Washington State: Preliminary avg. 2021 #ACA premiums: 1.8% reduction; sm. group up 3.4%

via the Washington Insurance Commissioner's office:

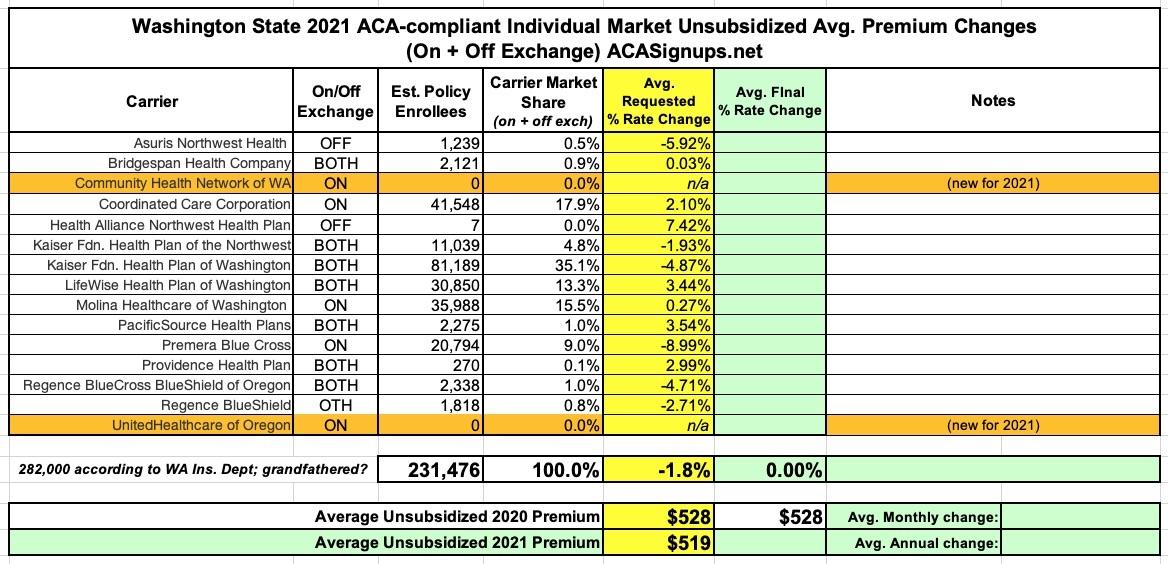

OLYMPIA, Wash. – Fifteen health insurers filed an average proposed rate decrease of 1.79% for the 2021 individual health insurance market. This includes two new insurers — UnitedHealthcare of Oregon and Community Health Network of Washington — that are joining Washington’s market.

With 15 insurers in next year’s individual market, all 39 counties will have at least two insurers selling plans inside the exchange, Washington Healthplanfinder. Ten insurers will sell plans outside of the exchange.

The proposed average rate decrease follows an average premium reduction of 3.25% for 2019 plans.

“Washington embraced the Affordable Care Act (ACA), and we’re seeing the continuing benefits today as we face the uncertainty created by the coronavirus pandemic,” said Insurance Commissioner Mike Kreidler. “Despite ongoing attacks from the Trump administration, the ACA’s reforms have helped create reliable access to quality health insurance for individuals and their families and a stable marketplace where insurers want to do business.”

Kreidler’s office will review all proposed health plans and rate changes over the next several months, with final decisions coming in the fall. Health insurers may adjust their requested rates and offerings as they re-evaluate their projections based on the financial impact of the coronavirus pandemic.

These are the first filings under Washington’s new Cascade Care, which includes standardized plan designs and the country’s first public option health plan program. The state Health Care Authority is in charge of running the procurement for public option plans and will release information later this month.

Approximately 282,000 people who don’t get coverage from their employer must buy their own health insurance through the individual market, with most shopping on the exchange. Approximately 19,500 people enrolled during a special enrollment period from March 10 through May 8 that the Washington Health Benefit Exchange launched in response to the pandemic.

In Washington, 65% of people who buy plans on the Exchange qualify for subsidies that help lower their monthly premiums.

The Washington state Legislature enacted Cascade Care last year, creating new coverage options that will be available through the exchange during open enrollment starting Nov. 1 for coverage effective Jan. 1, 2021.

See the proposed 2021 health insurers and plans by county. (PDF, 154.21 KB)

Unfortunately, they haven't posted the actual rate filing forms yet, so I don't know what the enrollment/market share of each carrier is; and they also haven't posted anything about the small group market yet. Still, they did include the weighted average across all carriers, which is the critical number I look at; here's the summary:

UPDATE: OK, they posted the actual filings the next day, so I was able to add the market share numbers as well as the small group data; see below for updated tables:

As noted by David Anderson, only two of the more than a dozen carriers are expecting more than a negligible impact from COVID-19 testing/treatment expenses next year:

Molina:

"Covid-19 Virus Impact: Molina has increased allowed claims 3% for the expected impact covid-19 will have on 2021 costs."

UnitedHealthcare (which is actually new to the WA exchange):

"We have included a 2.5% load to account for the net impact of COVID-19 on the 2021 claim cost as a result of incremental costs resulting from testing, vaccinations, COVID treatment and delayed medical services that would have been incurred in 2020 that are expected to be deferred until 2021. The assumption was developed by UHC and Wakely relied on UHC’s actuaries for this analysis. Due to the rapidly changing landscape due to the coronavirus, Wakely and UHC would like to reserve the right to change the COVID-19 impact assumption up until the rates are approved, to the extent state and federal rules allow"

According to Anderson, every other carrier either didn't mention COVID-19 at all in their filings or simply said they're in a "wait and see" mode.

This is pretty much in line with the other carrier filings so far from Vermont, Oregon and DC...for the most part they're either shrugging it off or only expect a fairly small impact to claims expenses.

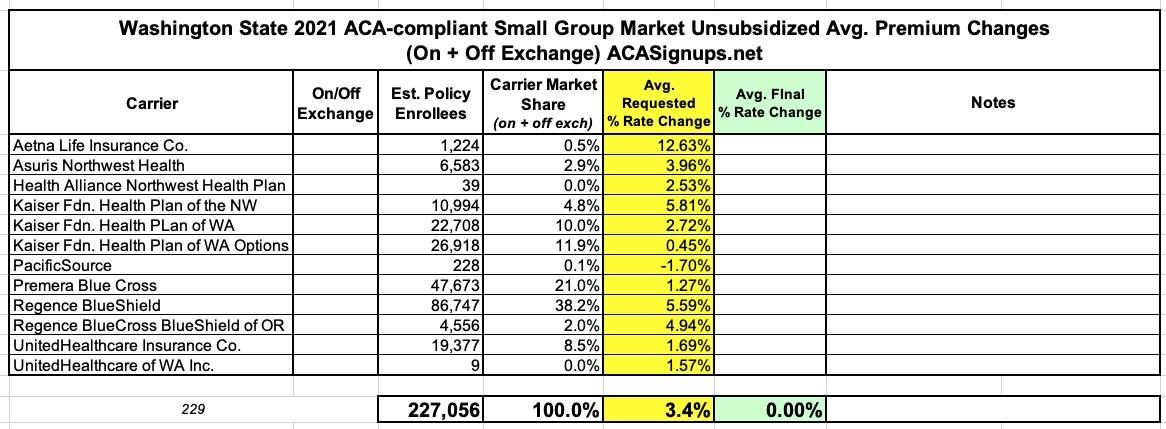

Meanwhile, here's the Small Group market...a weighted overall average rate hike of 3.4%: