An Open Letter to All Michigan (and other state) Democratic Nominees: 26 Ways to Protect, Repair & Strengthen the ACA at the state level

Note: Most of this isn't limited to Michigan...nearly all of the items listed here could/should be applied in other states as well.

Dear Democratic nominees for Michigan State House and State Senate:

Hi there, and congratulations on your primary victory!

If you're familiar with me and this site, you probably know three things about me:

- 1. I strongly support achieving Universal Healthcare coverage, and I'd ideally prefer to utilize some sort of Single Payer system as the payment mechanism to do so.

- 2. However, even with the recent strengthening in support, I remain skeptical that a SP/Medicare-for-All type of law is feasible yet, for a number of reasons I've talked about before but won't go into right now.

- 3. Having said that, during the interim between today and whatever the Next Big Thing is in healthcare (whether it's Medicare for All, Medicare X, Medicare Extra (my personal favorite), Medicaid Buy-In, Medicare Part E, CHIPA, USEAHIA, Healthy America or some other federal program), I strongly believe that it is vitally important to protect, repair and strengthen the Affordable Care Act even if it ends up being replaced by something else in the near future.

Here's why: The most optimistic scenario from a federal single payer advocate perspective would be as follows:

- Massive Blue Waves in 2018/2020, retaking the House, Senate and White House

- Progressive Democratic President takes office January 20, 2021

- Some version of a Medicare-for-All bill is immediately introduced, passed by a Democratically-controlled House and Senate

- The M4A bill is signed into law in early 2021, kicking into effect starting January 1, 2022

- It takes 4 years to fully ramp up, completely replacing the entire current U.S. healthcare system by January 1, 2026

I'm aware that there are some transitional period provisions in the M4A bill, but the bottom line is that even under the rosiest scenario, the ACA (or at least the parts which haven't been wounded by Trump and the GOP) will still remain in place for at least the next 4 years or so...and it does have some serious problems which need to be addressed immediately. Some were inherent in how it was designed, or due to mistakes made in how it was implemented by the Obama Administration. Some are due to years of undermining by the GOP even before Donald Trump took office. More recently, the rest are due to more aggressive sabotage by the Trump Administration.

In other words, unless there's some astonishing turn of events in which both Donald Trump and Mike Pence are impeached and removed from office (thus inserting the presumably Democratic Speaker of the House into the Presidency), the odds of any significant positive ACA legislation becoming law at the federal level before 2021 are slim at best.

That leaves things up to the states.

Now, I know Abdul El-Sayed campaigned on his MichCare state-based single payer platform. I wrote a generally positive in-depth analysis of it last month. I'm also aware that State Rep. Yousef Rabhi introduced his own "MiCare" single payer proposal, which is similar to El-Sayed's (including both proposals requiring a change to the state constitution and two federal waiver approvals by the Trump Administration to redirect federal Medicare, Medicaid, CHIP and ACA funding towards the new system).

However, again, even in the rosiest of scenarios, either of these would still take time to pass, sign into law and implement. Less time, perhaps, than a federal M4A law, but still at least several years.

There's also something like Julia Pulver's state-based Michigan Public Option proposal, which would still involve significant changes but which wouldn't be nearly as disruptive (employer-based coverage, Medicare, Medicaid, CHIP and subsidized ACA enrollees would be left mostly intact) and which, just as importantly, wouldn't require federal funds to be redirected, since federal funding for those programs would stay pretty much as they are today (I think there would still be at least one federal waiver sign-off involved).

My point is that the ACA will still need at least some fixes/improvements at the state level (at least temporarily) no matter what replaces it down the line.

Here's the good news: There's plenty of less dramatic, less complex but still important legislation to protect, repair and strengthen the ACA which can be done right here in Michigan.

You already know what some of these measure are...because you already included a few items on the list with last years Michigan Health Care Bill of Rights resolutions.

I agree with everything you laid out then...but the situation has gotten worse since then. The purpose of this letter is to provide a full list of the ACA protection, repair and strengthening bills I strongly recommend you campaign on and try to pass into law starting next January regardless of whether you retake the state House, Senate and/or Governor's office.

