 2021: 282

- Range of Increases: 3.3%-3.3%

Highmark BCBSD (sm. group market):

General Information:

Highmark Blue Cross Blue Shield Delaware Inc. (Highmark Delaware) has filed an average rate change of 3.9% for 2022 ACA-qualifying small group plans renewing with effective dates from January 1, 2022 through December 31, 2022.

Summary:

The 3.9% average rate change was measured across renewing benefit plans with renewal effective dates in 2021. The average renewing plan specific rate increases range from 2.8% to 8.0%. The exact premium change for a small group will depend on their effective date, the plan design they choose, as well as the age composition of the employees and dependents covered on the effective date in 2022. The rate increases will impact approximately 20,907 members in the small group market.

Optimum Choice, Inc. (sm. group market):

The requested rate change for small group health benefit plans sold in the state of Delaware will be effective January 1, 2022 and impact 303 covered lives. The rate change experienced by members will vary depending on plan selection and geographic area. Additional premium changes may occur upon renewal due to changes in member age, changes in plan selection, and changes in geographic location.

UnitedHealthcare Insurance Co (sm. group market):

The requested rate change for small group health benefit plans sold in the state of Delaware will be effective January 1, 2022 and impact 1,491 covered lives. The rate change experienced by members will vary depending on plan selection and geographic area. Additional premium changes may occur upon renewal due to changes in member age, changes in plan selection, and changes in geographic location.

UPDATE 10/19/21: the Delaware Dept. of Insurance has issued their final rate changes for the individual market (which, again, consists of just one carrier anyway) by knocking the rate increase down from 4% to 3%. They haven't issued decisions on the small group market as of yet: