UPDATE: 2017 Rate Request Early Look: Oregon

A few weeks ago, I got a heads up that Virginia was the first state out of the gate with their 2017 Rate Request filings. There were some confusing numbers which took awhile to sort out, but once the dust settled, the overall weighted average rate hike requests for Virginia's entire ACA-compliant individual market came in at around 17.9%.

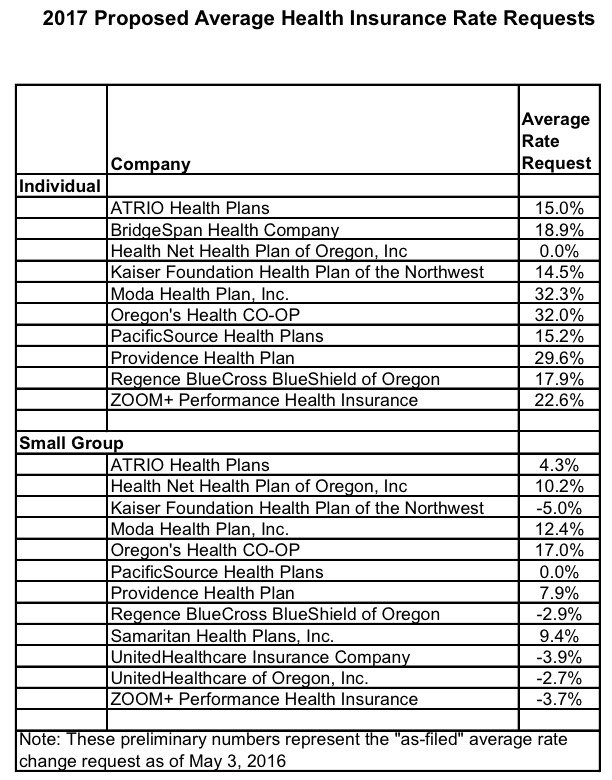

Some states make it next to impossible to track down this info. Others hand it to you on a silver plate. And then there are states like Oregon, who provide the average rate hike requests in a simple, easy format, but don't necessarily include the market share of those companies, making it difficult to compile a weighted average:

Fortunately, Portland Business Journal reporter Elizabeth Hayes has done the heavy lifting for the Oregon individual market, and has written this article from February breaking out the individual market share for each of the carriers!

There's one confusing discrepancy in her article; HealthNet isn't listed at all, but LifeWise is listed as having nearly 20,000 individual enrollees. I assume that LifeWise is dropping out of the OR indy market, or perhaps LifeWise is an alternate name for HealthNet? Then again, Centene is buying out HealthNet anyway.

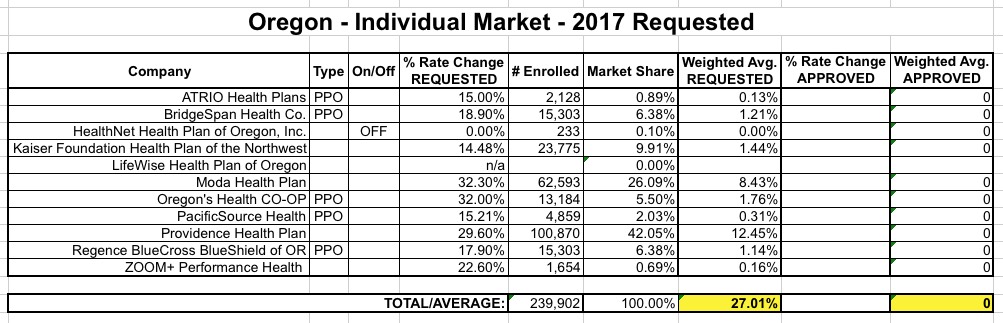

That mystery aside, plugging the data into a spreadsheet gives this:

It's important to note that the total number ends up being 5,000 lower than the 245K claimed in Hayes's article...and while some of that is likely LifeWise, adding all 20K LifeWise enrollees would make it 15K higher, so I'm not sure what to make of it.

It's also important to note that these numbers appear to include grandfathered enrollees. Then again, I'm pretty sure there are only about 1 million people still enrolled in grandfathered plans nationally as of today anyway, or perhaps 5% of the entire individual market. If that's accurate and proportional, the relative weighted rate hikes should still be about the same.

With all that in mind, it looks like the weighted average requested (not approved) rate increases for the Oregon individual market are right around a painful 27%.

As always, it's vitally important to remember that:

- These are requested hikes only, not approved;

- The rate hikes vary greatly not just by carrier but by metal level and individual plan as well

- The actual dollar amounts involved make a huge difference. A $300 premium going up 20% is still gonna cost less than a $400 premium going up 10%.

Still, assuming they're approved as requested, these aren't gonna make anyone happy.

UPDATE 5/4/16: OK, thanks to an anonymous tipster for clearing up the discrepancy above:

LifeWise Health Plan of Oregon will exit the Oregon health insurance market at the end of 2016 after 22 years in business. The company is another casualty of intense competition and declining market share in the state.

- Second: According to my source:

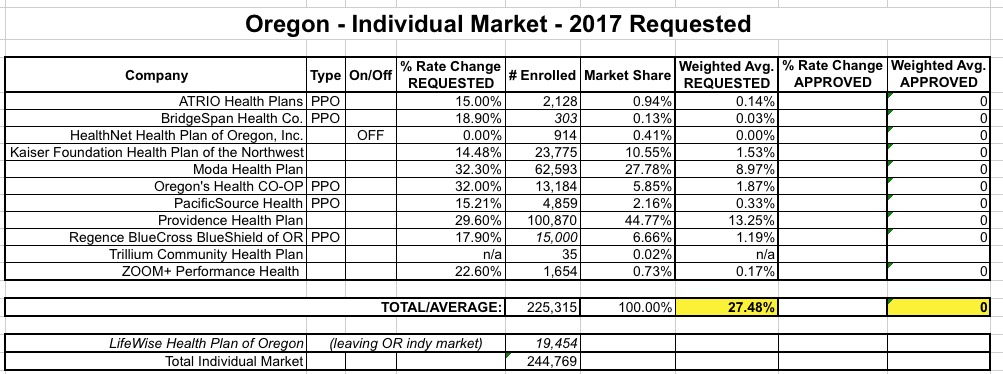

"Bridgespan and Regence have the same parent company and share the same data. The 15,000 overage you are seeing is because they are being double counted. The actual split should have Bridgespan with a handful of people and Regence with the majority."

OK, this explains the exact same number being listed for both BridgeSpan and Regence above. If I break it out at 303 BridgeSpan ("a handful") and 15K even via Regence, here's what it looks like:

This actually makes things look slightly worse, bumping the overall average up to 27.5% requested increases for 2017.