Democratic state legislators in other states have already introduced, passed, and/or implemented several of the items on this list, including Alaska, California, Colorado, D.C., Hawaii, Maine, Maryland, Massachusetts, Minnesota, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont and Washington State.

With that in mind, here's the bills I'd recommend. A couple of these may require a federal waiver sign-off, but these are cases where Trump's CMS Administrator has already approved of similar waivers in the past.

PROTECTIONS: Legislation which would lock in existing ACA protections in the event they're stripped away at the federal level (these are mainly the items included in the MI Health Care Bill of Rights):

- 1. Guaranteed Issue: Health insurance companies cannot deny coverage to anyone for having a pre-existing condition, nor can they subject enrollees to medical underwriting.

- 2. Community Rating: Health insurance companies cannot charge people higher rates or deductibles for a policy for having pre-existing conditions.

- 3. Gender Equality: Health insurance companies cannot charge more for a policy based on gender.

- 4. Limiting the Age Tax: Prior to the ACA (and under GOP repeal bills), seniors were often charged 5 times as much as younger enrollees; the ACA restricts the premium age band to a 3:1 ratio.

- 5. Essential Health Benefits: All health insurance policies must include coverage of at least the same 10 Essential Health Benefits mandated by the Affordable Care Act.

- 6. No Annual or Lifetime Coverage Limits: Health insurance policies cannot include caps on annual or lifetime benefit limits on policies.

- 7. Minimum Actuarial Value: Health insurance policies must cover at least 60% of enrollees' healthcare expenses on an actuarially-determined level.

- 8. Free Preventative Services: The ACA mandates a list of services such as annual physicals, mammograms, drug screenings etc. which enrollees cannot be charged any out-of-pocket fees for (as long as the provider is in-network).

- 9. Medical Loss Ratio: Health insurance companies are required to spend at least 80% of premium revenue on actual healthcare services for individual (nongroup) or small group market policies; anything under that has to be rebated to the policyholder. In the case of the large group market, the threshold is 85%.

- 10. Cap on Maximum Out of Pocket Costs: The ACA mandates that health insurance policies include a cap on the maximum amount that enrollees have to pay for medical services out of pocket regardless of how much the deductibles, co-pays and coinsurance are.

- 11. Young Adults on Parents Plans: Under the ACA, young adults are allowed to remain enrolled on their parents or guardians' insurance policies until they turn 26 years old.

- 12. Rate Review Protection: Under the ACA, insurance carriers which ask for rate increases of more than 10% per year have to undergo an additional regulatory process to review and justify those increases.

REPAIRS: Legislation which would restore ACA protections/regulations which have already been stripped away at the federal level either legislatively or via regulatory changes by the Trump Administration:

- 13. Renew ACA Medicaid expansion WITHOUT Work Requirements.

This one is a no-brainer, and I realize all of you are likely campaigning on it already, but it's still important to include here. The work requirement provision which was recently passed by the GOP legislature and signed into law by Gov. Snyder is cruel, counterproductive and very likely illegal, given the recent judicial ruling in Kentucky (that remains to be seen of course; it's an ongoing saga). The thing is, since Michigan's ACA Medicaid expansion is subject to a federal waiver, it has to be renewed every once in awhile, which means that if the current waiver (with work requirements) isn't approved by CMS (or more likely is approved by then ruled invalid by the courts), the entire "Healthy Michigan" program is set to expire at the end of 2019. This would kick all ~680,000 Michiganders off of Medicaid in one shot.

Michigan Democrats should push hard to avoid all of those issues by expanding Medicaid cleanly, as most other states have done...or, at the very least, renew it with the waiver terms exactly as they have been for the past five years, without the work requirement included.

- 14. Regulate Short-Term, Limited Duration Plans more strictly.

The ACA didn't actually ban STLDs, which don't include most of the protections listed above; instead, it laid out what provisions a policy had to include in order to qualify as ACA-compliant coverage to avoid having to pay the Individual Mandate penalty. Therefore, someone could still enroll in an STLD if they wanted, but they'd still have to pay the ACA penalty. In 2016, the Obama Administration put some additional restrictions on STLDs, limiting enrollment in them to no more than 3 months per year (thus keeping them "short-term") and forbidding them from being renewed within the same year (thus keeping them "limited duration"). Because of this (as well as the fact that STLDs fall far short of comprehensive coverage and are often junk plans), only a small number of people have enrolled in STLDs over the past few years, limiting their adverse selection impact on the ACA market risk pool.

Last December, however, Congressional Republicans effectively repealed the ACA's Individual Mandate (technically it's still there, they just changed the penalty amount to $0 or 0% of income). Then, the Trump Administration removed the 3-month and non-renewable regulatory limits on STLDs at the federal level, pushing the throttle wide open for junk plans to flood the market with no disincentive involved...other than the fact that these plans allow pre-existing condition denials, pricing discrimination, don't cover all 10 EHBs, have no minimum AV threshold, have annual/lifetime caps and so on. Basically, these are exactly the types of junk policies which the ACA set out to get people off of in the first place.

Michigan does currently have partial regulation of STLDs. According to the Commonwealth Fund, in Michigan...

- Total contract period for STLDs, including any renewal periods, cannot exceed 185 days out in a 365-day period

- Michigan keeps STLDs a small part of an insurer’s individual market portfolio by limiting the share of individual market premiums an insurer can collect from them.

However, I urge MI lawmakers to go further. Ideally, I'd like to see them eliminated entirely, as New Jersey does, and as California is in the process of (hopefully) doing. However, short of that, I strongly urge you to at least codify the Obama regulations restricting STLDs to no more than 3 months per year and preventing them from being renewable, as DC, Hawaii and Maryland are doing/have done (Illinois is trying to pass a bill limiting STLDs to 6 months). This wouldn't likely have a significant impact on premiums in Michigan given the limited protections already on the books, but even a 1% drop would save tens of thousands of Michiganders ~$60/year apiece.

- 15. Restore the Individual Mandate Penalty:

Repeal of the Individual Mandate is causing average individual market premiums to increase by at least 5% next year. That's an extra $300 per person for unsubsidized individual market enrollees. Restoring the mandate should, in turn, result in 2020 rates dropping by at least 5 percentage points. I know very well that this may be considered Kryptonite politically, but New Jersey, Vermont and DC have all done it, which means at least 4 states (yeah, I know, DC isn't a state) will have it in place for 2020 (the original mandate penalty law in Massachusetts is still on the books from the RomneyCare days). Many healthcare analysts feel that the ACA's penalty ($695/adult + $348/child or 2.5% of household income) was too weak to be properly effective, but I have to imagine that increasing it beyond that amount would be a bridge too far, so I'd recommend simply restoring it to the ACA levels.

As an alternative, Maryland has been working on a clever twist on the Individual Mandate: Under their proposed legislation...

Marylanders would be charged a fee on their tax forms if they failed to buy coverage. But the state would apply that fee to enroll the uninsured in health-care plans. Those who are due federal premium subsidies and can get a zero-dollar health-care plan would be automatically enrolled, unless they opted out. Those who would have to kick in their own money could use the fee toward the cost of insurance during the next open enrollment period. Rather than a penalty, the proposal’s backers call it a health-care “down payment,” reflecting the less punitive nature of the policy.

Unfortunately, this bill died in the Senate this year, but it's become a major issue in the MD Governor's race, with every Democratic candidate (including primary winner Ben Jealous) pledging support for it if they win (Republican incumbent Governor Larry Hogan is noncommittal on it).

STRENGTHEN: These are improvements to the ACA which take the ACA as it was supposed to be implemented to the next logical phase. Again, none of these steps go as far as either Single Payer or even a Public Option, but even a handful of them would dramatically improve & expand coverage and lower costs for enrollees.

- 16. REINSURANCE!

When the ACA exchanges first launched for the 2014 Open Enrollment Period, the law included three individual market stabilization programs. One of the programs was called reinsurance, and it worked pretty well. Unfortunately, the federal ACA reinsurance program sunsetted after only three years, at the end of 2016, which is part of why rates spiked so much in 2017 (they shot up in most states in 2018 as well, but for very different reasons).

In response, several states (Alaska, Minnesota and Oregon) have enacted their own, state-level reinsurance programs, and several more are on the way (New Jersey, Maryland and Wisconsin). It's a fairly cut & dried way of keeping premiums down (or even lowering them in some cases) which requires no additional federal spending and much less state spending than you would think.

I've written a (hopefully) straightforward tutorial on how reinsurance works. The beauty of it is that looking at some of the other states which have implemented similar programs, it's likely that the federal government would end up covering anywhere from 35% - 85% of the cost.

How much would this cost in Michigan in real dollars?

Well, in 2017 Michigan's individual market was around 373,000 people. I'm assuming it's dropped to perhaps 350,000 people this year. In 2018, enrollees pay an average of around $493/month last year. That's a total of around $2.07 billion in total premium revenue. Let's assume that 80% of those premiums are actual medical claims (to meet the 80/20 MLR rule). That means Michigan ACA individual market enrollees rack up around $1.65 billion in insurance claims each year, or around $4,800 apiece.

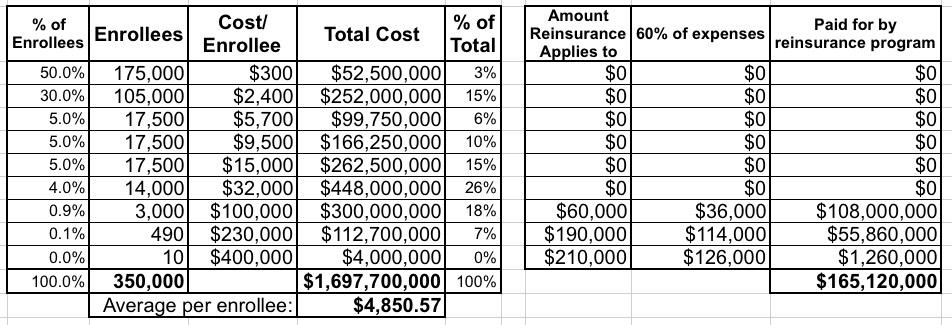

Let's suppose we established a reinsurance program identical to New Jersey's, and the enrollee cost breakout in Michigan was something similar to the following:

In this scenario, $165 million of the total expenses would be covered by the reinsurance program, or almost exactly 10% of the total cost.

However, thanks to the way the ACA federal waiver program works, as I explained here, a good chunk of that $165 million...perhaps half of it...would actually be covered by the federal government as a portion of the no-longer-needed ACA subsidies are redirected towards the reinsurance budget.

Put another way, it would only cost the state of Michigan $80 million to cut healthcare premiums by 10% for over 120,000 enrollees. And where would that $80 million come from? Well, in New Jersey, they expect to raise $90 million or so per year from...reinstating the individual mandate, which they're in turn going to use to help fund their reinsurance program.

Obviously the actual cost and impact on premium reductions could very widely depending on what the actual claim breakout is across the enrollees, how the program is structured and how much medical claims for high-risk enrollees are. In New Jersey, which actually has fairly close individual market demographics to Michigan, they expect rates to be about 15% lower than they would be otherwise next year.

If you want some real-world examples of how effective reinsurance programs can be, in Alaska, premiums dropped by a whopping 23.6% this year. In Minnesota, they only dropped by 6.3%, but next year are estimated to drop by another 8% or so even with the impact of mandate repeal sabotage. Oregon's reinsurance program isn't quite as robust; it only kept rates down by around 6% this year vs. what they otherwise would be, but that's still hundreds of dollars in savings per unsubsidized enrollee. REINSURANCE: IT'S A VERY GOOD THING.

- 17. Alternately, use the money from the reinstated individual mandate to provide additional subsidies to those over 400% FPL.

The reinsurance programs described above technically lower premiums for everyone on the individual market, but in practice it's only unsubsidized enrollees who see their premiums drop significantly, since most subsidized enrollees would see their subsidies drop to match the premium drop. However, there's another variant of this which does't require any federal funding at all and therefore doesn't, as far as I know, require a federal waiver either: The state could simply cut out the middle man and provide premium subsidies to those earning too much for APTC assistance directly.

Two other states provide their own, additional subsidies to ACA enrollees today (Massachusetts and Vermont). In each of those cases, they provide enhanced assistance to enrollees earning less than 300% FPL. While that's not a terrible thing, the 100-300% FPL crowd isn't where the biggest problems are; it's those earning too much for subsidies (basically enrollees earning over 400% FPL). An average of 373,000 Michiganders were on the individual market last year. Of those, around 160,000 were unsubsidized. When you include middle-class folks who've been forced to drop their coverage due to unsubsidized premiums rising too much, state-based subsidies would likely go to around 200,000 Michiganders over the 400% threshold. Average Silver ACA policy premiums are around $6,000 this year.

I'd estimated that keeping Silver premiums at the same 9.6% of income threshold that the ACA currently sets for people earning 300-400% FPL would probably cost somewhere in the neighborhood of $500 per person on average, or around $100 million or so. As it happens, reestablishing the mandate penalty would likely generate around...$100 million or so (I'm basing this on New Jersey figures; NJ has a slightly smaller population than Michigan and a similar individual market size).

- 18. Lower ACA premiums by $21 million/year by Establishing a State-Based ACA Exchange...

Right now, a whopping 3.5% of the premiums paid by Michigan ACA exchange enrollees goes to pay for the marketplace fee which funds HealthCare.Gov. That 3.5% has remained the same for five years straight, even as baseline premiums have more than doubled. That means Michigan residents are paying twice as much to fund the federal exchange today as they were five years ago for the exact same services (OK, HC.gov did improve substantially from 2014 to 2015, but otherwise not much has changed). In fact, as noted below, CMS has slashed the budget for marketing and outreach by around 90%...without lowering the corresponding fees paid for the marketing/outreach programs.

If Michigan broke off from HC.gov and established our own full ACA exchange, as Nevada is doing next year (and Oregon is considering doing), we could cut that cost down to as low as, say, 2.2% of premiums. If so, that would save over 260,000 Michiganders around $80/year apiece, or $21 million per year.

As for actually establishing the exchange in the first place, the world has changed dramatically since the ugly launch of HC.gov and some of the state exchanges back in 2013. Back then, many states spent hundreds of millions of dollars on technical disasters. Since then, however, exchange technology has become nearly an out-of-the-box commodity. Nevada's in-the-works ACA exchange will only cost about $24.5 million over five years (plus a $1 million Design Development & Implementation expense). Heck, that could potentially even be paid for just by delaying the fee reduction for the first year.

Assuming 2.2% per enrollee, 260,000 effectuated exchange enrollees per month would generate at least $34 million per year, which would be more than ample to operate the entire exchange. For comparison, Nevada and Idaho's annual budgets currently run around $10 million each for their exchanges; Michigan is a larger state, but the additional costs wouldn't scale up proportionately, so it's conceivable that the fee could be kept as low as 1.5% or so, saving enrollees to $30 million/year!

- 19 (18a). ...which would also allow Michigan to Extend the Open Enrollment Period.

This one really belongs under the "repair" category, but I'm listing it here since it would depend on moving to a state-based exchange: For several years, the official Open Enrollment Period ran for a solid 3 months: November, December and January. Last year the Trump Administration decided to slash that in half to just 6 weeks (11/01 - 12/15). While this had the upside of ensuring that a higher percentage of enrollees hit the ground running with effectuated coverage starting January 1st, it also caused problems for people with special circumstances who rely on having extra time to sign up.

State-based exchanges have the ability to establish their own Enrollment Periods. For 2018, California, New York and DC kept 1/31 as their deadline, while several other states bumped theirs out anywhere between one to five weeks. For 2019, California has decided to move both the start and end dates back (October 15th - January 15th). If Michigan had its own exchange, we'd have the flexibility to set enrollment dates that work best for us.

- 20 (18b). ...which would also allow Michigan to Actively Negotiate Exchange Plans.

(explanation coming)

- 21 (18c). ...which would also allow Michigan full control over our ACA marketing budget.

Again, this really belongs under "repairs:" Last year the Trump Administration slashed the marketing/advertising budget for HealthCare.Gov by 90%. While there are a lot of factors which impact enrollment each year, total enrollment across the 39 states which rely on HC.gov dropped by 5% this year...while enrollment in the 12 states which operate their own ACA exchanges (along with their own brands and marketing budgets) remained flat. If Michigan had its own ACA exchange, it would also include its own branding and marketing program/budget, not subject to the whims of the Trump Administration.

- 22 (18d). This would also allow Michigan full control over our navigator/outreach budget.

Yet another "repair": Last year the Trump Administration ALSO slashed the budget for HealthCare.Gov's "navigator" program (which funds 3rd-party nonprofit organizations which assist people with enrolling in ACA exchange plans and Medicaid programs, as well as generally educating them about how both private insurance and Medicaid work, among other services) by 40%. This year they're slashing it another 72% and will be "encouraging" the remaining navigators to push enrollees towards...short-term and other non-ACA compliant policies. Again, if Michigan had its own ACA exchange, we wouldn't have to rely on federal funding for our navigator program.

- 23. Sunset any remaining Transitional policies.

Under the ACA, all individual market policies were supposed to be fully ACA-compliant (guaranteed issue, community rated, etc.) starting on January 1, 2014. Originally, the only exceptions to this were "Grandfathered" policies which people were already continuously enrolled in since 2010. However, in response to the backlash over his "If you like it, you can keep it!" promise, President Obama had the HHS Dept. issue a policy change which allowed another batch of non-ACA-compliant policies (those enrolled in from 2010 - 2013) to be renewed for another year (these were called "Transitional" or "Grandmothered" policies).

The decision about whether to allow Transitional plans was left up to the individual states. Some states allowed them, some didn't. Even in the states which allowed them, it was still up to the individual insurance carriers whether to cut them off or not; some did, some didn't. Michigan, unfortunately, was among the states which did allow transitional plans. One way or another, that "one year" extension became two years...then three...and now it's at the point where "transitional" plans might as well be considered "grandfathered".

Just like with Short-Term plans, every Transitional Plan enrollee siphons away a healthy person from the ACA-compliant risk pool. Transitional plans probably shouldn't have been allowed in the first place (this is one mistake which belongs to President Obama, not Donald Trump), and even then they definitely shouldn't still be allowed nearly 5 years later. It's time to cut them off and transition the remaining enrollees over to fully ACA-compliant policies, which would also improve the ACA risk pool.

Unfortunately, I don't know exactly how many Michiganders are still enrolled in Transitional policies today, but I guesstimated it at perhaps 82,000 earlier this year. If that's accurate and even half of them shifted to ACA policies, that would enlarge the ACA market by over 10% with mostly healthy enrollees.

- 24. Merge the Individual and Small Group markets!

Most states have three major private insurance markets, which in turn have their own separate risk pool for purposes of setting rates: Large Group (companies employing 100 people or more); Small Group (companies employing fewer than 100 people) and Nongroup (aka Individual), which is for people who are either self-employed (like myself) or who work for companies which don't provide healthcare coverage.

In Michigan, around 51% of the population is covered through their employer. The small group market in Michigan is around 410,000 people, or 4.1% of the population, which means roughly 47% (4.7 million) are part of the large group market. I'm not sure how many of the 4.7 million work for companies with self-insure, but the point is that the large group market is huge. The individual market, of course, is the smallest and most volatile; that's what most of these bullet points focus on stabilizing and improving. In Michigan, the individual market currently consists of around 300,000 people, or 3% of the population.

The larger and more widespread demographically the risk pool, the more stable it tends to be...which is why the large group market tends not to be in the news a lot over dramatic rate increases.

Since both the small group and individual markets are so small, a couple of states (Massachusetts and Vermont) have merged these two into a single risk pool. If that was done in Michigan, it would total roughly 710,000 people, or 7.1% of the population. This would still be much smaller than the large group market, but it would be far more stable than either of them were before.

The downside is that this would mean higher rates for small businesses; the upside is that it would mean lower rates for the individual market...and it would mean both categories would be more stable and consistent going forward.

- 25. Tie ACA market participation to MCO or State Employee contracts

This one probably isn't necessary in Michigan at the moment since we seem to have pretty robust participation in the ACA market throughout the state, with several carriers available in each rating area. Still, it wouldn't be a bad idea to put into place anyway to prevent a "bare county" situation down the road. Basically, you pass a law mandating that in order to win either a managed Medicaid contract or, alternately, a state employee/public school group coverage contract, the insurance carrier has to also agree to offer a minimum number of individual market policies on the ACA exchange as well.

This policy is already in place in New York State (via executive order by Gov. Cuomo), while there's a bill to do so pending in California. Washington State, menawhile, recently passed HB2408, which would tie public school employee coverage contracts to ACA exchange participation.

- 26. Establish a Maryland-style All-Payer Rate Requirement.

Here's a simple explanation of what All-Payer means from Sarah Kliff of Vox a couple of years back:

All-payer rate setting, as the system is known, shares the same goals of single-payer: it aims to increase efficiency and reduce insurer overhead in the health care system. Single payer does this by eliminating private plans for one government plan. All-payer rate setting gets there by setting one price that every health insurer pays for any given medical procedure.

"[All payer] has everything except the government-run plan," says Mark Pauly, a health economist at University of Pennsylvania. "In all-payer systems, the government uses Blue Cross and other insurers as their agent. For consumers its the exact same except for who they write their check for premiums to."

...Right now, there is huge variation in health care costs at different hospitals and doctor offices. The reason is different health-insurance plans pay different prices for medical care. That means the price of an MRI scan or knee replacement surgery, for example, can vary widely, depending on how good an insurance plan is at negotiating.

Bigger plans tend to negotiate deeper discounts. Most research shows that private insurance plans pay the most, Medicare pays slightly less, and Medicaid pays the lowest rates. And even between different private insurance plans, there can be huge variation — a bigger plan with more members might be able to ask hospitals for lower prices because it can promise lots of patients.

Read the whole thing for more details. The point here is that Maryland recently experimented with All-Payer on a limited basis, and it worked well enough that they recently expanded upon the program:

Maryland Gov. Larry Hogan signed a contract with the federal government on Monday to enact the state’s unique all-payer health care model, which he said will create incentives to improve care while saving money.

Hogan signed the five-year contract along with the administrator of the federal Centers for Medicare and Medicaid Services, Seema Verma.

...The Hogan administration said the new contract is expected to provide an additional $300 million in savings a year by 2023, totaling $1 billion in savings over five years.

Maryland is the only state that can set its own rates for hospital services, and all payers must charge the same rate for services at a given hospital. The policy has been in place since the 1970s, though Maryland modernized its one-of-a-kind Medicare waiver about four years ago to move away from reimbursing hospitals on a fee-for-service basis to a fixed budget.

Because that change focused on hospitals only, the federal government required the state to develop a new model that would provide comprehensive coordination across the entire health care system.

Under the agreement, Maryland will be relieved of federal restrictions and red tape that the other 49 states face in the Medicare program. However, the state will have to meet benchmarks of improving access to health care while improving quality and reducing costs.

I know of quite a few progressive healthcare wonks who are more excited about All-Payer than they are about Single Payer, although obviously your mileage may vary.

There are plenty of other bills which could improve things as well, of course (I haven't even touched on prescription drugs), and I'll be happy to update this list further as appropriate, but passing the first 12 items above would prevent the Trump Administration from making the problems even worse, while passing even a few of the other 14 would dramatically improve the affordability and stability of healthcare coverage in Michigan for hundreds of thousands of Michiganders.

In closing, I need to once again stress that all of the above improvements should be pushed simultaneously with whatever the next phase in healthcare reform ends up being, whether it's MichCare, MiCare, a Michigan Public Option or some other major overhaul. It's not a false choice; we should be able to walk and chew gum at the same time.

Thank you for your consideration,

Charles Gaba

ACASignups.net